in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: When will a fix be available for Turbo Tax Premier w/r to calculation of Charitable Contribut...

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will a fix be available for Turbo Tax Premier w/r to calculation of Charitable Contributions, Form 1040-SR, Line 12b?

I have your token. When you say it "messes with your state return", in what way does this happen?

Did you have any charitable contributions (I don't see any).

Please describe your issue in more detail. Thanks

At the bottom of your response, please enter "@" and "BillM223" (without the space in between) so I will be notified of your response.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will a fix be available for Turbo Tax Premier w/r to calculation of Charitable Contributions, Form 1040-SR, Line 12b?

In my my case if I use the workaround, my IA state return then limits me on my charitable deduction. The point is TT need to quit screwing around nd fix this. It's inexcusable for this bug to still be present and it's also inexcusable for moderators to not acknowledge and provide estimate for a fix. TT customers are tired of lip service.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will a fix be available for Turbo Tax Premier w/r to calculation of Charitable Contributions, Form 1040-SR, Line 12b?

In my my case if I use the workaround, my IA state return then limits me on my charitable deduction. The point is TT need to quit screwing around nd fix this. It's inexcusable for this bug to still be present and it's also inexcusable for moderators to not acknowledge and provide estimate for a fix. TT customers are tired of lip service.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will a fix be available for Turbo Tax Premier w/r to calculation of Charitable Contributions, Form 1040-SR, Line 12b?

Exactly. I am waiting to file until I can run the check to make sure it is correct. Just some type of response would be good to know that they are working on it. Don’t like that people are coming up with “work arounds” instead of TT just fixing the issue.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will a fix be available for Turbo Tax Premier w/r to calculation of Charitable Contributions, Form 1040-SR, Line 12b?

3 software updates I know of since this bug was identified and still no fix. TT must not care or disagrees it's a bug.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will a fix be available for Turbo Tax Premier w/r to calculation of Charitable Contributions, Form 1040-SR, Line 12b?

I have the same problem with the charitable donations bug, which Intuit is unwilling or unable to fix.

I just checked my records: The last time I filed a paper return with handwritten entries was in 1992, exactly 30 years ago. Ever since, Intuit (or its predecessors) were able to provide software that yielded accurate returns.

Do I really have to go back to the stone age, pull out a pen and calculator, and start completing my federal and state return by hand, because Intuit cannot fix such a common error in their program? Have the supply issues become so bad in our country that not even tax return software is working anymore? I am curious where this tax program is headed if it cannot deliver accurate returns for common issues.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will a fix be available for Turbo Tax Premier w/r to calculation of Charitable Contributions, Form 1040-SR, Line 12b?

For the 2021 tax return using the Married Filing Joint filing status, you are allowed to deduct up to $600 in cash contributions to charity without claiming itemized deductions.

If you are using the Married Filing Joint filing status AND using the standard deduction:

As you go through your Federal return and you have entered your charitable contributions, you will not see any additional questions regarding your inputs. If your state return also allows you to deduct charitable contributions, then the amounts you entered will be taken into account on your state return.

After you have finished your state return and you are getting ready to file, when you run the final Review, you will probably see this message:

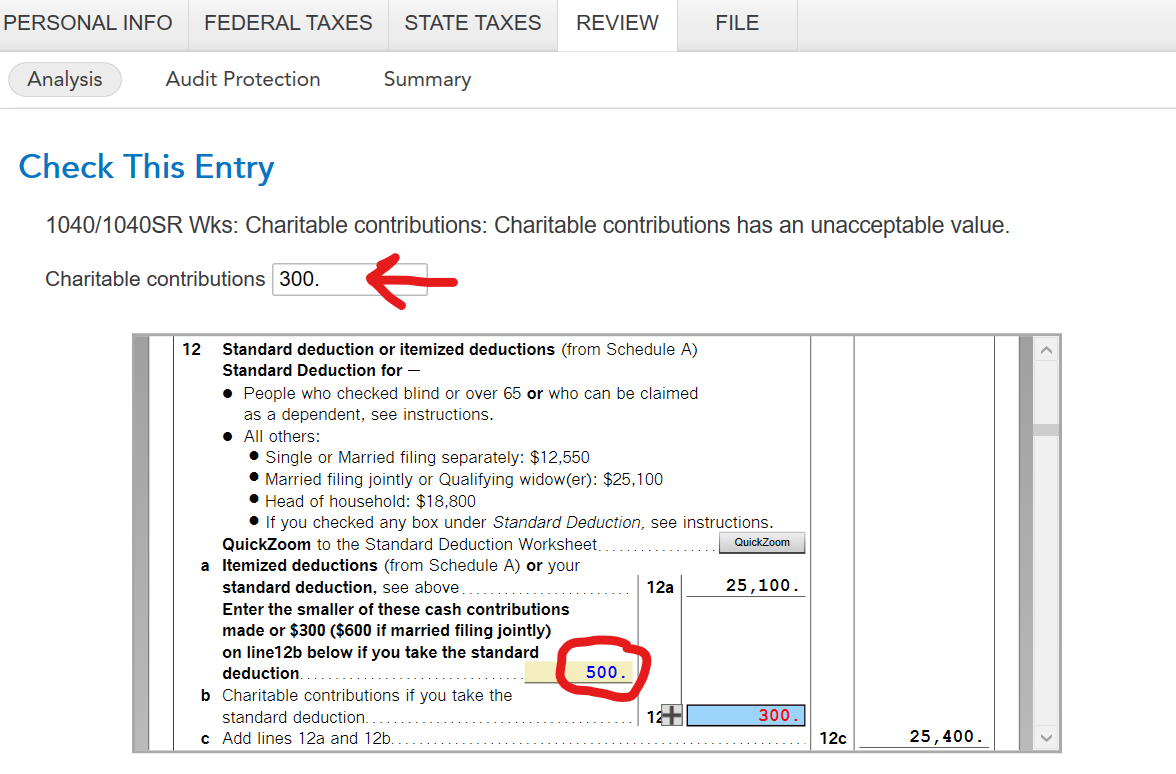

1040/1040SR Wks: Charitable Contributions: Charitable contributions has an unacceptable value

You will also see a place at the top of the screen for Charitable contributions with '300' in the box. Below that box, you can see your Form 1040 line 12a which shows the amount of your cash contributions that you already entered.

If your line 12a is greater or equal to $600, enter '600' in the box at the top of the screen.

If your line 12a is less than $600, enter your line 12a amount in the box at the top of the screen.

After changing the input at the top of the screen to the correct value, proceed through any other errors that may pop up and then move forward to file your return. It is very important that you do not revisit any other section of your return before you file or the change may not be retained or able to be changed a second time.

See the screenshot below for reference:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will a fix be available for Turbo Tax Premier w/r to calculation of Charitable Contributions, Form 1040-SR, Line 12b?

I see from the postings that this problem has been around for a few weeks. We shouldn't have to do any workaround. Why is it taking so long to fix what appears to be a very simple problem? When is the fix going to be available?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will a fix be available for Turbo Tax Premier w/r to calculation of Charitable Contributions, Form 1040-SR, Line 12b?

Yes, I figured this out early on. But, I would think it could/should be fixed by TT, and I should not have to “correct “ their program. I would like to run the check to insure all is correct - a promise made by TT.

I have been waiting for a fix, and an acknowledgment by TT that they were working on the problem.

I will “fix” it myself, but very disappointed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will a fix be available for Turbo Tax Premier w/r to calculation of Charitable Contributions, Form 1040-SR, Line 12b?

I have been a TT customers for many years, including several when I used TT Pro. I have never experienced such a dismal response from TT (i.e., NONE) and have always experienced a positive and timely response, What has happened that there is no response and seemingly no concern on the part of TT. Abandon ship, all ye rats!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will a fix be available for Turbo Tax Premier w/r to calculation of Charitable Contributions, Form 1040-SR, Line 12b?

Does this mean Intuit won’t be fixing this bug?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will a fix be available for Turbo Tax Premier w/r to calculation of Charitable Contributions, Form 1040-SR, Line 12b?

Why are you and other employees flagged as experts not providing us information on why the bug is not being fixed?

I don't trust TT if it I can't complete my return without the review not flagging errors.

While I can understand work-arounds are given, it does not negate that fact that the bug should be fixed. It does not sit well with me that TT has not fixed this issue. We. your customers, have a right to software to work correctly. It is reasonable for customers to expect any bug that causes the review to fail to be fixed.

Stop ignoring us and tell us is TT going to fix this bug or not and if so provide an estimate of when. Otherwise I will be seeking a refund.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will a fix be available for Turbo Tax Premier w/r to calculation of Charitable Contributions, Form 1040-SR, Line 12b?

Finally decided to "fix" my tax return myself and file. HELP! Now, will not let me enter my credit card information to e- file my state return!!! Gave me a number to call if I was having trouble. Said to give them the information on my screen and they would give me a state confirmation number. Called the number, spoke with "Douglas" for 1/2 hour. Could not get a state confirmation number. He wanted me to let him into my return. Told him not comfortable with that. So, he had me sign in to TT and let him into my computer. Told me he would not be able to see any tax information. Then, he told me I did not have a "product" and asked if I had ever used TT before. Told him I had Deluxe and had used TT for over 10 years. Told me several times that I did not have a product!!! Asked him several times to connect me with someone else that could help me. Asked to speak with a supervisor. He told me he does this all of the time and knew what he was doing. Finally, I asked if the only way to speak with someone else was to hang up. He said I could hang up any time and told me to have a nice day!!!!!! Can't make that call today. I need a break. If there is anyone out there from TT that monitors this site, please reply and tell me how to file my state return. I do not want to pay TT an additional $40+$20 and have it deducted from my federal return. Is this a scam to get the extra $40? So frustrated!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will a fix be available for Turbo Tax Premier w/r to calculation of Charitable Contributions, Form 1040-SR, Line 12b?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will a fix be available for Turbo Tax Premier w/r to calculation of Charitable Contributions, Form 1040-SR, Line 12b?

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

IY

Level 2

dkrawchu1

Level 1

in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill

bobjohnson25

New Member

av8rhb

New Member

xhxu

New Member