- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: Solar Credit Carry Forward

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Solar Credit Carry Forward

Hello,

I am using Turbo Tax and entered the information on the installation of my solar panels. The credit is being applied to 2019 and carrying forward to 2020. Is there a way to get the full credit in 2019 with no carryover to 2020?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Solar Credit Carry Forward

The solar credit is a non refundable credit meaning that it is limited by the amount of tax liability shown on your tax return. Once this credit, or any other credits with higher priority than this one, use up your liability and reduces it to $0, you can't get any more credit on this year's tax return. Credit that you can't use on this year's return can be carried forward to later years.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Solar Credit Carry Forward

Can an energy tax carry over be taken in the same year as the filing year. If no why not..

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Solar Credit Carry Forward

No, if 2019 is the year you filed the Solar Energy Credit and there is a carryover amount you cannot use the carryover amount until you file your 2020 tax return.

The Solar Energy Credit is a non-refundable credit that will reduce your tax liability to $0 any additional amount is carried to 2020.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Solar Credit Carry Forward

Where and how do I enter the carryover amount for my solar panels that I claimed last year? Last year I was able to take the credit but it was more than my taxable amount so it rolled forward but I can't figure out where to find that amount and where to enter it in Turbo Tax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Solar Credit Carry Forward

I had almost 5K in carry forward from last year but when I applied it to this year's return, my federal refund did not go up. Why not?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Solar Credit Carry Forward

The solar credit is non-refundable; meaning it is only applied to reduce your tax to zero. Since you were already getting a refund there was no tax to reduce.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Solar Credit Carry Forward

Does this mean the full carry forward moves onto all the upcoming years until I need to fully use it to get the full tax credit?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Solar Credit Carry Forward

Yes, although the solar credit is not a refundable credit, it can be carried back 1 year and forward 20 years until you are able to use the full credit.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Solar Credit Carry Forward

We purchased a PV solar energy system in 2020. It cost around $31,000, and the 26% rate for the tax credit equals roughly $8000. When I entered all of the info into Turbo Tax, it appears they added all $8000 to my federal refund. (Actually, we owed around $1500 so the federal refund now shows $6500). If this is intended to be a tax credit, why does it show on TT as a refund, when it should show $6500 as carryover tax credit for future years? I am worried if I file it this way, the IRS will accuse me of fraud when it is TT that calculated it that way.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Solar Credit Carry Forward

You can safely file your tax return. A Solar Energy Tax credit is a nonrefundable credit. 30% for those installed before December 31, 2019. The credit decreases to 26% for systems installed in 2020 and to 22% for systems installed in 2021. If your system cost 31K, then you are due a tax credit on this tax return of ~8K (26%). You can take the full credit as long as your tax liability is more than the credit (check line 18 of form 1040).

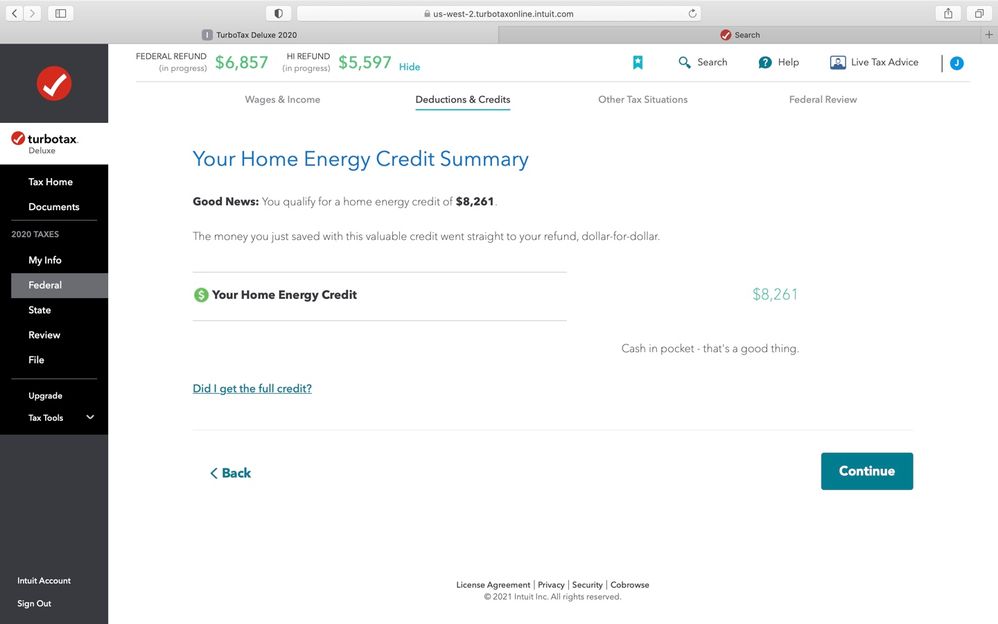

After you enter the credit, you should see a screen that tells you how much credit you qualify for (8K) how much, if any, will be carried forward to next year. See image below. In my example (31K solar system installed in 2020), my tax liability was only $6,185, so the remainder is carried over to 2021. You can view Form 5695 to see how the credited was calculated and also see the amount applied to this year's taxes and how much gets carried over.

Tax credits, dollar-for-dollar, reduce the amount of taxes you owe. If you claim more credits than you owe in taxes, you may end up owing nothing, and in certain situations, getting additional money back. But in your situation, you have no credit left to take next year since you are getting the full credit now. @jmh_in_hnl @Joanne-hogle

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Solar Credit Carry Forward

Thank you for your reply Dawn. The problem is on that same page you sent a picture of, I did not receive a message stating the remainder of my credit was going to carryover to 2021. Our tax liability prior to entering the solar energy info was only ~$1500 (per the TT calculation after entering all our income and other deductibles). As you can see in the picture below, it sent the remaining $6800 directly to our federal refund. I received no message anywhere about the extra amount being used for a carryover in 2021. Thanks again for any help you can provide.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Solar Credit Carry Forward

It depends. The solar credit is used to lower tax liability and is non-refundable. If your liabiltiy equals to your solar credit, the full credit will be used to offset your tax liability. Otherwise, it will be carryforward to the following year.

The investment tax credit (ITC), also known as the federal solar tax credit, allows you to deduct 30 percent in 2019 (26% in 2020) of the cost of installing a solar energy system from your federal taxes. The ITC applies to both residential and commercial systems, and there is no cap on its value Anyone who does not owe federal income taxes will not be able to benefit from the solar tax credit.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Solar Credit Carry Forward

I am pretty sure that this has been resolved by now, but after reading this over carefully I think there is some confusion regarding the definition of "tax liability". Tax liability is your total tax, not the tax you still owe. I think that you are thinking that your "tax liability" is what you still owe, which is not the case. For example, if you paid $20k in taxes throughout the year (withholding, estimated taxes, etc.), and your Tax Liability (your total tax) for the year was $21,500, you would owe Uncle Sam $1,500. In this case the Tax Liability is $21,500, not $1,500. If then entered a Solar Tax Credit of $8,000, you would get a $6,500 refund ($8,000 Credit - $1,500 still owed).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Solar Credit Carry Forward

I had a tax credit from 2020 that was suppose to carry over. After completing this portion of the tax return, it is saying that it is rolling over again to 2022. I'm suppose to pay that to the finance company to assure a certain payment and now I won't be able to do that. Why am having to roll it over again?

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17719012064

New Member

laura_borealis

Level 4

ocharc

New Member

kenpodawg68

New Member

artsmookler

New Member