- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: My Sale of Business Property shows $908,623.00 I can't find any way to make this disappear. T...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My Sale of Business Property shows $908,623.00 I can't find any way to make this disappear. The Edit button doesn't let me override it to zero.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My Sale of Business Property shows $908,623.00 I can't find any way to make this disappear. The Edit button doesn't let me override it to zero.

You can delete Form 4797 to get rid of that entry, but once you do that, you need to review the information that you entered about your 1031 exchange before you file.

If you are using TurboTax Online:

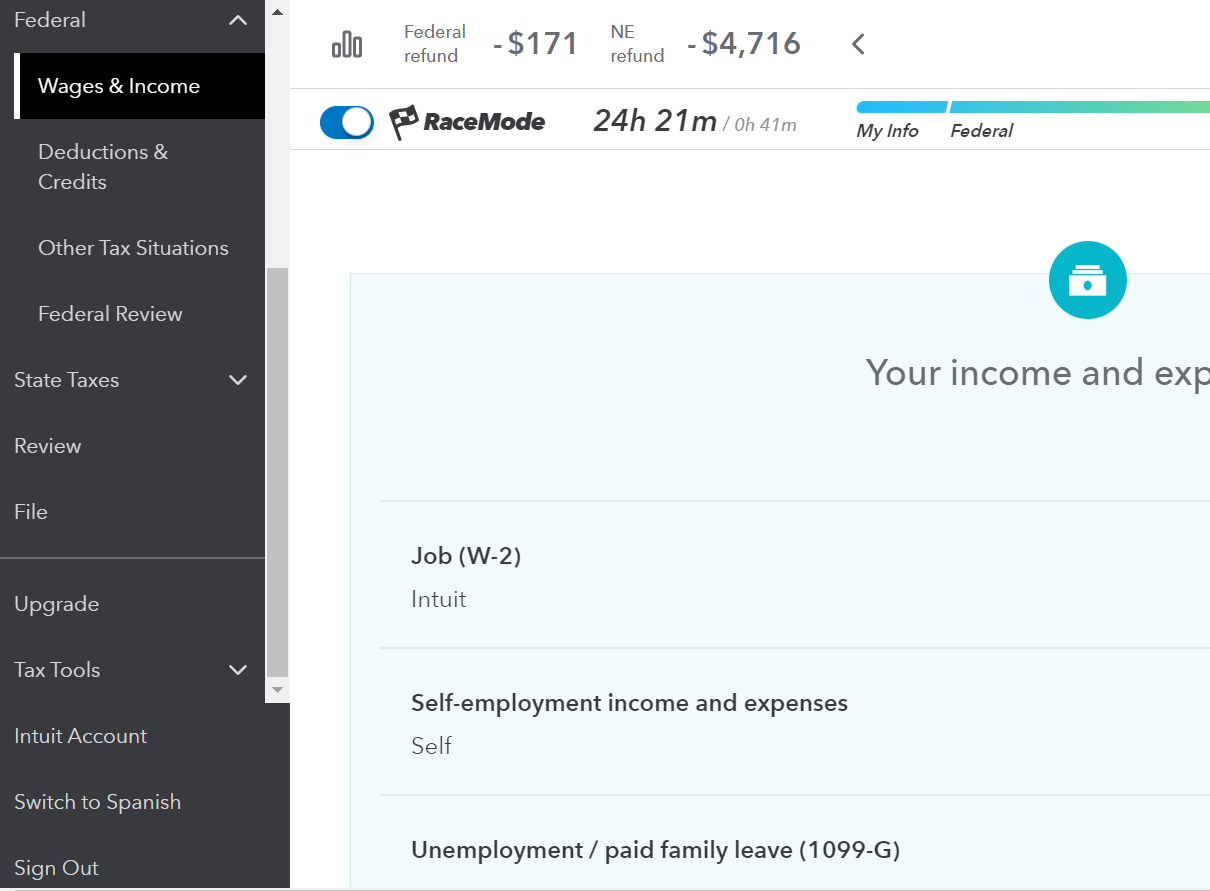

- From inside the return, scroll down to Tax Tools on the bottom of the left side menu.

- Select Tools.

- Click on Delete a form (third on the list at the bottom of the screen).

- Find Form 4797 on the list of forms.

- Click Delete to the right.

- Confirm your Delete.

If you are using the Desktop version (disc or download):

- Click Forms toward the upper right corner.

- Find Form 4797 on the list on the left.

- Highlight it, then click Delete in the lower left corner of the reading pane.

- Click on Step by Step in the upper right corner to return to the interview.

Click here for information about reporting your 1031 exchange.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My Sale of Business Property shows $908,623.00 I can't find any way to make this disappear. The Edit button doesn't let me override it to zero.

Sorry Julie,

There's no item called Tax Tools on the left hand side bottom. Only File an Extension, Intuit Account, Switch to Spanish and Sign Out are listed.

There's no entry for Forms on the top right hand side either (for desktop version, but checked it just in case).

Also, I could find no place where the 1031 exchange info can be entered.

On top of that, I bought 2 properties in the 1031 exchange (multi-asset exchange), which Turbotax doesn't handle.

Your help is greatly appreciated.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My Sale of Business Property shows $908,623.00 I can't find any way to make this disappear. The Edit button doesn't let me override it to zero.

Sounds like you aren't actually in the return. Be sure to open it up after you log in by clicking on Pick up where you left off.

If you still don't see it, look for a scroll bar on the left side of your menu.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My Sale of Business Property shows $908,623.00 I can't find any way to make this disappear. The Edit button doesn't let me override it to zero.

Julie,

I found Form 4797 p1, Form 4797 p2 (Copy 1) and Enterable 4797 (Copy 1)! The only option is to delete each one of them. I can't click on them to see the forms themselves. Maybe should just go ahead and delete all three?

Also, I could find no place where the 1031 exchange info can be entered.

On top of that, I bought 2 properties in the 1031 exchange (multi-asset exchange), which Turbotax doesn't handle.

Your help is greatly appreciated. SS

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My Sale of Business Property shows $908,623.00 I can't find any way to make this disappear. The Edit button doesn't let me override it to zero.

This is what TurboTax says about the 'out-of-scope' parts of 1031 exchanges are-

Like-Kind Exchanges (Form 8824): Any loss on other property given up shown on line 14 is treated as either trade or business, or investment income depending on your entries in the smart worksheet for Additional Information Regarding Unlike-kind Property Given Up. Losses on personal use property, which must be limited to zero, are not supported. A "summary" Form 8824 is not automatically created when there is more than one Form 8824 in the tax return. Multi-asset exchanges are not supported when lines 12 through 18 are left blank and the correct amount is entered directly on line 19. Form 8824 does not provide for any differences for alternative minimum tax (AMT) for gains reported on lines 14, 24, 35, and 36. Any AMT differences for these lines must be entered directly on Form 6251. If an exchange with a related party occurred in a prior year and the property has now been sold and line 24 must be reported as taxable in the current year, you may need to make entries directly on Form 4797 to correctly split the amount on line 24 of Form 8824 between ordinary income recapture and other reportable gain.

That's a big word wall that says that this may be the year that you're better off hunting for a tax professional to do your return than trying to do it your self.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My Sale of Business Property shows $908,623.00 I can't find any way to make this disappear. The Edit button doesn't let me override it to zero.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My Sale of Business Property shows $908,623.00 I can't find any way to make this disappear. The Edit button doesn't let me override it to zero.

If you would like to request a refund for your TurboTax product, you can do so in the below TurboTax Help Article.

How do I request a refund for my TurboTax product?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17550205713

New Member

SB2013

Level 2

Kenn

Level 3

pv3677

Level 2

lou-chapko

New Member