- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

@williasp wrote:

@Opus 17 "Sorry, you have to have a qualifying dependent to use either the credit or the FSA."

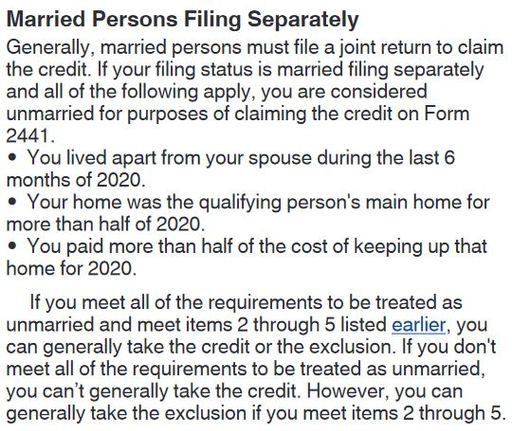

I refer to IRS rules ( https://www.irs.gov/pub/irs-pdf/i2441.pdf ) and wonder if the TT 2441 form is erroneous.

AS it says above, if you meet qualifications 2-5, you can take the exclusion. And even if you can't claim the child as a dependent, he or she is treated as your "qualifying person" if the child was under 13 and you were a custodial (or joint custodial) parent.

So how do I get TT to correct it's program to comply with the above rules.

You must also live apart from your spouse for at least the last 6 months of 2020 (from July 1 onward)? Did you live apart? In that case you will typically file as head of household, in which case you are eligible for the full credit and full exclusion. If you did not live apart from your spouse you can't use these special rules. But I understood you were filing MFS for student loan reasons.