- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: Illinois Teacher - Educator expenses get entered in both Federal AND State?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Illinois Teacher - Educator expenses get entered in both Federal AND State?

Details:

- 2 Qualified Educators

- $455 in combined expenses for Instructional Materials and Supplies

- Illinois State

Do we enter our educator expenses twice in TurboTax? The questionnaire asks for Federal Credit AND again in State Credits. I thought that I could only enter in one spot but I'm getting strange results.

If I do NOT enter expenses ANYWHERE I get (-$558) Fed & $1323 State

If I enter only in federal I get (-$459) Fed & $1345 State

If I enter only in state I get (-$558) Fed & $1778 State

If I enter BOTH federal and state I get (-$459) Fed & $1800 State

$0 benefit for entering nowhere (duh)

$121 benefit from entering in only Federal

$455 benefit from entering in only State (full recovery of cost)

$576 benefit from entering in both Federal and State (benefit is more than cost of supplies)

I know I can enter in one or the other but if I can't enter in both shouldn't TurboTax clarify that I cannot enter the same expenses in both locations and maximize the refund by determining which return to place the expenses on?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Illinois Teacher - Educator expenses get entered in both Federal AND State?

First of all, the educator expense is a income adjustment and not a credit. You would enter this in your federal return:

- Under federal>deductions and credits>employment expenses>show more

- Select teacher (education expenses) and enter the combined total of $455.

When this is entered properly, the amount will be shown on line 10a as a reduction against your taxable income up to that point. Your Illinois return will adjust the taxable income for that state to reflect the $455 expense. The second scenario you presented where you entered only in federal does sound correct because it does reduce taxable income but it doesn't reduce by the same amount of the expense because it is not a credit.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Illinois Teacher - Educator expenses get entered in both Federal AND State?

Quote: "Your Illinois return will adjust the taxable income for that state to reflect the $455 expense"

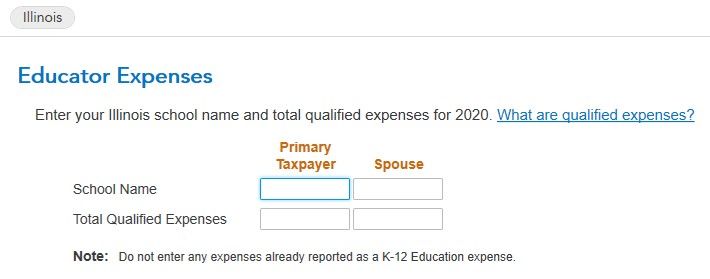

See, that doesn't make sense because then why is it asking in the State Questionnaire after entering the expenses in the federal return. Here, let me show you exactly what TurboTax is asking.

Educator Eligibility question:

And then after answering "yes" about eligibility:

I get wildly different results if I enter expenses into only federal or only state. You would think that if the state return "pulls the info" from the federal return, that entering into only state would get a smaller overall benefit. In fact, entering into state only gets a MUCH larger benefit than only entering into federal. But it doesn't make sense that you would have to forgo the federal benefit to get the state one.

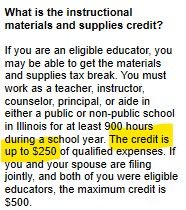

I don't recall ever seeing these same two questions during the State return in TurboTax in the past. The more I think about it, the more I believe that we are supposed to enter it into BOTH returns because the state has a higher standard to qualify for the benefit. When you enter the expenses into federal return, you get a deduction for both federal and state. But in the state questionnaire you have to meet certain criteria in order to be be a qualified educator and you they need to be qualified expenses. On the state side TurboTax says it is an Educator Expense credit. Here is an image of what TurboTax shows if you click "Learn More"

So it appears to be a deduction for both federal and state and you get a state credit in addition to the deduction. Am I missing something?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Illinois Teacher - Educator expenses get entered in both Federal AND State?

Yes, after examining the Illinois return, you are eligible for a credit for Educator expenses in your Illinois return up to $500. I apologize I was not aware of this credit. You do need to report this in your state return in order to claim the credit. You also get the adjustment in your federal return that reduces your taxable income on the federal level. Illinois begins taxation on your final adjusted gross income taking this adjustment in consideration.

In this case, if you enter the information in the federal section that I outlined and enter the credit in your state return, your federal return should be (-$459) and state $1800. This is correct.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Illinois Teacher - Educator expenses get entered in both Federal AND State?

Thanks!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

srobinet1

Returning Member

Babyelise88

Returning Member

owlnal063

Level 1

shikhiss13

Level 1

Rsachdeva

New Member