- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: Taxpayers using the Married Filing Separately status do n...

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

We file MFS. I put $2500 in my dependent FSA. Can my wife put $2500 in her FSA too? Will I/we be able to claim the money as childcare credit on our taxes?

@williasp wrote:

I've now spent several hours looking at the 2441 form (in forms view) as well as the child worksheet. I've also gone through the interview process several times, but with no luck.

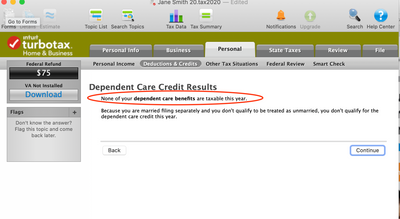

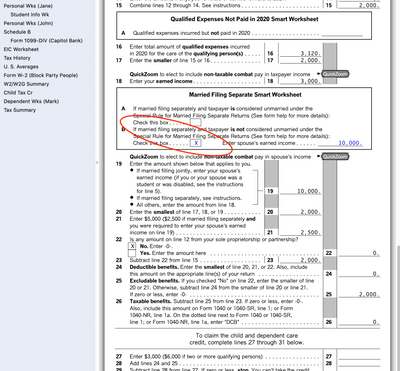

The W2 box 10 info specifying the dependent care FSA carries over to the 2441. But there is no way I can see to input and subtract out payments made to child care providers. So if I input the name, address etc of the child care provider and indicate the payment, that payment doesn't show up in any lines below. I can try to override certain lines, but that will result in an error exclamation point. No matter what check boxes I check, it seems that once I am in MFS mode, the dependent care expenses are "non-qualifying." Again, I am not trying to get the child tax credit. I am simply trying to zero out the FSA account so it is non-taxable. This seems to be a bug in the program because when I read the IRS instructions, it sounds like FSA expenses can be taken if one files MFS.

Please don't keep creating new posts for the same issue. If you are using the desktop program, did you find the checkbox on the line 18 worksheet for form 2441 as indicated here?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

We file MFS. I put $2500 in my dependent FSA. Can my wife put $2500 in her FSA too? Will I/we be able to claim the money as childcare credit on our taxes?

My mistake, if you lived together with the other parent and are filing MFS for other tactical reasons, you need to check box 18B on the form 2441 worksheet.

Incidentally, the program worked fine for me straight through from the beginning with no blocks or errors. You may need to delete your dependent and/or your W-2 and start over. Be careful because in the W-2 interview, you will be asked about your box 10 dependent care benefit, and be careful to the expense questions in the dependent care interview.

You won't get the credit for amounts more than the FSA, but you do get to exclude the FSA amount from your taxable income.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

We file MFS. I put $2500 in my dependent FSA. Can my wife put $2500 in her FSA too? Will I/we be able to claim the money as childcare credit on our taxes?

I just had a brain wave, did you list your child as a dependent? When filing MFS, you can't use an FSA to pay for dependent care expenses unless you are the parent who claims the child as a dependent.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

We file MFS. I put $2500 in my dependent FSA. Can my wife put $2500 in her FSA too? Will I/we be able to claim the money as childcare credit on our taxes?

@Opus 17 Ok, that's interesting it worked for you. Are you also NOT claiming the child as a dependent. That seems to be the problem, along with MFS. I am not claiming the child as a dependent.

I'll try again tomorrow, although I'm not optimistic mainly because I've gone through every possible iteration today.

I've already checked box 18b and filled in spouse's income, so that's not the issue. I've gone through the child worksheet, from which numbers translate to the 2441, but no help. I suppose I could delete the worksheet and go through the interview, but I'm not optimistic. I can go through the W2 interview again and see if that's useful. I hate to delete the W2 because it's a lot of info to reenter. I've gone through the W2 (and worksheet if there is one) in forms view to make sure all the info is correct.

I'll check back tomorrow if no progress. Again, I'm not optimistic only because I've already tried just about every possible variation I could think of. This shouldn't be this difficult.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

We file MFS. I put $2500 in my dependent FSA. Can my wife put $2500 in her FSA too? Will I/we be able to claim the money as childcare credit on our taxes?

Just saw this. Is that really the case? That seems a bit illogical. If I'm paying into an FSA account and spending the money on child care, and I'm a parent, why shouldn't I be able to deduct those expenses. My reading of the IRS instructions seemed to suggest that I'm not entitled to any type of child tax credits. But I don't want those credits. I simply want my FSA reimbursements to be qualified as not taxable. In other words, the FSA amount should be excluded from taxable income.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

We file MFS. I put $2500 in my dependent FSA. Can my wife put $2500 in her FSA too? Will I/we be able to claim the money as childcare credit on our taxes?

Sorry, you have to have a qualifying dependent to use either the credit or the FSA.

It is almost never to your tax advantage to file separately, this is just one of many reasons. You may want to rethink your strategic decision.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

We file MFS. I put $2500 in my dependent FSA. Can my wife put $2500 in her FSA too? Will I/we be able to claim the money as childcare credit on our taxes?

Unfortunately, married people where one partner has an income-based student loan repayment plan is forced to file MFS if they want to keep their loan payments within reason. Otherwise, filing MFS is a real pain in the butt.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

We file MFS. I put $2500 in my dependent FSA. Can my wife put $2500 in her FSA too? Will I/we be able to claim the money as childcare credit on our taxes?

Keep in mind that income-based repayment plans can often last for many years, and one's tax situation is likely to change over time. A visit to a tax planner might be in order at some point.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

We file MFS. I put $2500 in my dependent FSA. Can my wife put $2500 in her FSA too? Will I/we be able to claim the money as childcare credit on our taxes?

I’ve never been convinced that IBR is actually worth it. I got a low income repayment plan and stretched 10 years worth of loans out over 27 years and boy did it suck to be making payments in between playing with my grandchildren. At the end I was making double and triple payments and I couldn’t wait to get the damn thing finished.

You are going to lose a ton of tax benefits by filing separately especially now that you have kids. You need to consider the cost of all of those benefits over the next 10, or 20, or 25 years to make sure that it is really worth it in the long term. In addition to the child tax credit and the FSA rules, your ability to contribute to an IRA is severely restricted, and a number of other credits and deductions are reduced or disallowed.

IBR might make sense if you will qualify for public service loan forgiveness after the first 10 years. But you should check the success rate of PSLF applications, a couple of years ago when the first loan started to mature, the success rate was less than 5%. People found that their jobs didn’t qualify, or that they hadn’t registered their income properly with the Department of Education, or that somewhere they had slipped up in the paperwork and their application was denied. I suppose IBR might also makes sense if you think that a Democratic-led federal government is someday going to forgive most of student loans. There are just enough moderate Democratic senators that I think that is unlikely to happen, at least for the near future.

Finally, unless the laws change, any forgiven student loan amount will be taxable income to you in the year it is forgiven. Once you consider the fact that the forgiven loan balance is taxable income, and add all the tax benefits you lost over the previous decades, you may not be as enamored of the plan as you are now.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

We file MFS. I put $2500 in my dependent FSA. Can my wife put $2500 in her FSA too? Will I/we be able to claim the money as childcare credit on our taxes?

Thanks for the input. Actually, this post is really about my son and daughter-in-law who are in this situation. I simply do their taxes along with my own.

She does have public employment, so the plan (hope) is that the loan is erased in 10 years. I am aware the erased loan may be taxable. However, paying the tax on a huge loan balance is far better than having to pay the balance. Several years back I even offered to pay off half the loan if she could get her father to pay the other half, but she didn't want to ask, mainly because she thought it wouldn't be fair to her siblings.

We have a workaround for the loss of IRA eligibility. They each do a backdoor Roth, first making a non-deductible t-IRA contribution, then converting to Roth. So that actually works out fine.

Perhaps filing MFS will result in some losses along the way. For 2020, there was at least one benefit. She and her child could claim the Covid stimulus payment because her salary is relatively low. If they filed jointly, I'm not sure they would have been eligible. (I'd have to check the limit on that to be sure.)

Believe me, I would much rather they file MFJ. That would make tax time a lot easier. It is really unfortunate that the IBR plan messes things up.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

We file MFS. I put $2500 in my dependent FSA. Can my wife put $2500 in her FSA too? Will I/we be able to claim the money as childcare credit on our taxes?

@Opus 17 "Sorry, you have to have a qualifying dependent to use either the credit or the FSA."

I refer to IRS rules ( https://www.irs.gov/pub/irs-pdf/i2441.pdf ) and wonder if the TT 2441 form is erroneous.

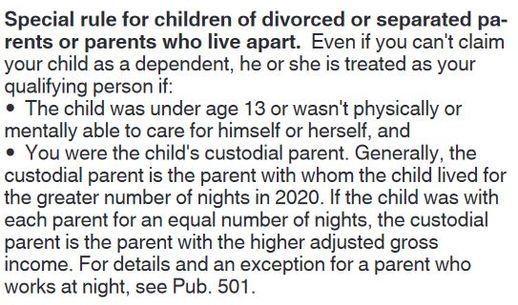

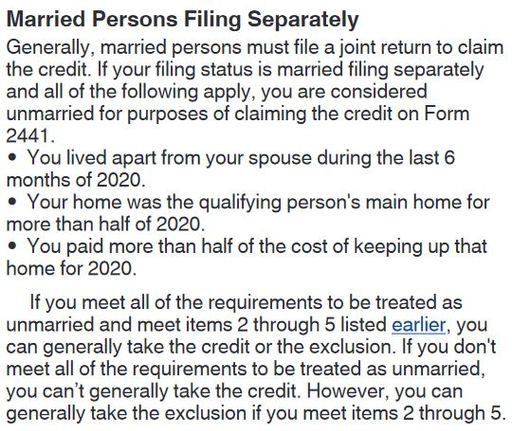

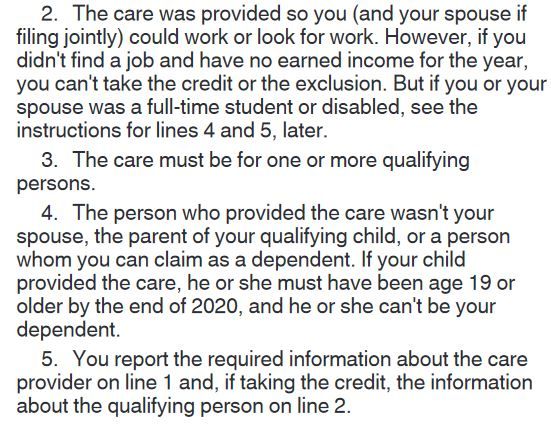

AS it says above, if you meet qualifications 2-5, you can take the exclusion. And even if you can't claim the child as a dependent, he or she is treated as your "qualifying person" if the child was under 13 and you were a custodial (or joint custodial) parent.

So how do I get TT to correct it's program to comply with the above rules.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

We file MFS. I put $2500 in my dependent FSA. Can my wife put $2500 in her FSA too? Will I/we be able to claim the money as childcare credit on our taxes?

I have the exact same question. My income is way lower than my partner. If I file MFS with our dependents, I can get full stimulus check (me+2 dependents). If we file MFJ like we did in the past years, we'll get much smaller stimulus check amount. MFS seems to be a better filing strategy this year. My partner has used around $2300 FSA, but it looks like he can't make it tax exclusion without claiming a dependent. Wonder if there is a solution in TT.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

We file MFS. I put $2500 in my dependent FSA. Can my wife put $2500 in her FSA too? Will I/we be able to claim the money as childcare credit on our taxes?

@williasp wrote:

@Opus 17 "Sorry, you have to have a qualifying dependent to use either the credit or the FSA."

I refer to IRS rules ( https://www.irs.gov/pub/irs-pdf/i2441.pdf ) and wonder if the TT 2441 form is erroneous.

AS it says above, if you meet qualifications 2-5, you can take the exclusion. And even if you can't claim the child as a dependent, he or she is treated as your "qualifying person" if the child was under 13 and you were a custodial (or joint custodial) parent.

So how do I get TT to correct it's program to comply with the above rules.

You must also live apart from your spouse for at least the last 6 months of 2020 (from July 1 onward)? Did you live apart? In that case you will typically file as head of household, in which case you are eligible for the full credit and full exclusion. If you did not live apart from your spouse you can't use these special rules. But I understood you were filing MFS for student loan reasons.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

We file MFS. I put $2500 in my dependent FSA. Can my wife put $2500 in her FSA too? Will I/we be able to claim the money as childcare credit on our taxes?

@hujor123 wrote:

I have the exact same question. My income is way lower than my partner. If I file MFS with our dependents, I can get full stimulus check (me+2 dependents). If we file MFJ like we did in the past years, we'll get much smaller stimulus check amount. MFS seems to be a better filing strategy this year. My partner has used around $2300 FSA, but it looks like he can't make it tax exclusion without claiming a dependent. Wonder if there is a solution in TT.

There is no solution in Turbotax because there is no solution in the tax laws. If you are married and live together, you can't "split" the dependent (spouse 1 claimed dependent for the rebate and spouse 2 claims the dependent to qualify for the FSA). The spouse who claims the child claims all the benefits that child might entitle them to, and the other spouse does not even list the child on their tax return.

If you were separated from the other parent for all of the last 6 months of the year (from July 1 onward) then the parent who had actual physical custody more than half the days of the year can use the child to qualify for the FSA exclusion, and either parent can claim the child for the child tax credit and rebate. But this is not allowed if you are not separated for all of the last 6 months of the year.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

We file MFS. I put $2500 in my dependent FSA. Can my wife put $2500 in her FSA too? Will I/we be able to claim the money as childcare credit on our taxes?

Thanks! We live together. Filing MFS this year just because we find we can get more credit this year so we are first time trying to file MFS. Since we live together and I'm the lower income of the household, can I claim all dependents? Do we need to file another form 8332 to claim the dependents?

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

ajm2281

Level 1

user17538710126

New Member

sakilee0209

Level 2

afletchertfc

New Member

user17524145008

Level 1