- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

SALT 2020 vs 2019 | Deductions

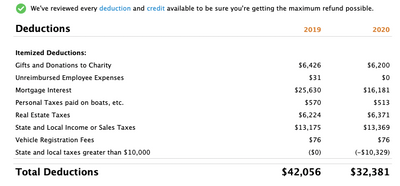

Please help me understand how the SALT line item can go from ($0) in 2019 to (-$10,329) in 2020. From what I have read so far, there was not a tax law change from 2019 to 2020 (I could be wrong). Maybe my 2019 return was incorrect. I used Turbo Tax for both. The biggest change from 2019 to 2020 for me is that I refinanced. My mortgage changed between 3 lenders in 2020. I feel like I am missing something here.

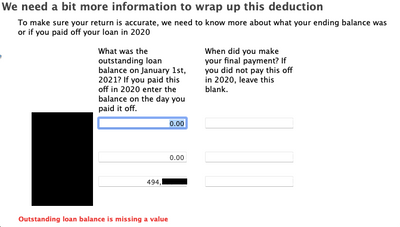

After I enter in my 1098 information from the 3 lenders, I get this screen which is a little confusing. Note the red error that comes up. Other searches on this forum led me to put zeros for the first two vendors as these were simply refinanced (I did not take out equity or pay points or any other odd scenario). Even with the red error message, if I hit "Continue" twice, that Turbo Tax app will allow me to proceed. The later Smart Check does not flag any errors.

In the end my "Mortgage Interest, Refinancing, and Insurance" Deduction total drops from 22,126 (whats reported) to 16,181 (what TurboTax tells me in the summary picture above (#1)).

Back to the original question, "Please help me understand how the SALT line item can go from ($0) in 2019 to (-$10,329) in 2020?"