- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Self-employed abroad for a full year, qualify for Foreign Earned Income tax exclusion yet Turbotax shows taxes owed

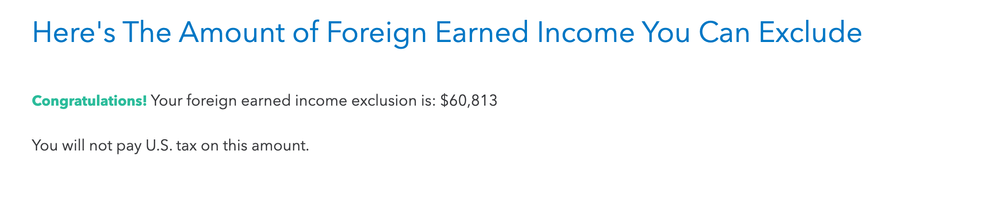

I went through the foreign earned income tax exclusion and the final screen showed me that all of my income qualifies to be excluded.

However, tax owed only shows Self-employment tax being excluded $2,627. The full amount is still taxable after the standard deduction of $13,850 AND Self-employment tax of $5,253 is added.

From the calculation it looks like Foreign Earned Income tax exclusion didn't do anything. Is this a Turbotax error or am I not correct to expect to pay $0 in taxes?

Full details:

Income source: self-employment, 3 clients

Physical presence: foreign resident since 05/2023; travel before, no time spent in the US

Legal: company formed abroad to get residency, hired myself as an employee, using foreign address for tax purposes.

Topics:

April 11, 2024

7:45 AM