- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: QBI deduction (phased in reduction)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

QBI deduction (phased in reduction)

I have QBI that is from an SSTB and my income is within (but not greater than) the phase-out range. I understand that a portion of my QBI will be reduced, however the Turbo tax software seems to be reducing it twice. It is first reduced on rows 5 through 11 of the Form 8995A Schedule A Smart Worksheet. This reduced amount carries to Line 2 of Form 8995-A, where it is subsequently reduced again in Part III of that form. This does not seem right to me. I may have input something wrong but I can't figure out where. Has anyone else seen this? Is it correct? Any suggestions?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

QBI deduction (phased in reduction)

It depends. I assume this is reported from a K-1. Can you clarify this by telling me if:

- If this a K-1 from an S-Corp or partnership?

- The amounts listed in each box of the K-1.

- Once I have this information, I will test this in my software to see if I get the same results as you.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

QBI deduction (phased in reduction)

Yes, there is a K-1 involved. It is for a partnership. The amounts on the K-1 are:

Row 1: 19,356

Row 14a: 19,356

Row 14c: 30,371

Row 19a: 19,237

Row 20, Code Z:

Ordinary income 19,356

Self-employment income 19,356

(The SSTB box is also checked yes on row 20)

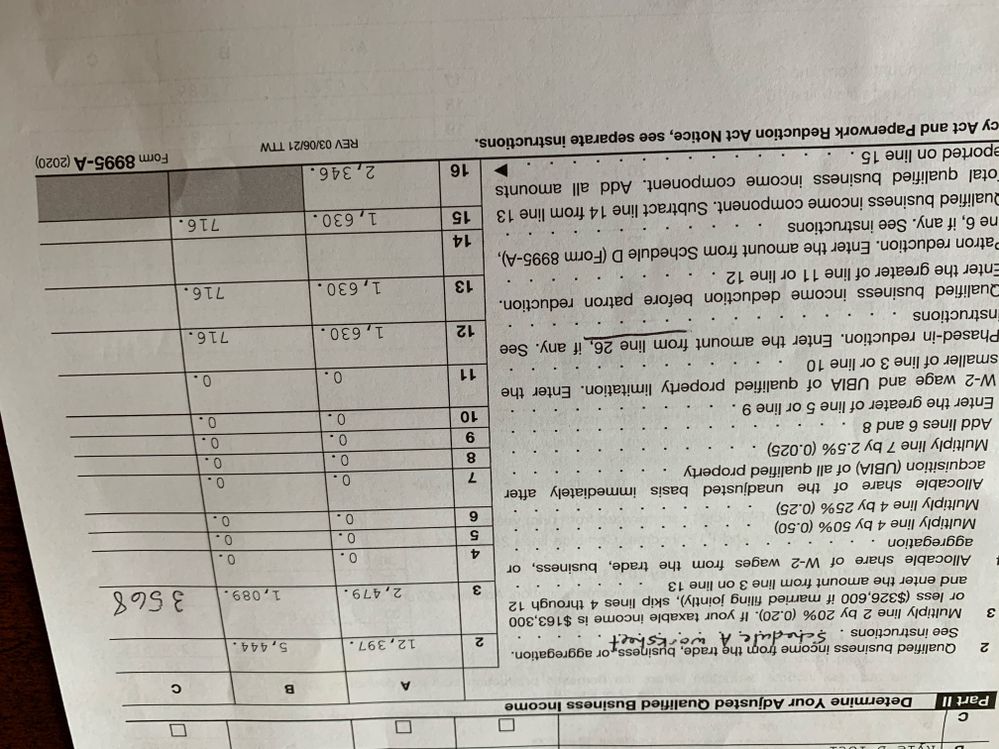

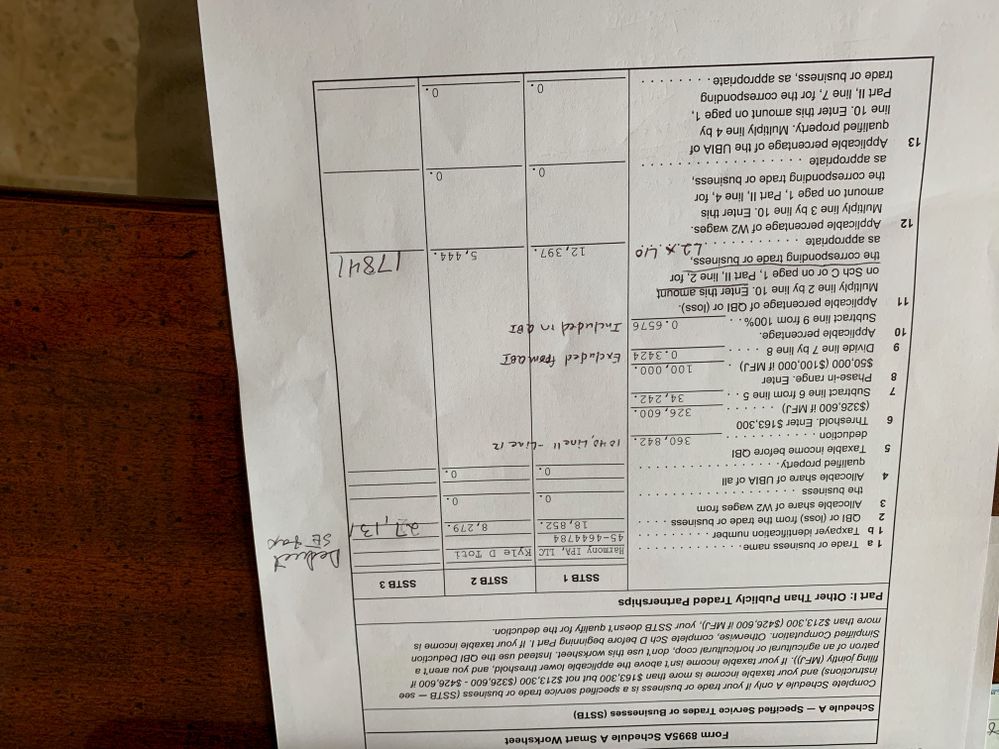

The K-1 is the biggest part of my QBI, but I also have $8,279 of Schedule C income which is eligible QBI and is a SSTB. Both the K-1 income and the Schedule C income are getting the same calculation of QBI. I am attaching pictures of the Form 8995-A and the 8995A Schedule A smart worksheet from turbo tax. Thanks so much for your help on this.

Dave

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

QBI deduction (phased in reduction)

There is a phase-out of the deduction based on your income under normal QBI rules, then there is an additional phase-out if you are a SSTB, that is why it appears you are being hit twice with phase-outs.

You may find this article helpful:

What is the Qualified Business Income (QBI) deduct... (intuit.com)

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

afletchertfc

New Member

CRHawkins

New Member

janinemramsey

New Member

rileyjeanyoung

New Member

niks_sabharwal

Returning Member