- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

Much appreciated! Hope you stick with me here.

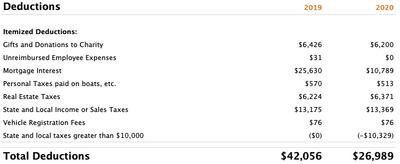

“so you have an excess of $10,045 that is not showing on the same line as the 2020 "amount greater than $10,000". that excess of $10,329 is showing for 2020”

Got it! The software just isn’t showing that for the 2019 column.

“for 2020 total $42,710… excess taxes $10,329… leaving $32,381”

Got it!

“for the original mortgage, you need to enter the balance before the refi this can't be zero. if you did a cash-out refi and didn't use the cash to substantially improve the property a portion of your mortgage interest will be non-deductible.”

Ok. No cash-out refi. I did this (updated) per the second image in the original post.

Line #1/Orignal Mortgage: I put the balance before the refi w/ date.

Line #2/Mortgage company that did my refi. They held it for ~1 month before it was bought. I put the balance there before the final mortgage company took over w/ date.

Line #3/Current mortgage company. Balance as of 1/1/2021 w/out date.

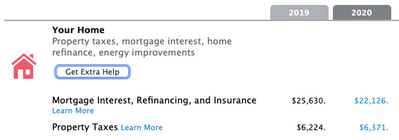

This resulted in my mortgage interest dropping from $16,181 to $10,789. Dropping my total deductions to $26,989. Increasing the amount I owe. Now that gap from 2019 to 2020 is much larger. I am trying to make sense of this. The amount I paid in Mortgage interests is very close between 2019 and 2020, but only $10,789 is being reported in 2020. I did not make changes to withholdings and my situation is almost the same other than making a little more. I did refinance to a lower interest rate.

Updated: