- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: Totalled Vehicle - Used for both Personal and Business purpose.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Totalled Vehicle - Used for both Personal and Business purpose.

I had a vehicle that I was using for both personal and business use, for my small computer business. I used the vehicle all through out 2018 and claimed my mileage deduction for that. Then in April of 2019, I was rear-ended on the highway and the vehicle was totalled out.

The insurance paid off what was owed on that vehicle and I was also given $9000 to put down on a new vehicle. I purchased another used vehicle (the first one was used as well) that I put into service for the remained of the year. I put the $9000 down on it and making my payments now.

How do I go about putting this into my taxes. Again this vehicle is used for both personal and business purposes for my small company I have. Yes I track all the mileage for both vehicles using an approved app and keep records of use for business.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Totalled Vehicle - Used for both Personal and Business purpose.

You need to treat one vehicle at a time in TurboTax.

For the auto you sold, find the vehicle under "Business Vehicle Expense" in the area where you report your business income and expenses. When you edit that entry, you will see an option for "I stopped using this vehicle for business". Click on that option and you will be prompted to report the sale information for the vehicle.

The insurance proceeds will be your sale amount for the vehicle you lost. TurboTax will calculate a gain or loss on the disposition based on what your undepreciated balance (basis) was in the auto you lost, netted against the insurance proceeds.

For the new vehicle, you will go in the same section and set up a new vehicle like you did for the one that you lost.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Totalled Vehicle - Used for both Personal and Business purpose.

Great information, almost to the point I want to be at with this. So here is my next part of this question, since I am putting the info into TurboTax and not 100% what to put. So here is a little more information about the business and such, so maybe you can point me in the right direction. We are 100% husband/wife only owned LLC in a community property state (Texas), which means that the business is considered a disregarded entity and we both file a Schedule C for this business. Since we do this, we split everything in half. each claiming 50% of the income and expenses.

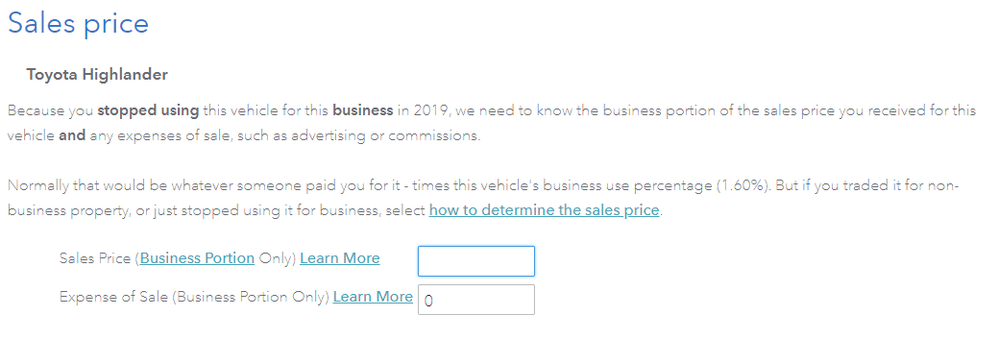

Now since this is the only vehicle we own (yep, a one car family), we use it for both personal and business use. I use an IRS approved mileage tracking app. The mileage we drive each year for business various, so TurboTax can not automatically figure out the sale price and I have to do this, which is fine. According to our mileage app, we only used the vehicle 7.71% for business use, so in my mind, I just take the total amount received from insurance and times it by 7.71%, so for example, the insurance paid out $20,000 total (paid off loan and cash to me for next vehicle). 7.71% of that total is $1542 (which I would split in two and list each on the Sch C). Now the reason I am asking this is because on the page to enter the sale price within TurboTax (I am using the online version), if states "Normally that would be whatever someone paid you for it - times this vehicle's business use percentage (1.60%). But if you" (see included image).

Not sure if they are telling me to use 1.6o% or is that % number was an example. Like I said the un-split % is 7.71% and half that for each of us would be 3.85%. Is that just an example or how are they coming up with 1.60%.

Thanks in advance.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Totalled Vehicle - Used for both Personal and Business purpose.

Use the amount you calculated.

TurboTax can not automatically figure out the sale price and business percentage over the life of the vehicle, since the mileage you drove each year for business varied.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Totalled Vehicle - Used for both Personal and Business purpose.

Thank you so much, that make sense and that is what I was thinking but needed clarification.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Totalled Vehicle - Used for both Personal and Business purpose.

Now I have found something interesting and not sure about this one. I am figuring up the "sale" price and such of the vehicle and I must be doing something odd or wrong.

Here are the numbers I am working with. The payout for the vehicle, part used to pay off loan and the remained given to be to put on a newer vehicle was $20,221.81. So I did this. Took 20,221.81 x 7.71% and got 1559.1015. Now I took that 1559.1015 and divided it by 2 which gives me 779.550.

But if I take the $20,221.81 and divide it in half, I get 10,110.905 then take amount times 3.855% (which is half of the 7.71%) and I actually get 389.775 for each person. But if I take 10,110.905 and times it by 7.71% I get the 779.550 again.

So my question would be do I use the 7.71% regardless of which value number I use, or should divide the % in half and use the half (3.855%) for myself and my wife?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Totalled Vehicle - Used for both Personal and Business purpose.

You would take your business use percentage times the sales price to determine the sale amount to enter in TurboTax. So, $20,221.81 times 50% (if that is the business use percentage) would give you the sale amount to enter in TurboTax.

It wouldn't matter who drove the vehicle, the business miles divided by the total miles put on the vehicle would determine the business use percentage.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Totalled Vehicle - Used for both Personal and Business purpose.

Ok, so I will take the amount that they gave me for the accident (payout on the car) and times that by 7.71% which is our actual business of the vehicle and then divide that number into 2 so that we each put a portion into each of our Schedule C's. That should give us our equal share for this. Or should I just use the total amount that I come up (not splitting it in half after I get my numbers) meaning that I would list $20,221 for each of us (I don't think that is right as that would basically say we sold the car for $40,000+).

Or would it, for the sake of preventing confusion, easier for me to just claim the vehicle by myself 100% and not on my wife's Schedule C. So I would claim in on my Schedule C and not on her's. The app that we use to track mileage is set to record business trips, but it has no clue as to if its me or my wife, its a shared data account so its all pooled into one. The simple fact is that I most likely drive more for the business than my wife does. I guess I could say that I did 100% of the driving this past year and she did none. She may have in fact drive 1% or less of those business miles this year. (Just me kinda of thinking out for an opinion).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Totalled Vehicle - Used for both Personal and Business purpose.

You can report the sale on whichever schedule C you have the vehicle listed on. If it is just listed on your schedule C, then record it there, or if you have it on both schedule C's, then you have to divide things by 2.

You would multiply the $20,221 by 7.71% if that is your your business use percentage and that would be your sales proceeds.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Totalled Vehicle - Used for both Personal and Business purpose.

Last tax year we listed it on both Schedule C's, so I assume I need to just go ahead and split it out between the two of us for this vehicle only, correct, since its already listed for last year? Then when I add the new one I will only listed it on my Schedule C and take 100% of the results from here on out, since she's unable to drive due to health problems?

Another problem that I see, though its not really a problem is that on my Schedule C it shows a loss ( -300) after I have taken the deductions for both vehicles and such and my wife has close to the same amount as a positive income (we did not do much business this past year). That should be fine correct?

The only issue I see, and not sure how turbo tax gets this, it said that I had a gain on the sale of the vehicle. It said that I gained $771 (for each of us). It doesn't make since that I had a gain, when I paid $30,000+ on the vehicle, they paid market value of $20221.81 and my business portion of the sale price was $1559.

Should I delete both Schedules C's and start them from scratch?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Totalled Vehicle - Used for both Personal and Business purpose.

Not sure what happened to my last reply, so if it shows up for some reason along with this one, I only did this one a second time since it was missing when I originally posted it.

On our 2018 taxes I split its use 50/50 with my wife. In 2019 until it was totaled, I used it 100% of the time for business. So I guess I need to split it again 50/50 since it was like that for the prior year. Due to health reasons she can no longer drive it, even prior to the accident. But since we split it in 2018, I guess I just need to go ahead and do it again (and list the new vehicle only on my return this year, going forward).

But TurboTax states that I have a gain in the sale of this vehicle, which I don't understand. The check we got from the insurance company was, again, $20,221.81. We were paying a total of $36,000 (total final financed priced of vehicle, or should I use the cash price without the financing?), the business portion that we received in that sale price was 1559.10. So I don't understand fully understand how they say I have a gain on the sale of the vehicle. How is that figured up?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Totalled Vehicle - Used for both Personal and Business purpose.

The missing piece is the depreciation. If you used the standard mileage rate to deduct your vehicle costs, a portion of each mile is considered depreciation.

For 2019, the total standard mileage rate is 58 cents per mile and 26 cents is considered depreciation. if you drove 1000 miles for business in 2019, that would reduce the basis of your vehicle $260.

I don't know many miles you claimed for this vehicle over the years that you used it, but it should work out if you used Turbo Tax every year.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Totalled Vehicle - Used for both Personal and Business purpose.

Thank you for that. That makes a little more since. Its actually rather easy in a way, the only other year the vehicle was owned and used in was the tax year 2018. We took the standard deduction for 2018. Total miles drive for the earn was 25,307 and total business miles out of that was 3,600.5, which I think TurboTax said for 2016-2015 it was 25 cents to use so that comes out to about $900.13 for 2018.

So still not 100% sure on that, LOL, but I guess TurboTax knows what its doing. Thanks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Totalled Vehicle - Used for both Personal and Business purpose.

You are welcome.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Totalled Vehicle - Used for both Personal and Business purpose.

Why am I getting an error for schedule C for my KIA Sorento and it wont let me change anything?

The issue I have is I had a KIA and it was stolen and totalled in 2021. I used the Kia for self employment and personal and don't know what to put in Basis for gain/loss(enter 100% of basis)___, or basis for AMT gain/loss(enter 100% of basis)____ I also bought a new car in 2021.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

sandyswet

New Member

SusanROA

Level 2

SusanROA

Level 2

Adw1002

New Member

anothertaxuser

Level 2