- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

DaveF1006

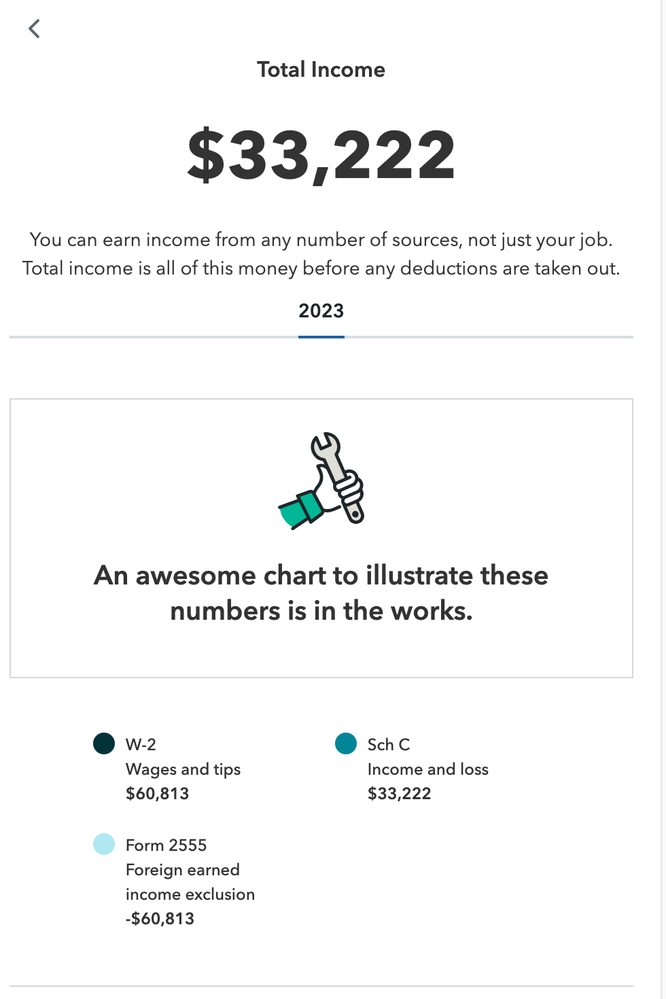

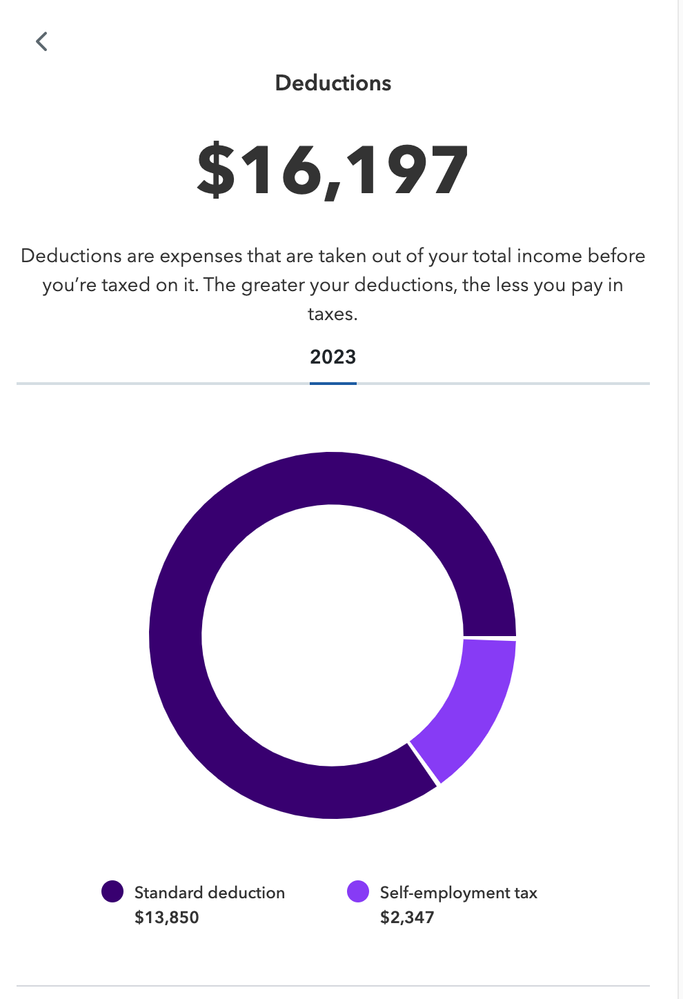

I finished entering all the expenses. Based on my calculations I should owe $2,604.82 (15.4%) in self-employment tax on taxable income of $17,025. I should owe no income tax due to Foreign Earned Income Tax exclusion. Is this calculation correct?

I finished entering all the expenses. Based on my calculations I should owe $2,604.82 (15.4%) in self-employment tax on taxable income of $17,025. I should owe no income tax due to Foreign Earned Income Tax exclusion. Is this calculation correct?

Note: I do not have W2 income and I did not enter it, just income & expenses in Schedule C.

April 11, 2024

10:41 AM