- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

Quote: "Your Illinois return will adjust the taxable income for that state to reflect the $455 expense"

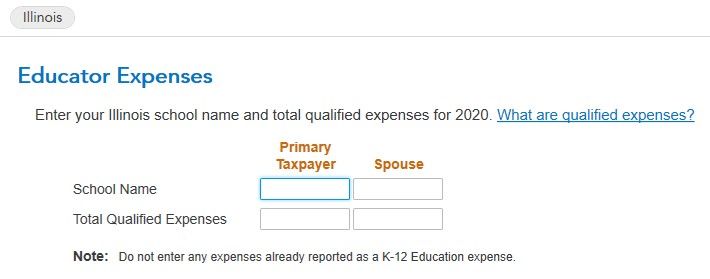

See, that doesn't make sense because then why is it asking in the State Questionnaire after entering the expenses in the federal return. Here, let me show you exactly what TurboTax is asking.

Educator Eligibility question:

And then after answering "yes" about eligibility:

I get wildly different results if I enter expenses into only federal or only state. You would think that if the state return "pulls the info" from the federal return, that entering into only state would get a smaller overall benefit. In fact, entering into state only gets a MUCH larger benefit than only entering into federal. But it doesn't make sense that you would have to forgo the federal benefit to get the state one.

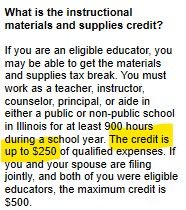

I don't recall ever seeing these same two questions during the State return in TurboTax in the past. The more I think about it, the more I believe that we are supposed to enter it into BOTH returns because the state has a higher standard to qualify for the benefit. When you enter the expenses into federal return, you get a deduction for both federal and state. But in the state questionnaire you have to meet certain criteria in order to be be a qualified educator and you they need to be qualified expenses. On the state side TurboTax says it is an Educator Expense credit. Here is an image of what TurboTax shows if you click "Learn More"

So it appears to be a deduction for both federal and state and you get a state credit in addition to the deduction. Am I missing something?