- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- The error condition stating that “limit int/points should...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What am I supposed to put for Limit Int/points on 1098 that can't be greater than -2000.00?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What am I supposed to put for Limit Int/points on 1098 that can't be greater than -2000.00?

The error condition stating that “limit int/points should not be greater than –XXXX” is being generated for the case where the taxpayer has mortgage interest reported on Form 1098 from their lender as well as a Mortgage Credit Certificate (MCC), but both forms were not entered into the tax return (or another specialized situation discussed at the end).

In order to be able to claim the MCC, the mortgage interest information from your lender must also be entered even though you are not claiming itemized deductions.

To correct the error, be sure that both the form 1098 information (and all the follow-up questions) and the MCC information has been entered into your tax return. Also, do not enter any values or answers on the screen where you see the error.

To go directly to the section of your return to enter the 1098 information, you can use the following steps:

- On the top row of the TurboTax online screen, click on Search (or for CD/downloaded TurboTax locate the search box in the upper right corner)

- This opens a box where you can type in “1098” and click the magnifying glass (or for CD/downloaded TurboTax, click Find)

- The search results will give you an option to “Jump to 1098” or just click the button to Go to 1098

After your 1098 information has been entered and the follow-up questions answered, the error condition should be cleared.

(There was one additional case where the error could be generated even though both documents were entered. If the box is checked that your name is not shown on the 1098 from your lender, then the error could be generated. As long as your name is on the loan documents, you are liable to pay the mortgage, and you did pay the mortgage interest reported on the 1098, then you can uncheck that box to clear the error condition.)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What am I supposed to put for Limit Int/points on 1098 that can't be greater than -2000.00?

I followed these instructions exactly and I am still receiving this error message. So at this point I have tried all of these things:

- Entering both the 1098 and MCC info (this is what I did the first time and the most recent time)

- Double-checked many times to ensure all fields were filled in properly

- Deleting the Tax and Interest worksheet

- Refreshing the page

My name is on all mortgage documents. I saw a another post where the person recommended navigating to the form and selecting "no" on the question about the interest being limited, but I do not see how to navigate to that view. I have been trying several different things for over an hour and I cannot get this error to clear. I pushed past it, filled in all of the rest of my e-file info and thought I was home free, but it routed me back and it seems that I cannot e-file until this error is cleared.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What am I supposed to put for Limit Int/points on 1098 that can't be greater than -2000.00?

It looks like the mortgage interest entered is not enough to cover the MCC entry.

In the online version run through the step-by-step for entering the form 1098 once again. At the end you will wrap up deductions and you will get to a screen that compares your standard deduction to your itemized deductions. Under the graph you will see an option to look at your itemized deductions. Select that and take a look at the mortgage interest showing there. There may be a clue to where the error is being triggered.

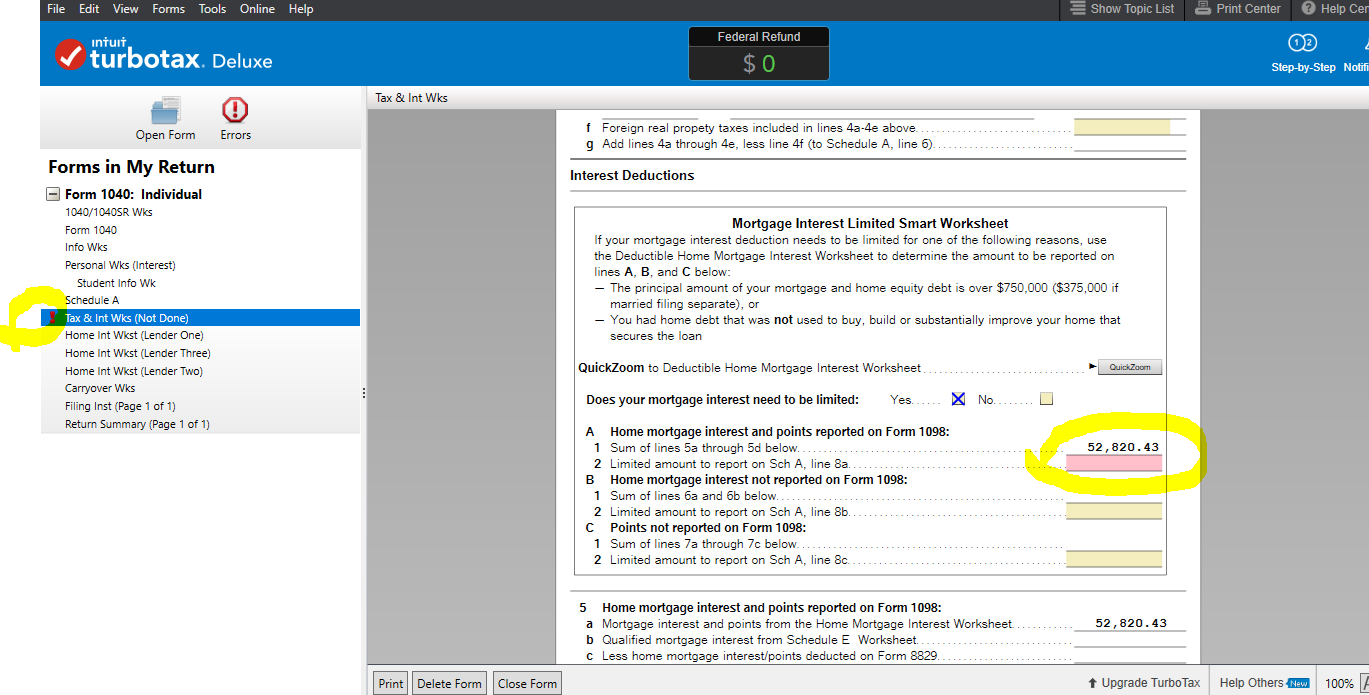

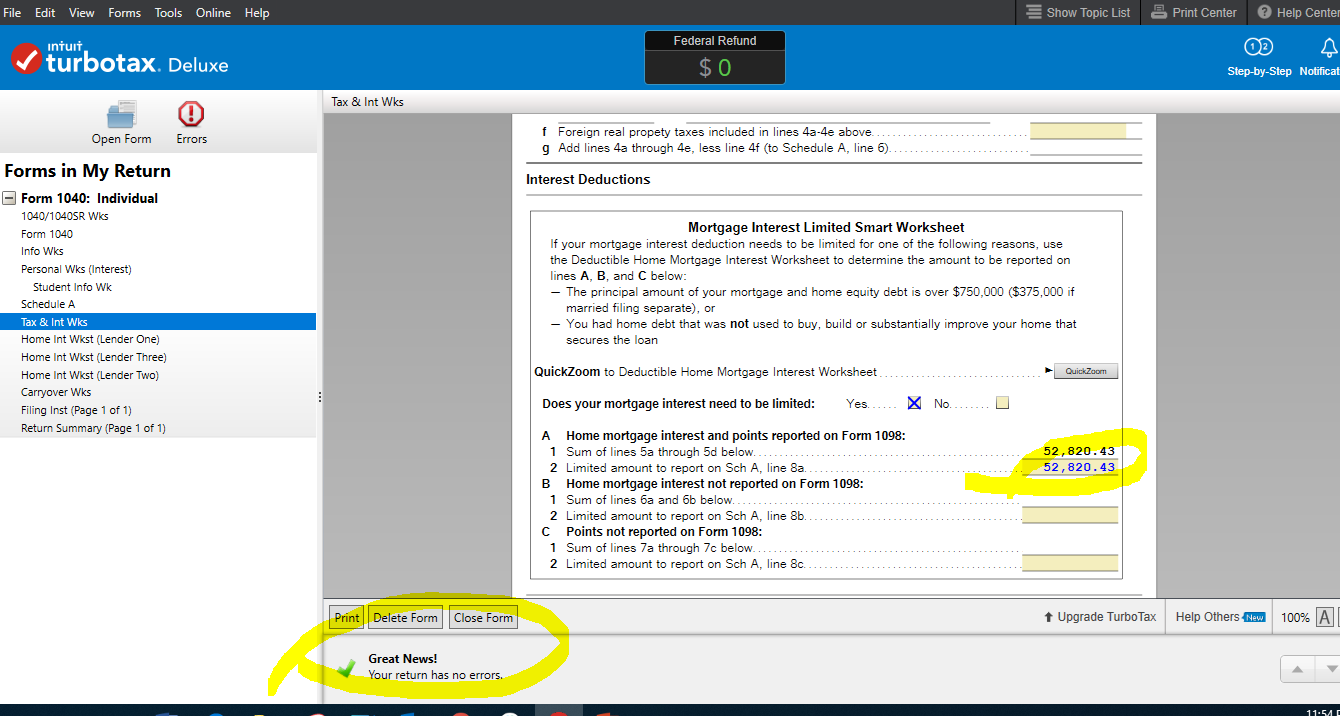

In the desktop version follow these steps to get to the "Tax & Interest worksheet."

1. Click "Forms" in the upper right of page

2. Find the "Tax & Int Wkst" in the list on the left hand side

3. If not there, click "Open form"

4. Select the "Form 1040 drop down"

5. Select the "Schedule A drop down"

6. Select the "Tax and Interest worksheet" and open form

Scroll down to the interest area. You will see the entries there including the "Yes or No" for the interest limitation. You can also gain some insight into the possibilities for the error by looking at the entries on that form.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What am I supposed to put for Limit Int/points on 1098 that can't be greater than -2000.00?

Thank you very much for your response! I re-entered all of the info for the 1098 and MCC. I took a look at my itemized deductions on the page with the graphs of itemized vs standard deduction, and the only itemized items showing were SALT taxes and property taxes. There was no info from my 1098 (which did not surprise me as TurboTax said out mortgage interest couldn't be itemized since our loan wasn't secured) and no info regarding the MCC. I moved through to the Federal Review and still received the same error.

To be clear, the mortgage interest amount that's requested for the MCC (the 4th box down in TT online version) is the same amount as listed in Box 1 on the 1098, correct? When I filed last year, I included the same amount as was listed in Box 1 of my 2018 1098. I did not encounter this error last year.

Any other troubleshooting tips? Thanks again for you assistance!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What am I supposed to put for Limit Int/points on 1098 that can't be greater than -2000.00?

Please try this:

ONLINE USERS:

Please go back to the Home Mortgage Interest section:

Click Federal on the left side-bar

Click Deductions & Credits along the top

Scroll down to “Mortgage Interest and Refinancing (Form 1098)” Click Edit/Add

Scroll down the “Here’s your 1098 info” screen and click Done.

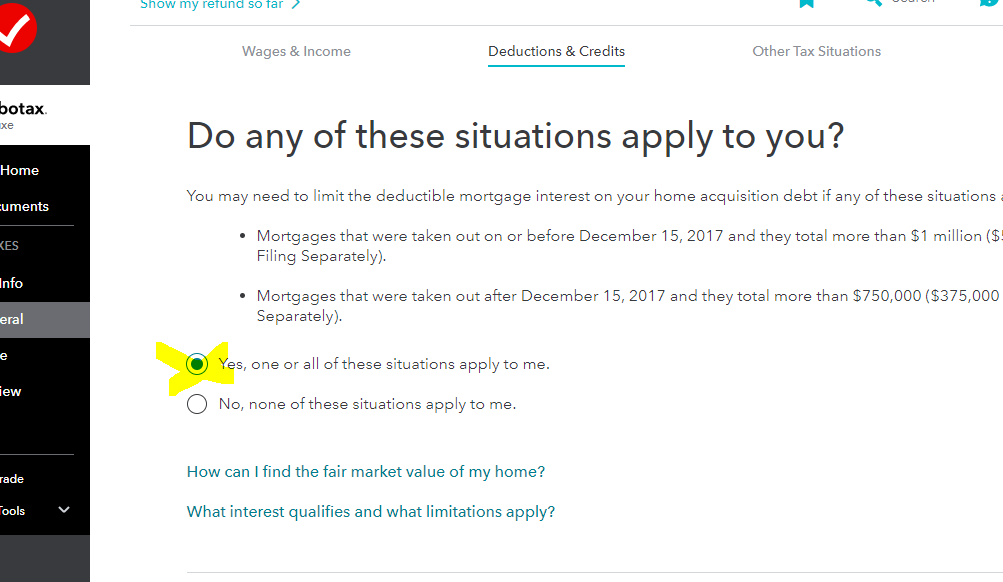

Next screen asks “Do any of these situations apply to you?” Select “Yes, one or all of these situations apply to me.” and Continue.

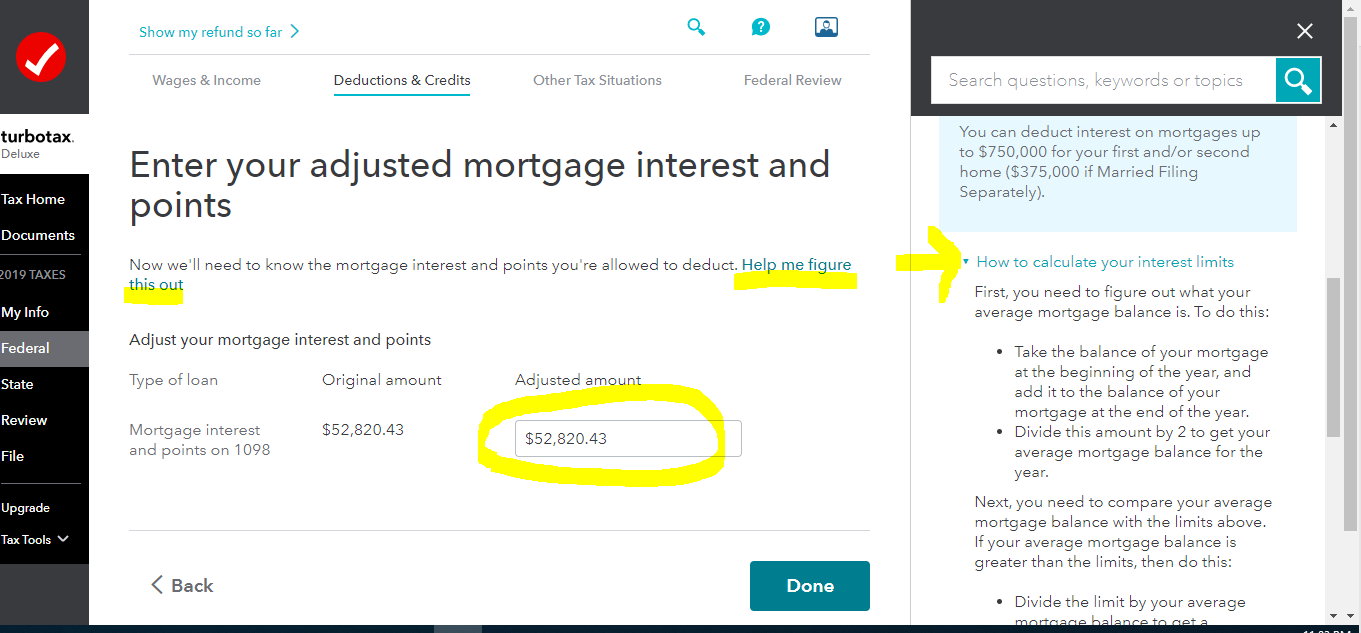

On the following screen, you will see the “Original amount”.

Enter the amount you can claim as a Home Mortgage Interest deduction in the “Adjusted amount” box. The Adjusted amount cannot be larger than the original amount or you will receive an error when trying to file. Instructions on who needs to adjust interest and how to calculate are available by clicking the blue “Help me figure this out” link.

DESKTOP USERS:

Go into Forms (top right)

Enter the amount on Tax & Int Wks

Mortgage Interest Limited Smart Worksheet section

Line A2

OR

Step by Step

Federal

Deductions & Credits

Mortgage Interest, Refinancing and Insurance Click Update

Click Done

Click Yes, one or both of these situations apply to me. And Continue

Enter the Adjusted amount and Continue

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What am I supposed to put for Limit Int/points on 1098 that can't be greater than -2000.00?

Thank you very much for your response. I am using the online version and I followed the steps you outlined. After all of the 1098 info is entered and I select Done, I am routed straight to the screen that says "Let's get more info about these additional tax breaks." I have never moved through the screens that you included on your snapshots (which were very helpful, btw). I actually deleted my 1098 and started again from scratch, thinking that perhaps I could trigger the screen that way, but it did not. I once again followed through to the review and got the same error. Any other ideas?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What am I supposed to put for Limit Int/points on 1098 that can't be greater than -2000.00?

Are you selecting that the 1098 is NOT secured by your property?

Isn't it? Shouldn't you be answering that as "Yes" and then the MCC will go through with no error?

That question is asking if the loan is on the property. If it is, please answer "Yes" to that question.

Not secured, refers to a personal or signature loan.

If the interest on the 1098 is Home Mortgage Interest, it should be secured by the property.

Are you confused by this question or is this loan truly not secured by one of your homes?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

ramonwi

New Member

dispatch-cab

New Member

carl-ackerman116

New Member

alplue

New Member

eriktowns1217

New Member