- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: what's the SSN due date for 2020 tax return

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

what's the SSN due date for 2020 tax return

hello,

today I received a mail from IRS on my tax return for 2020, which stated my child doesn't have the SSN before the due date of tax return.

I filed extension for year 2020, which means my due date is 10/15/2021 and my child got the SSN in Sep 2021, from https://www.irs.gov/publications/p972, in publication p972, the due date included extension, my understanding the due date for 2020 tax return Oct 15 , 2021.

Is my understanding correct ? why IRS reject my child's CTC ? how to communicate with IRS to resolve this issue ?

Thanks

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

what's the SSN due date for 2020 tax return

Is my understanding correct ? You are correct ... filing the extension was the correct thing to do.

why IRS reject my child's CTC ? Unknown.

how to communicate with IRS to resolve this issue ? If the IRS sent you a notice then read it carefully to see how to refute their findings. Attach any supporting documents to support your position.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

what's the SSN due date for 2020 tax return

@jidong1 - if you feel comfortable doing so, I'd include a copy of the SS card as documentation, since the issue date is printed on it.

you didn't state it, but can I assume you indeed filed prior to 10/15/21?

did you maintain a copy of the extension form? I'd include that as well. Maybe they didn't update your record to document you filed an extension.

Look at your transcript - anything there help your case documenting either the extension occured and / or the date you filed your tax return?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

what's the SSN due date for 2020 tax return

Is my understanding correct ? You are correct ... filing the extension was the correct thing to do.

why IRS reject my child's CTC ? Unknown.

how to communicate with IRS to resolve this issue ? If the IRS sent you a notice then read it carefully to see how to refute their findings. Attach any supporting documents to support your position.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

what's the SSN due date for 2020 tax return

@jidong1 - if you feel comfortable doing so, I'd include a copy of the SS card as documentation, since the issue date is printed on it.

you didn't state it, but can I assume you indeed filed prior to 10/15/21?

did you maintain a copy of the extension form? I'd include that as well. Maybe they didn't update your record to document you filed an extension.

Look at your transcript - anything there help your case documenting either the extension occured and / or the date you filed your tax return?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

what's the SSN due date for 2020 tax return

@NCperson Thanks .

I filed tax for my child with ITIN number for year 2019. and in early of 2021, I paid additional tax from IRS web site so that to extend my tax return automatically. You can get an automatic extension when you make a payment with Direct Pay

I filed my tax return on 12 Oct 2021 by paper mail. as I just got my kids' SSN number on the end of Sep 2021. so I filed my tax with turbotax software on the early of Oct 2021 with my kid's SSN number.

I didn't attached my children SSN paper copy as I think IRS should get it from their database.

I doesn't have transcript on extension. but I should be able to find the electronic transfer record when I pay additonal tax to IRS in the early of 2021.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

what's the SSN due date for 2020 tax return

Wait a minute ... so you made an estimated tax payment in early 2021 for the 2020 return and you did NOT file an actual 2021 extension form 4868 ? If so you are probably SOL. The filing deadline for the 2021 return was 5/17/21 so the SS# was issued after the filing deadline so the IRS is correct.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

what's the SSN due date for 2020 tax return

You can get an automatic extension when you make a payment with Direct Pay, the Electronic Federal Tax Payment System or by debit or credit card. When paying electronically, you must select Form 4868 as the payment type and the payment date to get the automatic extension.

https://www.irs.gov/pub/irs-utl/oc-electronic-payment-and-automatic-extension.pdf

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

what's the SSN due date for 2020 tax return

Hello Guru,

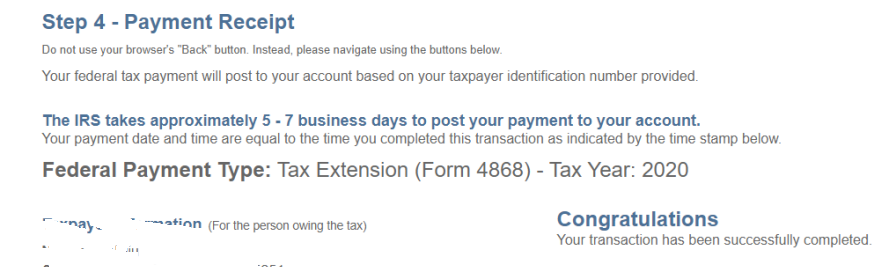

from my bank record. I paid extension on 27 April. 2021. here are the picture I saved.

is this script enough to prove automatic extension ?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

what's the SSN due date for 2020 tax return

@Critter-3 , yes. I think I selected the form 4868. and I pasted my screen shoot.

So hopefully I can get my credit back if I filed tax correctly with the SSN numbers which I got on the end of Sep 2021.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

pmrbgr5099

New Member

dave

New Member

stays

New Member

Aaliyahgm23

New Member

ajs813

Returning Member

in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill