- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

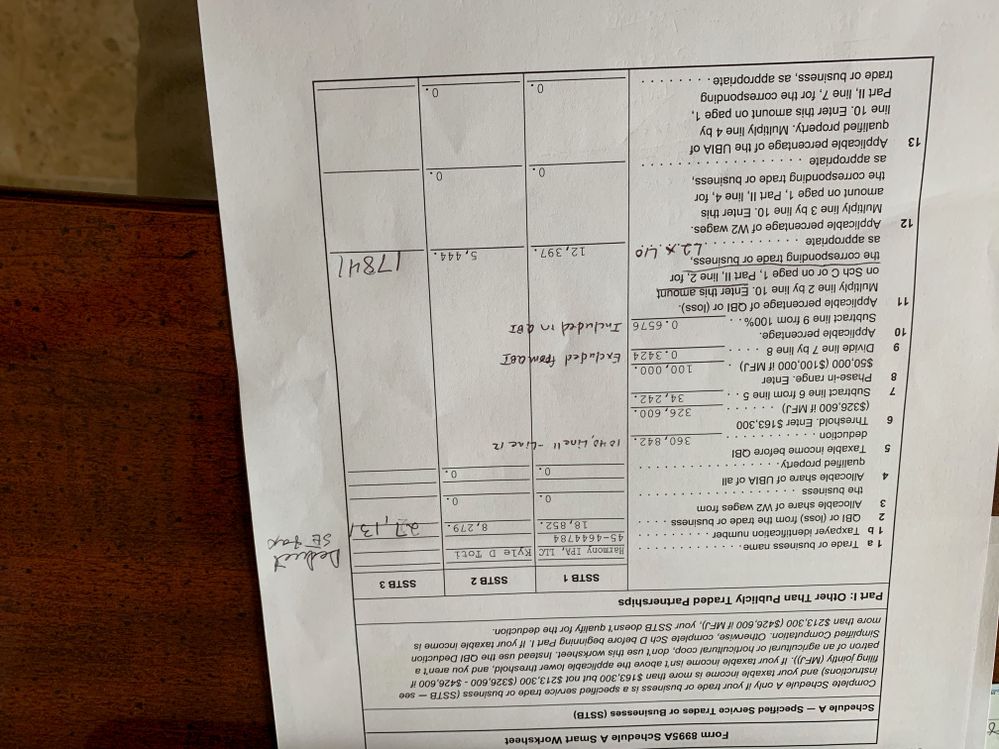

Yes, there is a K-1 involved. It is for a partnership. The amounts on the K-1 are:

Row 1: 19,356

Row 14a: 19,356

Row 14c: 30,371

Row 19a: 19,237

Row 20, Code Z:

Ordinary income 19,356

Self-employment income 19,356

(The SSTB box is also checked yes on row 20)

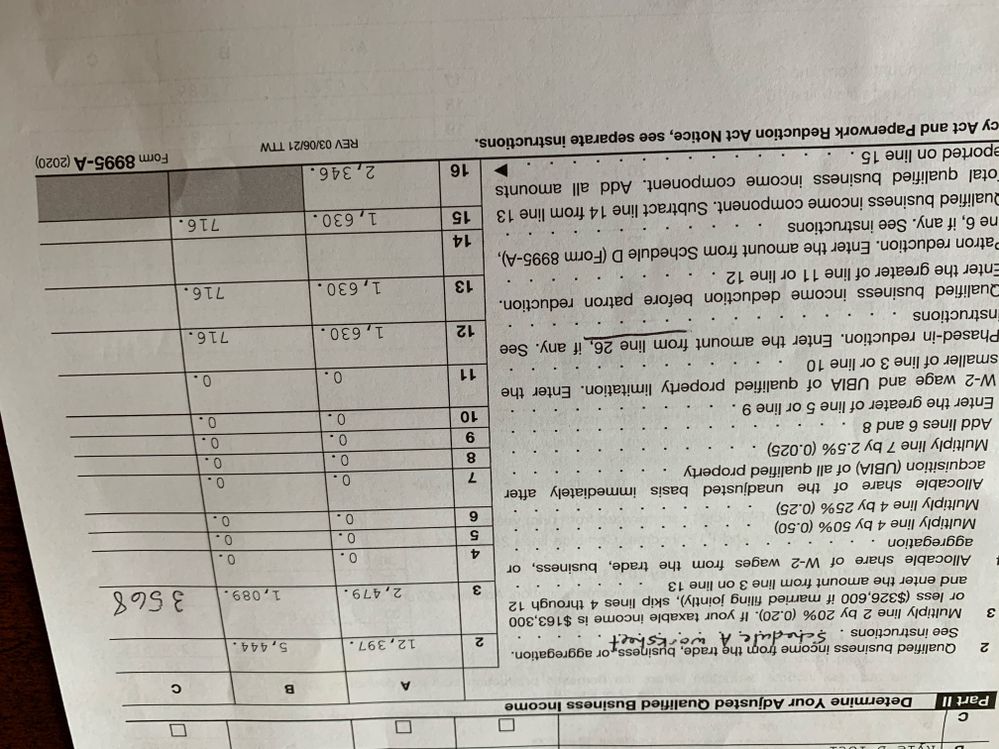

The K-1 is the biggest part of my QBI, but I also have $8,279 of Schedule C income which is eligible QBI and is a SSTB. Both the K-1 income and the Schedule C income are getting the same calculation of QBI. I am attaching pictures of the Form 8995-A and the 8995A Schedule A smart worksheet from turbo tax. Thanks so much for your help on this.

Dave

March 16, 2021

1:02 PM