- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Stimulus Eligibility

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Stimulus Eligibility

I am in the middle of doing our taxes. TurboTax shows we are eligible for a $1078.00 stimulus. I do not understand how this is possible because our AGI exceeds the $160000 limit for a married couple filing a joint return. I used a stimulus calculator using the same numbers from my return and it says we are ineligible. We have received no stimulus payments in the past. I went all the way through the return checks and there are no errors. Why is TurboTax showing us as eligible?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Stimulus Eligibility

The 160,000 max is for the 3rd Stimulus just going out now. It is not included on your tax return. The 2020 tax return only reconciles the first 2 rounds. First round phases out 150,000-198,000 and the second round 150,000-174,000. I think those are the limits.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Stimulus Eligibility

TurboTax is showing the first and second stimulus payments. You may be eligible for a partial amount. The amount of the payment is reduced after $150,000.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Stimulus Eligibility

What is your 2020 AGI? How much did you already get for the first and second rounds? I made a spreadsheet to check. Any dependents under 17?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Stimulus Eligibility

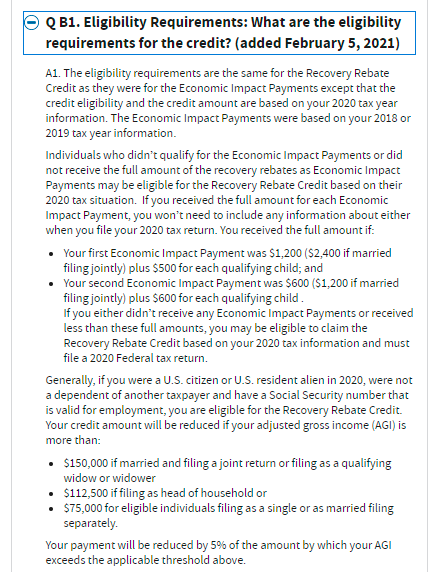

Thank you for the prompt reply! This reads different than what I've seen elsewhere. Here is a clip from the IRS website that sets the $160,000 limit. The article you posted does not list a maximum AGI of $160,000. I used the 5% differential in the article and it comes up exactly. Really confused.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Stimulus Eligibility

2020 AGI is $177,000

No previous stimulus payments.

No Dependents under 17.

Only my wife and I filing married jointly.

Thanks.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Stimulus Eligibility

The 160,000 max is for the 3rd Stimulus just going out now. It is not included on your tax return. The 2020 tax return only reconciles the first 2 rounds. First round phases out 150,000-198,000 and the second round 150,000-174,000. I think those are the limits.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Stimulus Eligibility

Well I come up with $1,050 for the first round and nothing for the second round. That's pretty close. Maybe you gave me a rounded 177,000.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Stimulus Eligibility

Thank you. It was very confusing since I expected nothing, thought we were ineligible and perhaps there was a problem with TurboTax or the way I entered information. Based on your help I will feel comfortable moving forward.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Stimulus Eligibility

Hi,

For a non-resident alien, how to tell Turbotax that the person isn't eligible for the stimulus?

Thanks,

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Stimulus Eligibility

If you are filing as a non-resident alien you will use a form 1040NR and stimulus payments will not be part of the interview. TurboTax does not support the 1040NR, but you can use Sprintax for support with that form.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

gagekig

New Member

user17538899852

New Member

user17692003622

New Member

Jordankwalker

New Member

matt1235

Level 2