- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

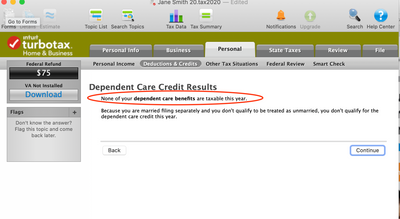

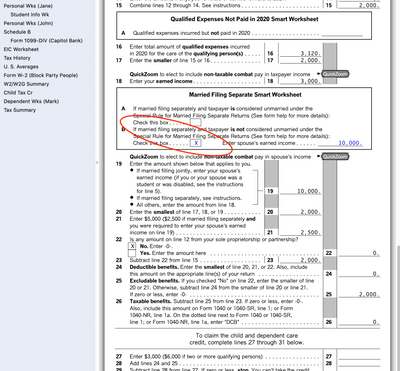

My mistake, if you lived together with the other parent and are filing MFS for other tactical reasons, you need to check box 18B on the form 2441 worksheet.

Incidentally, the program worked fine for me straight through from the beginning with no blocks or errors. You may need to delete your dependent and/or your W-2 and start over. Be careful because in the W-2 interview, you will be asked about your box 10 dependent care benefit, and be careful to the expense questions in the dependent care interview.

You won't get the credit for amounts more than the FSA, but you do get to exclude the FSA amount from your taxable income.

March 8, 2021

2:50 PM