- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: My child will turn 13 during 2022. I have elected a $5,000 Dependent Care FSA for 2022 because he is eligible for PART of the year. I know TurboTax won't even let me access this part of the return...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My child will turn 13 during 2022. I have elected a $5,000 Dependent Care FSA for 2022 because he is eligible for PART of the year. I know TurboTax won't even let me access this part of the return, as if he weren't eligible all year. How can I fix??

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My child will turn 13 during 2022. I have elected a $5,000 Dependent Care FSA for 2022 because he is eligible for PART of the year. I know TurboTax won't even let me access this part of the return, as if he weren't eligible all year. How can I fix??

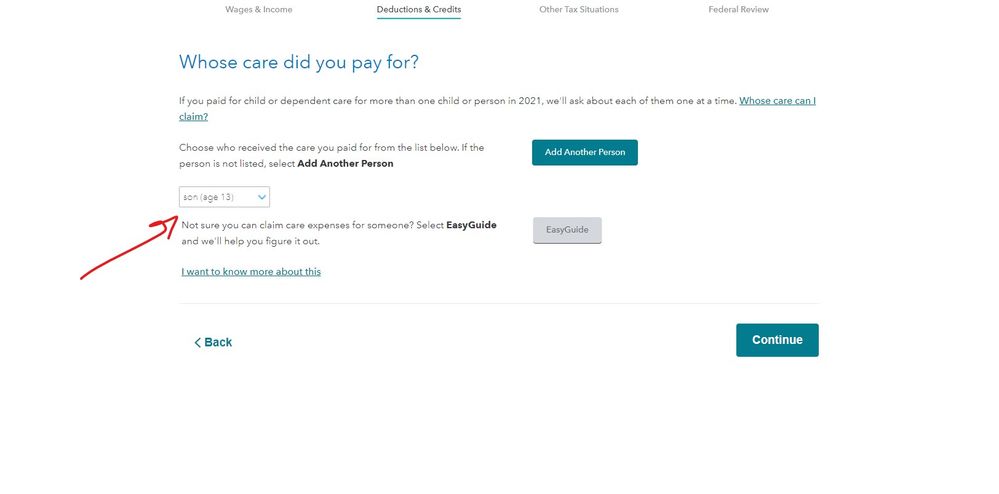

Not sure where you are having an issue on the current 2021 return ... I put a 13 year old on my test return and the child care section came up correctly. Did you enter in any income yet ???

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My child will turn 13 during 2022. I have elected a $5,000 Dependent Care FSA for 2022 because he is eligible for PART of the year. I know TurboTax won't even let me access this part of the return, as if he weren't eligible all year. How can I fix??

Thanks for replying. The dependent ages are in there, carried from year before. The Dep Care FSA is for children under the age of 13. The issue is that TurboTax treats a 13-year-old who turns 13 mid-year as if the child were 13 for the entire year, so it skips this section for them entirely. I've seen this happen with my older children, when they turned 13 mid-year. There is no way to add them back. So I'm concerned I won't have a way to apply the $5,000 to my return. I'm wondering why TurboTax won't fix this or how other people have dealt with this issue.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My child will turn 13 during 2022. I have elected a $5,000 Dependent Care FSA for 2022 because he is eligible for PART of the year. I know TurboTax won't even let me access this part of the return, as if he weren't eligible all year. How can I fix??

Again I reviewed my 2021 test return with a child who turned 13 mid year with $10K paid in child care and $5K in FSA W-2 box 10 and the program gave me credit for all of it correctly. Not sure where you are having issues so talk to TT support directly and they can help you thru that section.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My child will turn 13 during 2022. I have elected a $5,000 Dependent Care FSA for 2022 because he is eligible for PART of the year. I know TurboTax won't even let me access this part of the return, as if he weren't eligible all year. How can I fix??

"My child will turn 13 during 2022."

Call me crazy but how is this an issue for your 2021 tax return if your child will be twelve years old for all of 2021? You say your child will turn 13 in 2022.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

karliwattles

New Member

kip16

Level 1

kip16

Level 1

Questioner23

Level 1

gborn

Level 2