- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- SALT 2020 vs 2019 | Deductions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

SALT 2020 vs 2019 | Deductions

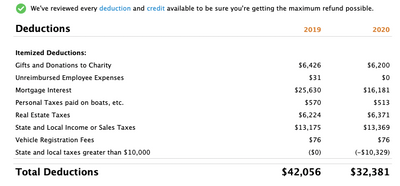

Please help me understand how the SALT line item can go from ($0) in 2019 to (-$10,329) in 2020. From what I have read so far, there was not a tax law change from 2019 to 2020 (I could be wrong). Maybe my 2019 return was incorrect. I used Turbo Tax for both. The biggest change from 2019 to 2020 for me is that I refinanced. My mortgage changed between 3 lenders in 2020. I feel like I am missing something here.

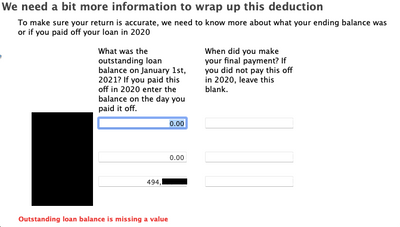

After I enter in my 1098 information from the 3 lenders, I get this screen which is a little confusing. Note the red error that comes up. Other searches on this forum led me to put zeros for the first two vendors as these were simply refinanced (I did not take out equity or pay points or any other odd scenario). Even with the red error message, if I hit "Continue" twice, that Turbo Tax app will allow me to proceed. The later Smart Check does not flag any errors.

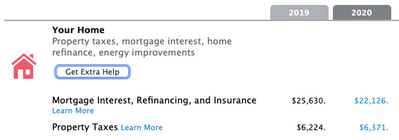

In the end my "Mortgage Interest, Refinancing, and Insurance" Deduction total drops from 22,126 (whats reported) to 16,181 (what TurboTax tells me in the summary picture above (#1)).

Back to the original question, "Please help me understand how the SALT line item can go from ($0) in 2019 to (-$10,329) in 2020?"

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

SALT 2020 vs 2019 | Deductions

ok for 2019

the total of all those items is $52, 132

taxes are $20,045

a change in the tax laws effective for 2018 limits SALT (and all other schedule A taxes) deduction to $10,000 so you have an excess of $10,045 that is not showing on the same line as the 2020 "amount greater than $10,000". that excess of $10,329 is showing for 2020

$52,132 less the excess taxes leaves you with $42,087 in itemized deductions

as an employee, your job related expenses are not deductible (also effective with 2018)

so $42,087 less the $31 leaves you with the $42,056 in itemized deductions

for 2020 total $42,710

excess taxes $10,329

leaving $32,381

for the original mortgage, you need to enter the balance before the refi this can't be zero. if you did a cash-out refi and didn't use the cash to substantially improve the property a portion of your mortgage interest will be non-deductible.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

SALT 2020 vs 2019 | Deductions

Much appreciated! Hope you stick with me here.

“so you have an excess of $10,045 that is not showing on the same line as the 2020 "amount greater than $10,000". that excess of $10,329 is showing for 2020”

Got it! The software just isn’t showing that for the 2019 column.

“for 2020 total $42,710… excess taxes $10,329… leaving $32,381”

Got it!

“for the original mortgage, you need to enter the balance before the refi this can't be zero. if you did a cash-out refi and didn't use the cash to substantially improve the property a portion of your mortgage interest will be non-deductible.”

Ok. No cash-out refi. I did this (updated) per the second image in the original post.

Line #1/Orignal Mortgage: I put the balance before the refi w/ date.

Line #2/Mortgage company that did my refi. They held it for ~1 month before it was bought. I put the balance there before the final mortgage company took over w/ date.

Line #3/Current mortgage company. Balance as of 1/1/2021 w/out date.

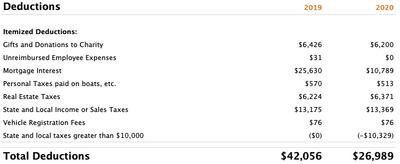

This resulted in my mortgage interest dropping from $16,181 to $10,789. Dropping my total deductions to $26,989. Increasing the amount I owe. Now that gap from 2019 to 2020 is much larger. I am trying to make sense of this. The amount I paid in Mortgage interests is very close between 2019 and 2020, but only $10,789 is being reported in 2020. I did not make changes to withholdings and my situation is almost the same other than making a little more. I did refinance to a lower interest rate.

Updated:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

SALT 2020 vs 2019 | Deductions

Check your Deductible Home Mortgage Interest Worksheet. TurboTax may be limiting your mortgage interest more than necessary. When multiple mortgages and refinances are entered, the average mortgage balance does not always get figured correctly and this causes you to not get the full deduction that you qualify for. Try entering the mortgage statements as described in the link below. You will most likely see an increase to your mortgage interest deduction in TurboTax.

What do I do if I have multiple 1098s from refinancing my home debt?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

SALT 2020 vs 2019 | Deductions

Thanks for the link! This is what I did per the reference provided.

*My mortgage was not over the limits identified ($750,000 for Married Filing Jointly and $375,000 for Married Filing Separately)

- I took all three of my 1098's and

- combined box 1, box 5, and real estate taxed (added them together)

- took my original 1098 (from the first lender) and entered info from boxes 2, 3, 7, and 11

This seems like the correct steps given my scenario.

- Original mortgage from a previous year. Made one payment here in 2020.

- Refinanced in 2020 using Lender #2. Made one payment here in 2020.

- Lender #2 sold my mortgage to Lender #3. Made 10 payments here in 2020.

- I had 3 1098 forms

The numbers seem more in line with what I would expect. Let me know if I messed this up or read the referenced link incorrectly.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

SALT 2020 vs 2019 | Deductions

Yes, this is the recommended procedure for reporting your 1098's. It is recommended to enter your more current mortgage loan balance in Box 2 but this is fine in the way this is entered. Also, when you refinanced, did you take cash out of the refinance for other things other than your home? If not, this is perfectly acceptable the way you reported this.

[Edited 04-29-2021|06:17 PM PST]

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

SALT 2020 vs 2019 | Deductions

Thanks all! This was very helpful!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

zenmster

Level 3

sam561

Level 2

FOR_TAX

New Member

Allthingsmustpass

New Member

frankharry

Level 3