- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: Taxpayers using the Married Filing Separately status do n...

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

We file MFS. I put $2500 in my dependent FSA. Can my wife put $2500 in her FSA too? Will I/we be able to claim the money as childcare credit on our taxes?

@hujor123 wrote:

Thanks! We live together. Filing MFS this year just because we find we can get more credit this year so we are first time trying to file MFS. Since we live together and I'm the lower income of the household, can I claim all dependents? Do we need to file another form 8332 to claim the dependents?

When you are married and living together, ignore all the "special rules" for claiming dependents, they only apply to parents who are divorced or separated and living apart while sharing custody. Either parent may claim one or more of the children in any combination, as long as each child is claimed only once. The parent not claiming the child should not even list the child on their return, and the parent claiming the child will answer "no" to the custody question in the dependent interview. Form 8332 is not used in this situation, and if Turbotax tells you that you need one, you have entered the dependent incorrectly.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

We file MFS. I put $2500 in my dependent FSA. Can my wife put $2500 in her FSA too? Will I/we be able to claim the money as childcare credit on our taxes?

It is extremely rare that MFS is beneficial, so you may be doing it wrong. There are also special calculations if you live in a Community Property State. You cannot use HOH if you are married and live together. Further, Form 8332 is used only by divorced or separated parents. See this for more:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

We file MFS. I put $2500 in my dependent FSA. Can my wife put $2500 in her FSA too? Will I/we be able to claim the money as childcare credit on our taxes?

Thanks. We didn't use HOH, just use MFS. And we are not in Community Property State. We'll double check the number through.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

We file MFS. I put $2500 in my dependent FSA. Can my wife put $2500 in her FSA too? Will I/we be able to claim the money as childcare credit on our taxes?

Please let me know if you find a fix. I’m in the exact same situation.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

We file MFS. I put $2500 in my dependent FSA. Can my wife put $2500 in her FSA too? Will I/we be able to claim the money as childcare credit on our taxes?

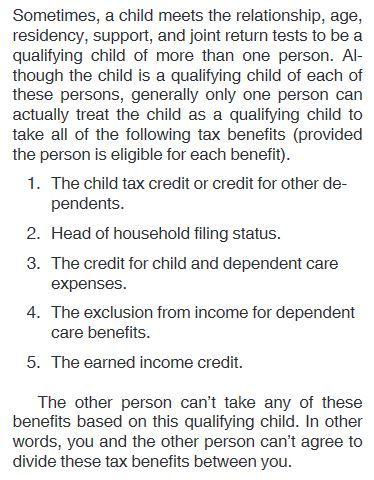

@peachette19 I was in full agreement with you, until I read Pub 501 reproduced below. Apparently, if you file MFS and don't claim the child as a dependent, then you can't obtain the tax benefit of using an FSA. It really doesn't make any sense, but that seems to be the situation. It totally messed up my son, who contributed to an FSA, then used the funds to pay for child care, only to find out that the FSA sum is added back to income and taxable. Of course, how are you supposed to know at the time you elect to participate in an FSA what your tax filing status will be 15 months later?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

We file MFS. I put $2500 in my dependent FSA. Can my wife put $2500 in her FSA too? Will I/we be able to claim the money as childcare credit on our taxes?

Hmm. The instructions to 2441 seem pretty clear that you can...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

We file MFS. I put $2500 in my dependent FSA. Can my wife put $2500 in her FSA too? Will I/we be able to claim the money as childcare credit on our taxes?

@peachette19 wrote:

Please let me know if you find a fix. I’m in the exact same situation and it makes no sense that only one spouse can exclude the $2,500 from their income - what’s the point of the FSA if it’s added back to income at the end of the year? I had this exact issue last year and couldn’t get my tax software to understand it so I had to paper file. I was correct (I could use the $2500 for dependent care for a child I didn’t claim as my dependent) and the IRS adjusted my return accordingly. But I thought I’d try TT this year to save the trouble. Oh well.

That is simply how the law was written. There are many tax benefits that are reduced or denied when filing as "married filing separately" and this is one of them. The maximum FSA exclusion is $2500 and only applies to the parent who claims the child as a dependent.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

We file MFS. I put $2500 in my dependent FSA. Can my wife put $2500 in her FSA too? Will I/we be able to claim the money as childcare credit on our taxes?

@peachette19 wrote:

Hmm. The instructions to 2441 seem pretty clear that you can... if you meet conditions two through five, you can take the exclusion (below). I also paper filed last year with a note explaining this, and it was accepted. I just couldn’t get the tax software to do this. Why do they tell MFS couples to each put in $2500? If only one can exclude from income? It makes no sense. A “qualifying person” is someone you CAN claim as a dependent but not necessarily a dependent.

Married Persons Filing SeparatelyGenerally, married persons must file a joint return to claim the credit. If your filing status is married filing separately and all of the following apply, you are considered unmarried for purposes of claiming the credit on Form 2441.

You lived apart from your spouse during the last 6 months of 2020.

Your home was the qualifying person's main home for more than half of 2020.

You paid more than half of the cost of keeping up that home for 2020.

If you meet all of the requirements to be treated as unmarried and meet items 2 through 5 listed earlier, you can generally take the credit or the exclusion. If you don't meet all of the requirements to be treated as unmarried, you can’t generally take the credit. However, you can generally take the exclusion if you meet items 2 through 5.

If you meet the special conditions, then you also qualify to file as head of household. Filing MFS instead of HOH when you qualify for HOH is a huge mistake, because there are lots of other tax benefits that are denied to MFS. HOH is allowed to use a dependent care FSA and the credit, so what you are doing is telling the IRS that you qualify for HOH but are choosing to file MFS and pay more tax.

Remember the first special condition is You lived apart from your spouse during the last 6 months of 2020. That means your spouse was legally separated and living apart, or on an out of state assignment, or incarcerated, or in some other way not living with you and not part of your household for all of the last 6 months of the year.

If you don't meet all the special conditions, then MFS filers can use a $2500 FSA and can't take the credit at all.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

We file MFS. I put $2500 in my dependent FSA. Can my wife put $2500 in her FSA too? Will I/we be able to claim the money as childcare credit on our taxes?

@peachette19 wrote:

Maybe. As a trained lawyer (also in the student loan MFS boat) I’d like to think I’m half okay at interpreting rules and my interpretation is that you can claim the DCA income exclusion for a qualifying child, which CAN be a dependent but not MUST be a dependent. I am further confused because I paper filed with this explanation for 2019 and the IRS agreed with me. Otherwise doing $2,500 each spouse makes no sense, if only one spouse can exclude it from income on the back end.

If you file MFS, the maximum exclusion is $2500. See here,

https://www.law.cornell.edu/uscode/text/26/129

This concept is incorporated on lines 19-21 of form 2441 and their instructions.

If you do not meet the special conditions, a person filing MFS is only eligible for a $2500 exclusion, and only if they actually claim the child, and they are not eligible for the credit.

Just because the IRS paid your refund last year, doesn't mean they accepted your claim. They have 3 years to audit you. If you attached a statement confirming that you and your spouse lived apart for all of the last 6 months of the year, then you are fine, but you also would have qualified for HOH and probably cost yourself a few thousand dollars by filing MFS instead.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

We file MFS. I put $2500 in my dependent FSA. Can my wife put $2500 in her FSA too? Will I/we be able to claim the money as childcare credit on our taxes?

@peachette19 Further to what @Opus 17 said, if you meet the qualifications for meeting the "unmarried" exception and check the box on the 2441 form that says you meet those qualifications for being "unmarried", then I presume the TT form will work for you and permit you to exclude the FSA money from income.

Believe me, I ran into the same problem on my son's tax return and debated mightily with Opus 17, including citing the same provisions as you. Frankly, it makes no sense. It was only when I stumbled on the section of Pub 501 that I finally gave in. And as I said, it is particularly idiotic when one realizes you elect to participate in an FSA program 15 months prior to knowing your actual tax status. And to add insult to injury, by the time you realize the hopeless situation you are in, you are already well into the next year's FSA program, and such programs don't let you opt out mid-year.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

We file MFS. I put $2500 in my dependent FSA. Can my wife put $2500 in her FSA too? Will I/we be able to claim the money as childcare credit on our taxes?

@peachette19 wrote:

I think this is the part I’m hung up on, interpretation-wise - hear me out - since we aren’t being treated as unmarried or meet those special conditions, we can’t claim the credit - but seem to “generally be able to take the exclusion” if we meet the conditions in 2-5, which we do.

Everyone must meet the 5 general conditions.

If you file MFS, you must also meet the 3 special conditions.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

We file MFS. I put $2500 in my dependent FSA. Can my wife put $2500 in her FSA too? Will I/we be able to claim the money as childcare credit on our taxes?

The care must be for a qualifying person and Pub 501 defines qualifying person and specifically says the non-claiming parent can't exclude dependent care expenses.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

We file MFS. I put $2500 in my dependent FSA. Can my wife put $2500 in her FSA too? Will I/we be able to claim the money as childcare credit on our taxes?

Now for an intriguing follow-up question. Once I came to grips with NOT being able to exclude FSA income on my son's return, thereby adding that money back to taxable income, the next question is whether you need to identify those parties to which you paid dependent care (Part 1 of the form). Originally, I had filled out that section, assuming those costs would be excluded. When TT would not allow this and I finally accepted this, I then started over and noticed TT left Part 1 blank. When I tried to add the names of dependent care providers, it looked like TT did not like this. In any event, I left Part 1 blank and TT let this sail through the Error Check. So that's how I submitted the form electronically with the tax return - Part 1 blank, and Part 3 showing a portion being taxable and a portion carried over into 2021 (and presumably ultimately taxable in 2021).

So my question is whether that is correct to leave Part 1 blank and NOT name child care providers. My instinct says that should be correct because you are not excluding the FSA money, so you have paid tax on it and, therefore, do not need to show the money trail for those FSA funds. Do you agree?

All and all, what a phenomenal waste of time trying to take advantage of a fictitious minor tax break. This "non-deduction" probably cost in time spent substantially more than the potential tax savings

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

We file MFS. I put $2500 in my dependent FSA. Can my wife put $2500 in her FSA too? Will I/we be able to claim the money as childcare credit on our taxes?

You don't need to list the provider because you have no qualifying expenses against which to claim the exclusion or credit. The instructions for form 2441 say to fill out part 3 first if you have an FSA. Your part 3 should show that your benefits are not deductible or excludable and are taxable (zero on line 24 and 25, and the full amount on line 26). That means there's nothing to transfer to parts 1 and 2 of the form.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

We file MFS. I put $2500 in my dependent FSA. Can my wife put $2500 in her FSA too? Will I/we be able to claim the money as childcare credit on our taxes?

Makes sense. Thanks.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

ajm2281

Level 1

user17538710126

New Member

sakilee0209

Level 2

afletchertfc

New Member

user17524145008

Level 1