- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

@Opus 17 "Sorry, you have to have a qualifying dependent to use either the credit or the FSA."

I refer to IRS rules ( https://www.irs.gov/pub/irs-pdf/i2441.pdf ) and wonder if the TT 2441 form is erroneous.

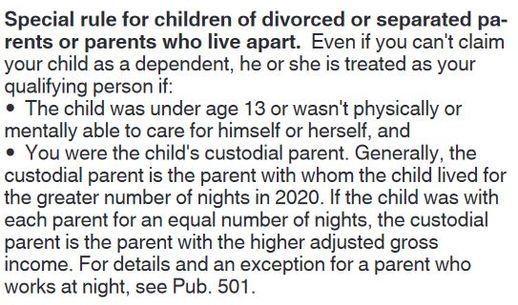

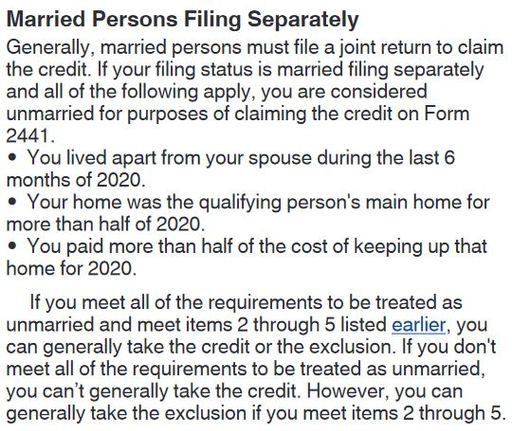

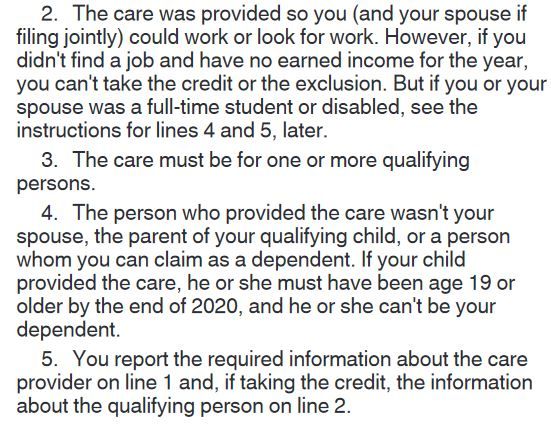

AS it says above, if you meet qualifications 2-5, you can take the exclusion. And even if you can't claim the child as a dependent, he or she is treated as your "qualifying person" if the child was under 13 and you were a custodial (or joint custodial) parent.

So how do I get TT to correct it's program to comply with the above rules.

March 8, 2021

7:34 PM