- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

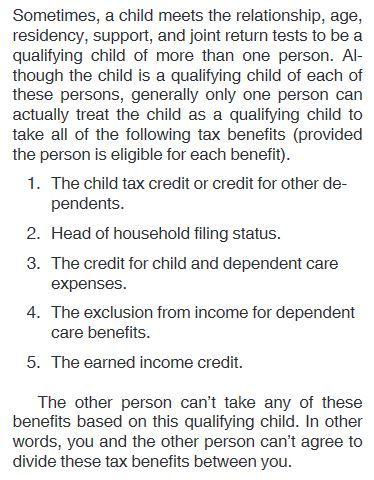

@peachette19 I was in full agreement with you, until I read Pub 501 reproduced below. Apparently, if you file MFS and don't claim the child as a dependent, then you can't obtain the tax benefit of using an FSA. It really doesn't make any sense, but that seems to be the situation. It totally messed up my son, who contributed to an FSA, then used the funds to pay for child care, only to find out that the FSA sum is added back to income and taxable. Of course, how are you supposed to know at the time you elect to participate in an FSA what your tax filing status will be 15 months later?

March 18, 2021

6:41 AM