- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Self-employed abroad for a full year, qualify for Foreign Earned Income tax exclusion yet Turbotax shows taxes owed

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Self-employed abroad for a full year, qualify for Foreign Earned Income tax exclusion yet Turbotax shows taxes owed

I went through the foreign earned income tax exclusion and the final screen showed me that all of my income qualifies to be excluded.

However, tax owed only shows Self-employment tax being excluded $2,627. The full amount is still taxable after the standard deduction of $13,850 AND Self-employment tax of $5,253 is added.

From the calculation it looks like Foreign Earned Income tax exclusion didn't do anything. Is this a Turbotax error or am I not correct to expect to pay $0 in taxes?

Full details:

Income source: self-employment, 3 clients

Physical presence: foreign resident since 05/2023; travel before, no time spent in the US

Legal: company formed abroad to get residency, hired myself as an employee, using foreign address for tax purposes.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Self-employed abroad for a full year, qualify for Foreign Earned Income tax exclusion yet Turbotax shows taxes owed

Since you are self-employed, in general, you would still need to pay SE tax. This is not part of the exclusion. So you are not paying your ordinary income tax, just your SE (FICA) taxes.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Self-employed abroad for a full year, qualify for Foreign Earned Income tax exclusion yet Turbotax shows taxes owed

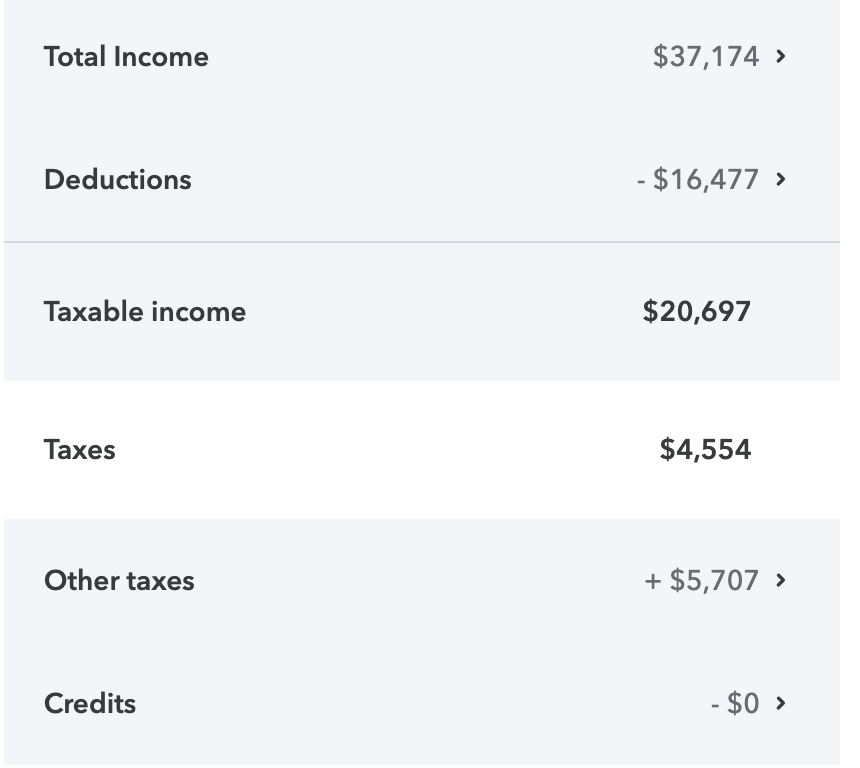

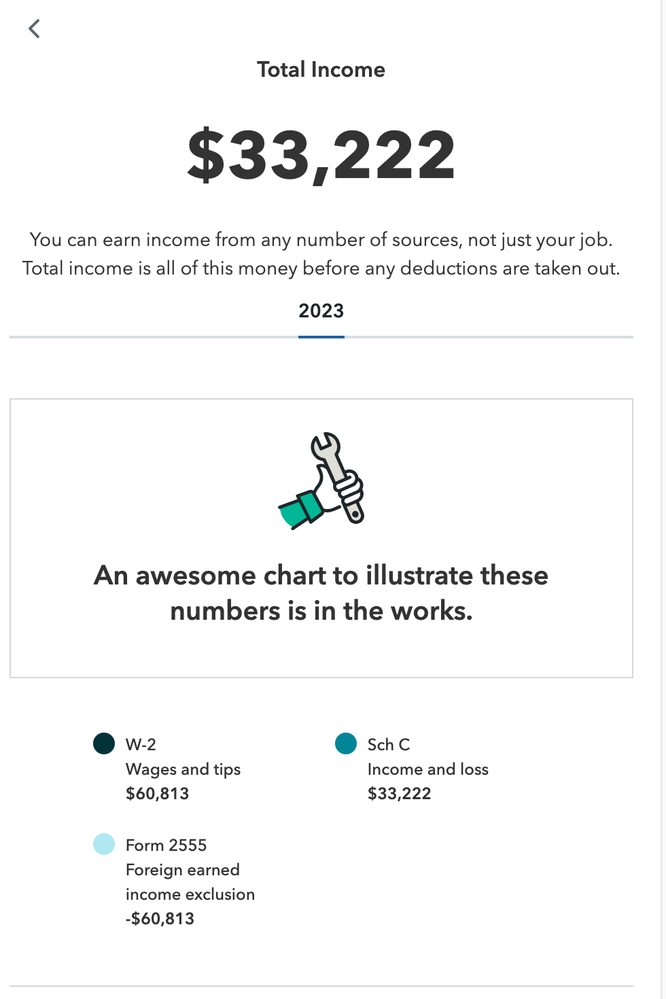

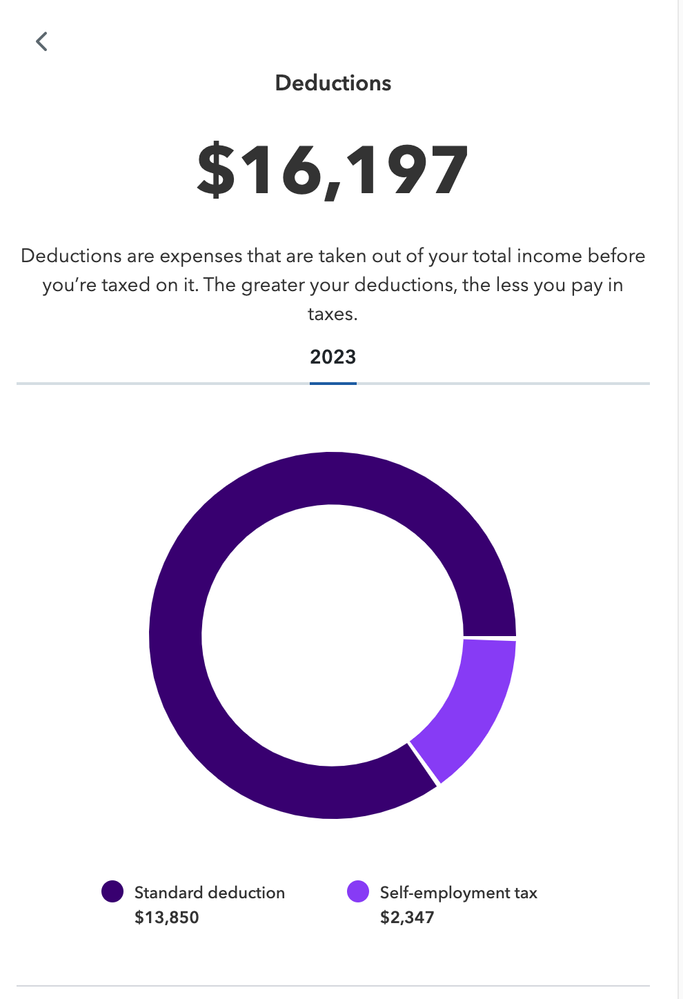

Turbo tax still calculates income tax owed after the standard deduction. Here is the current calculation (I still have about 2.5k of expenses to add which will not change this by much).

Additionally, the income tax rate is 22% (4,554 of 20,697) while it should be 12% in the Single income bracket of $11,601-$47,150. Am I understanding correctly that this is another error?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Self-employed abroad for a full year, qualify for Foreign Earned Income tax exclusion yet Turbotax shows taxes owed

if you are self-employed, you have self-employment tax to consider in addition to federal income tax. Also i am confused by your summary totals you put there. For an example, what is the deduction totals you have listed. This does not resemble any standard deduction amount I am aware of.

Reply back and give us a total of your net income for the year, minus the standard deduction amount so we can give you an accurate summation. Use this as a guide for Standard Deduction.

- Single or Married filing separately—$13,850.

- Married filing jointly or Qualifying surviving spouse—$27,700.

- Head of household—$20,800.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Self-employed abroad for a full year, qualify for Foreign Earned Income tax exclusion yet Turbotax shows taxes owed

I finished entering all the expenses. Based on my calculations I should owe $2,604.82 (15.4%) in self-employment tax on taxable income of $17,025. I should owe no income tax due to Foreign Earned Income Tax exclusion. Is this calculation correct?

Note: I do not have W2 income and I did not enter it, just income & expenses in Schedule C.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Self-employed abroad for a full year, qualify for Foreign Earned Income tax exclusion yet Turbotax shows taxes owed

Sounds like you need to review Form 2555, Foreign Earned Income Exclusion, if the income is not being correctly excluded on Form 1040.

If you are using TurboTax Desktop, in FORMS you can review the calculations and make entries/edit directly on the form.

In TurboTax Online, you will need to pay for your return to see the forms, or you can transfer your tax file to TurboTax Desktop. Here's info on How to Transfer from TurboTax Online to TurboTax Desktop.

You could delete Form 2555, and go through the interview again to re-create it. You should close the program, then clear your Cache and Cookies before doing this.

Here's more info on the Foreign Earned Income Exclusion.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Self-employed abroad for a full year, qualify for Foreign Earned Income tax exclusion yet Turbotax shows taxes owed

@tanyamedukha , generally confused but also agreeing with my colleagues @DaveF1006 , @MarilynG1 and @Vanessa A .

If I assume that you are a US person ( citizen/GreenCard) , single and having left the USA on 05/xx/2023 with a self-employed foreign income of US$60,813 and ignoring any US income for this discussion

(a) you will not meet the Physical Presence Test ( on form 2555 ) till after 05/xx+2/2024. This assumes that host country is in Europe ( leaving US , taking an overnight flight, arriving next morning and the first full day in that country being 2 days later. Thus the test period of continuous is 05/xx+2/2023 till 05/XX+1/2024.

(b) only foreign earned income during 05/xx+2/2023 till 12/31/2023 are eligible for Foreign Earned Income Exclusion.

(c) I am assuming here that you entered the Foreign Income using Schedule-C ( because it is self-employment) and then make sure " Foreign Earned Income Exclusion" is worked on p--- TubroTax should automatically import the schedule-C income as foreign earned income for purposes of form 2555

(d) Schedule-C income would have triggered a Schedule-SE fill -- you don't have to do anything on and also enter 1/2 of SECA income as an adjustment on form 1040.

(e) thereafter you can enter any US income .

Is this what you did or ?

Note that even though the foreign income is excluded from US taxes, the tax bracket on any non-excluded income ( foreign or US sourced ) is based on your world income without regard to exclusion -- thus pushing you into a higher marginal rate.

Does this make sense ? or am I in total left field

By the way which country are you in ?

pk

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Self-employed abroad for a full year, qualify for Foreign Earned Income tax exclusion yet Turbotax shows taxes owed

Thank you @pk for your explanation regarding the exclusion process. Looks like self employment tax is taken from worldwide income after expenses but before the standard deduction.

To clarify, I do qualify for FEIE due to the physical presence test. I've been out of the US for several years now continuously. I just happen to have residency in a foreign country since May of last year.

Not to anyone reading this in the future. Turbo tax online's current version does not calculate Foreign Earned Income Tax exclusion correctly and should not be used for this purpose.

A correct calculation for someone qualifying for FEIE would remove all of their income tax and will leave only self-employment tax which is based on wages or business income after expenses. The percentage of self-employment tax will stay the same (15.3%) up to $160,200.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

jtraini21

New Member

crash12_mn

Level 3

tanyamedukha

Level 2

John B

Returning Member

bhoward1963

Returning Member