- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: Where to enter 1099-S from sale of rental property

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where to enter 1099-S from sale of rental property

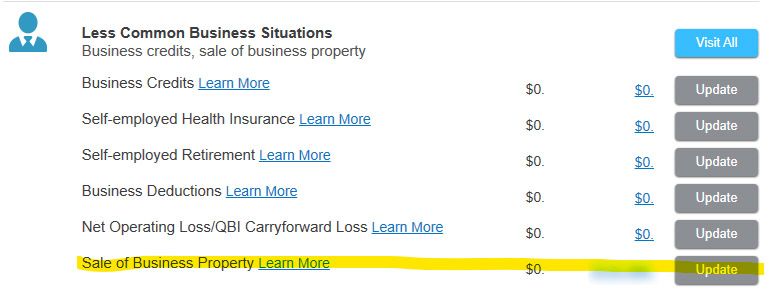

When I go into Business -> Rental Properties and Royalties -> Rental and Royalty Summary and edit the rental property in question, I can select that I sold the property. This eventually lands me at this screen:

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where to enter 1099-S from sale of rental property

Keep going in the input untill you eventually get to this screen see here

From the screen that you were on originally hit continue then continue then installment sales, no, then next screen, hit done, then done again, then sale of other business property, hit no and then you'll get to this screen.

Hope this helps for you. Good luck!

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where to enter 1099-S from sale of rental property

I've gone through that whole section to the end, multiple times, and have not seen that screen. I tried to follow the directions you gave, but they do not correspond to the 2022 Home and Business TurboTax that I am using.

@AbrahamT wrote:From the screen that you were on originally hit continue then continue then installment sales, no, then next screen, hit done, then done again, then sale of other business property, hit no and then you'll get to this screen.

After my screen shown, I get to "Personal Residence", "Installment Sales", "Results", "Gain on this Asset's Land", then I'm back at the "Your Property Assets" screen. I cannot locate a "Sale of Other Business Property" screen, and the search in TurboTax turns up nothing for that.

Is this the option that you are directing me to?

If so, I've gone all the way through that section as well without seeing the screen you mentioned.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where to enter 1099-S from sale of rental property

It appears from your initial post that you began the process of entering the sale of your rental property in the correct section of TurboTax. You should not also have to enter the sale of the rental property in the Sale of Business Property section you reference in your post. Have you gone into Forms mode? If not, select Forms in the upper right of your screen, and in the left margin, search for Form 4797, Sale of Business Property. Select Form 4797 (assuming it is there) and scroll down the page to Part II, Ordinary Gains and Losses. You should see the information relating to the sale of your rental property in Part II.

While the screens you reviewed in the rental property section did not necessarily coincide with your 1099-S, the information you entered in that section should have transferred to Form 4797. Let us know if Form 4797 has been prepared and whether the information on that form is consistent with your rental property information.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where to enter 1099-S from sale of rental property

First rental property sale ever and not having fun trying to find out how to enter data. First, do I complete the normal stepbystep section for the property? taxes, hoa,utilities, etc. I assume that I do. Then,Do I enter the commission I paid to the salespeople on the stepbystep or do I add up all the sales expenses, including commissions listed on the 1099-s and enter them later?

I, like the original questioner, have NOT found the lines that are shown with sales price, etc. And what is with the asset page? Since I sold the condo with all the assets, do I not change anything? I don't see how I should enter anything there. I will reread these postings and try again, and again, and again. Should I have gone to the forms once I got to that section??

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where to enter 1099-S from sale of rental property

Yes, you enter it in the asset section. You will not enter a 1099-S form, only the sales figures. The selling expenses are entered in the sale area as you go through each asset for your rental.

TurboTax is fully capable of reporting the sale of a rental property. Here are some tips that may be useful.

The selling price should be prorated for each asset then entered for each asset when you indicate they were sold or disposed of. You will not lose the remaining depreciation because you will use the remaining basis against the selling price to determine gain or loss.

To figure out the selling price for each asset:

- Take the current basis of each asset against the total combined basis of all of your assets to figure out the sales price for each one; OR

- Determine a fair market value for each asset against the total value of all assets to figure out the sale price for each one.

Use the original cost of each asset listed on depreciation, add those together then divide each one by the combined total to find the percentage of the cost for each asset. Use that percentage times the sales price and sales expenses to find the selling price/sales expenses for each asset. (Choices would also be fair market value on the date of the sale or adjusted basis on the date of the sale, which is cost less depreciation.)

Example: Original Cost (of each asset on your depreciation schedule)

$10,000 Land = 13.33%

$50,000 House = 66.67%

$15,000 Improvements = 20%

$75,000 Total = 100%

Multiply each percentage times the sales price/sales expenses to arrive at each individual sales price/sales expense.

I hope this example provides clarification to enter your sale. If you have not used TurboTax, enter each asset exactly as it appears on your prior year return.

You need to dispose of the property by telling TurboTax how and when it was disposed of. Follow the instructions below.

- Click on Wages & Expenses

- Scroll to Rental properties and royalties, click Edit/Add or Start/Revisit

- Do you want to review your rental?, click Yes

- Under Rent and Royalty Summary, click Edit

- Click Update to the right of Assets/Depreciation.

- Do you want to go directly to your asset summary?, click Yes and Continue

- Click Edit to the right of each asset to be disposed of/sold

- Go through several screens until you get to Tell Us More About This Rental Asset

- Click on This item was sold……. And continue to answer the questions. The sales price and expenses will be asked for each asset.

You might also review information here.

@mobster27

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where to enter 1099-S from sale of rental property

this is a lot of math for me...I would like to have someone help me. ( the annual paperwork reporting income and expenses was soooo easy!) Do I call the Contact Us number?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where to enter 1099-S from sale of rental property

If you would like to have your taxes done for you, you can click here to be taken to TurboTax Full Service. If you are using TurboTax Online, there is a button in the upper right hand corner that Says "Do My Taxes For Me" Click that button to start the process of having your taxes done for you.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where to enter 1099-S from sale of rental property

@mobster27 wrote:

this is a lot of math for me...I would like to have someone help me. ( the annual paperwork reporting income and expenses was soooo easy!) Do I call the Contact Us number?

If you are using the TurboTax online editions, see this TurboTax support FAQ for accessing the Live editions which provide a Tax Expert to assist you with your tax return - https://ttlc.intuit.com/turbotax-support/en-us/help-article/intuit-product-orders/get-turbotax-live/...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where to enter 1099-S from sale of rental property

Disposition of Assets! I have reflected on your guidance and I believe that I am finally understanding! I have used Turbotax for the life of the rental so I have all the assets clearly listed with previous depreciation, etc! In fact, most of the added assets reached the end of their life. So, for those assets I will enter a zero as I go down the list and edit value, right? Example for you for a more complicated case: The new electric circuits came with a 27.5 life and have used up 14 of those years. Original cost was $1310 and $631 was prior depreciation. Annual depreciation amount is 48 dollars. To determine value when I edit the assets, do I enter the remaining amount (1310-631) or ...? Does the sales price have an impact on the asset value? And finally, my husband always used his vehicle to visit the property and that is on record since 2008. He still has the vehicle, so is that something I will have to address.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where to enter 1099-S from sale of rental property

Thank you, Diane. I reviewed my form 4562 and found that most of the depreciable assets had already completed their depreciation life...showing zero for current depreciation. The property I sold was purchased for 99500, 85000 for the cost net of land and 14500 for the land. I made a significant gain.

Help me with two examples, please. I will use approximate numbers....

1.So when I go down the list of assets (I have always used TurboTax and have the comprehensive list), my 14 year old kitchen cabinets had a cost of 4700, a depreciable basis of 2400, an expired life of 10 years and no remaining depreciation. How will I determine value in this case? (they were still in great condition, BTW)

2. New windows had a cost of of 2300 with the same depreciable basis, a life of 27.5 and remaining depreciation of 1300. Value?

Finally, total asset additions to sale over the 22 years of ownership totaled about 25000. This was added to the cost net of land over the years. Is this significant? Does it relate to the sale value?

Thank you in advance!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where to enter 1099-S from sale of rental property

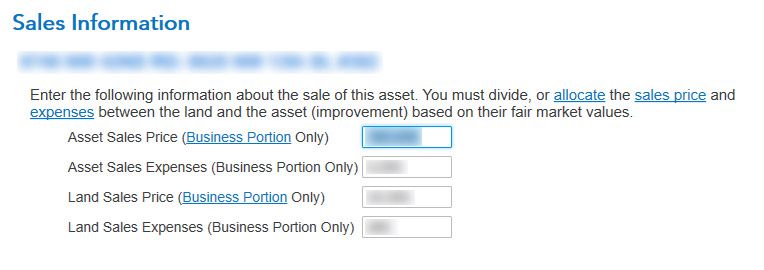

I will try to do justice to the excellent instructions by @DianeW777 which outline how you determine a Sales Price for

- the rental property,

- the land under the rental property, and

- the improvements to the rental property

by allocating the Sales Price across all of the rental property assets.

The Sales Price is entered at the screen Sales Information in the box Sales Price.

Using the numbers that you report above and assuming a selling price of $213,000 (to make the numbers easy), see here.

The same allocation method may be used to allocate Sales Expenses.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where to enter 1099-S from sale of rental property

sorry about the double message! I thought that the first message had been lost! So, thank you for those numbers. I have set up a spreadsheet with percentages and will do the math that way!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where to enter 1099-S from sale of rental property

Thank you, thank you... I have a completed tax return, thanks to you all, but especially DianeW777 and JamesG1! First time rental property sale and I'm shocked by the amount of taxes I have to pay due to the sale and I noticed that some general tax benefits disappeared... Charity deduction? oh, well!

Now, I want to sign up for a review of my return...the live assist. But thank you again!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

misstax

Level 2

keithl1

Level 2

misstax

Level 2

VJR-M

Level 1

pgdriver

New Member