- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

Great information, almost to the point I want to be at with this. So here is my next part of this question, since I am putting the info into TurboTax and not 100% what to put. So here is a little more information about the business and such, so maybe you can point me in the right direction. We are 100% husband/wife only owned LLC in a community property state (Texas), which means that the business is considered a disregarded entity and we both file a Schedule C for this business. Since we do this, we split everything in half. each claiming 50% of the income and expenses.

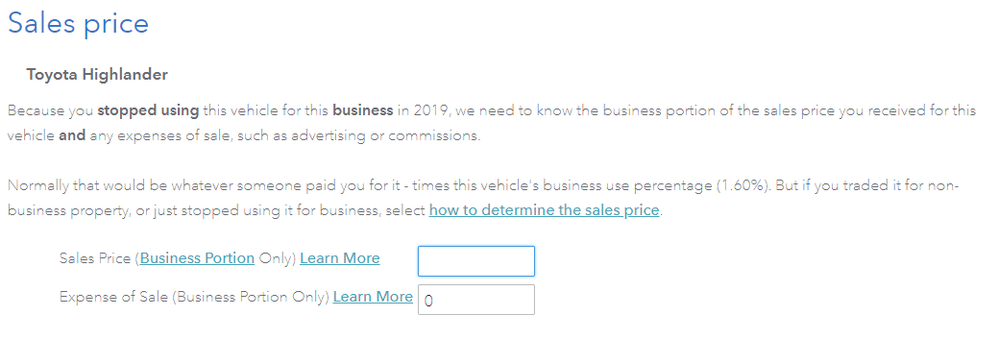

Now since this is the only vehicle we own (yep, a one car family), we use it for both personal and business use. I use an IRS approved mileage tracking app. The mileage we drive each year for business various, so TurboTax can not automatically figure out the sale price and I have to do this, which is fine. According to our mileage app, we only used the vehicle 7.71% for business use, so in my mind, I just take the total amount received from insurance and times it by 7.71%, so for example, the insurance paid out $20,000 total (paid off loan and cash to me for next vehicle). 7.71% of that total is $1542 (which I would split in two and list each on the Sch C). Now the reason I am asking this is because on the page to enter the sale price within TurboTax (I am using the online version), if states "Normally that would be whatever someone paid you for it - times this vehicle's business use percentage (1.60%). But if you" (see included image).

Not sure if they are telling me to use 1.6o% or is that % number was an example. Like I said the un-split % is 7.71% and half that for each of us would be 3.85%. Is that just an example or how are they coming up with 1.60%.

Thanks in advance.