- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: If you have refinanced your home, it is normal that you h...

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I refinanced and have two 1098 forms

I worked online with support for several hours. It appears the desktop version definitely has some bugs. If you go to the Form portion of the application, you will find additional fields, like was this paid off, etc. So it's not asking the correct questions on the walk through. If you check the box on the form itself, then go back to the walk through, you will see additional fields. Also, the CA state form is messed up in that it adds the amounts of both 1098's together. We ended up re-entering all the data in the Online version and that seems to work as expected. Not so good news for the desktop users at this point.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I refinanced and have two 1098 forms

Can you advise what you used for online? I am doing it online, following the advice on this thread, and our loans are being overstated on the california form.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I refinanced and have two 1098 forms

Update for the online version. Looks like if you delete all the forms and go in order, you can get the screens asking if the loan was paid off, so say "yes" there. The answer on original loan or refinanced later doesn't seem to matter. When you go to the CA form, you will be asked to put in the ending balances for the year. This is where you can put 0 for the original (non-refinanced) loan and any refi loan that was bought out during the year. That seems to produce a total mortgage balance that doesn't trigger the limits. I should also clarify that the Federal form forces you to put something in the "Outstanding Balance" on the main page, and I put "0" there.

Note: This only applies to the desktop version, I guess. You cannot override anything in the online version. The problem appears to be the use of the Average Balance method. If the interest rate method is used instead (divide the interest for each loan by the respective interest rate), then the average balance can be manually entered with the correct values. See: https://proconnect.intuit.com/community/help-articles/help/entering-a-refinance-in-the-excess-mortga...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I refinanced and have two 1098 forms

I used the online live. I can't see the actual forms just yet as I have an appointment with live specialist to review that area to make sure it all looks good. You can't see the forms until you pay I guess. I already paid for the desktop version which doesn't work so I wanted to see if the online would calculate. The only thing I can tell is that the questions were working properly on the online version and the adjustment to my interest looks to be correct. The desktop version for CA was adding the two together so hopefully that's not the case on the online version.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I refinanced and have two 1098 forms

Be sure to sign out of TurboTax and sign back in to be sure you have the latest updates of the software. In the CA interview now you should get question in the "Income and adjustments" interview section asking you to input "end-of-year" mortgage balances. When you put zero in for ones paid off, the mortgage interest adjustment should correct.

You may also "Edit" the "Mortgage Interest Adjustment" item to get to the questions.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I refinanced and have two 1098 forms

Does this mean the error has been fixed in downloaded Deluxe as well? If so, should I go back and delete all the 1098 and mortgage worksheets, and re-enter data? (Of course I'll go experiment meanwhile...)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I refinanced and have two 1098 forms

I’m giving up and just doing TT online. It lets me (and tells me) to input 0 on box 2 for the refinanced loan. As far as the California total goes, it still comes out wonky but I think that only appears on a worksheet that doesn’t go to IRS

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I refinanced and have two 1098 forms

And the answer is, NO, the error has not been corrected.

The Federal mortgage interest worksheet now computes the Federal mortgage deduction limit correctly.

The corresponding California step-b-step is now asking for the ending balances on original and refi loans, which is a step (so to speak) forward, but it's still not calculating the two average balances correctly. The mortgage Ded Home Mort worksheet is still not pro-rating the original and refinanced mortgages correctly; rather, it's doing (begin-end)/2 calculation for the original loan (which means it's in effect assuming a June 30 refi), but it's doing an (orig-end)/2 calculation for the refi, which would only be correct if the refi were on Jan 1. So it's still overestimating the average balance of all home acquisition debt.

The error can be corrected manually by overriding the "average balance" entries in the "Above debt categorized..." section, substituting the correctly prorated average balances calculated by the Federal form.

In my case (mortgage originally taken out before Dec 2017, and then refinanced in 2019, both loans >$1m), the calculations should be almost identical for Federal and California returns. The only difference is that the Feds allow me to deduct interest on no more that $1m of average mortgage balance, whereas California allows an additional $100k for a $1.1m cap. Only the limits, and not the balance calculations, are different for someone whose original loan came before Dec 2017.

But in either case the calculations for average balances should be identical between Fed and CA, and I really wish TurboTax would get on the ball and fix this so we don't have to override to get correct tax calculations.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I refinanced and have two 1098 forms

Same thing...box not popping up asking if this loan was paid off. This function is not working.

Works if I put $1 in loan balance but will not work with 0.

Please fix this!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I refinanced and have two 1098 forms

Yes, deleted 3 times. Started fresh. Tried changing order. Not working.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I refinanced and have two 1098 forms

Looks like you've written this logic wrong

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I refinanced and have two 1098 forms

Enter the 1098

No 1098 should have a blank box 2

Box 2 is either the balance of the loan on 1-1-2019 OR the balance when you took out the loan in 2019.

This is a reporting change from 2018.

If you get an error after entering:

ONLINE USERS:

Please go back to the Home Mortgage Interest section:

Click Federal on the left side-bar

Click Deductions & Credits along the top

Scroll down to “Mortgage Interest and Refinancing (Form 1098)” Click Edit/Add

Scroll down the “Here’s your 1098 info” screen and click Done.

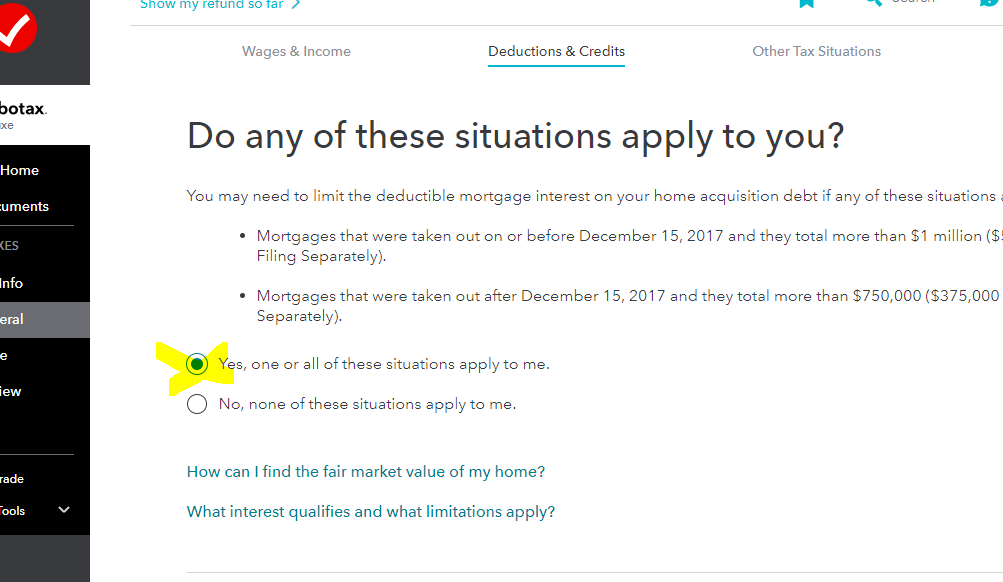

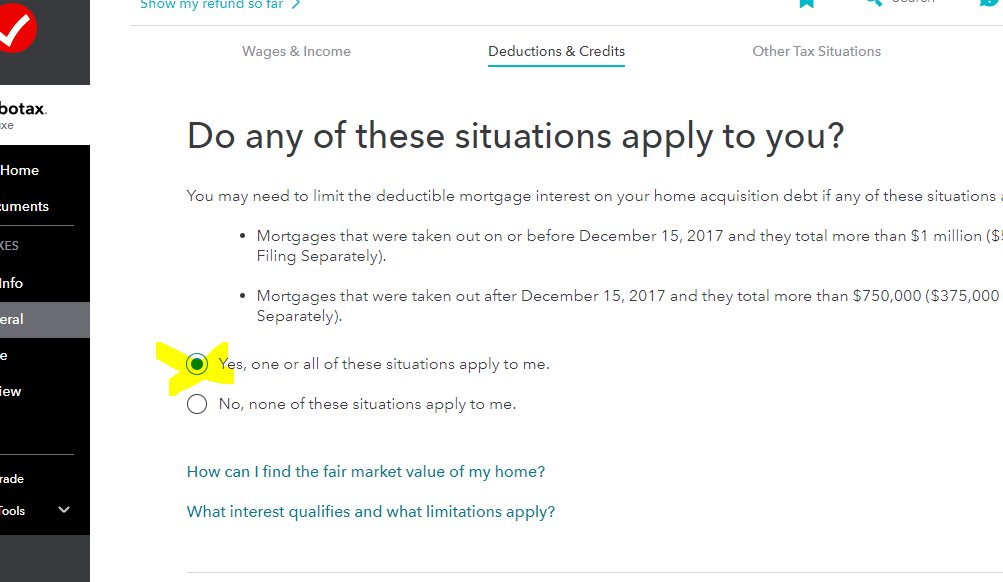

Next screen asks “Do any of these situations apply to you?” Select “Yes, one or all of these situations apply to me.” and Continue.

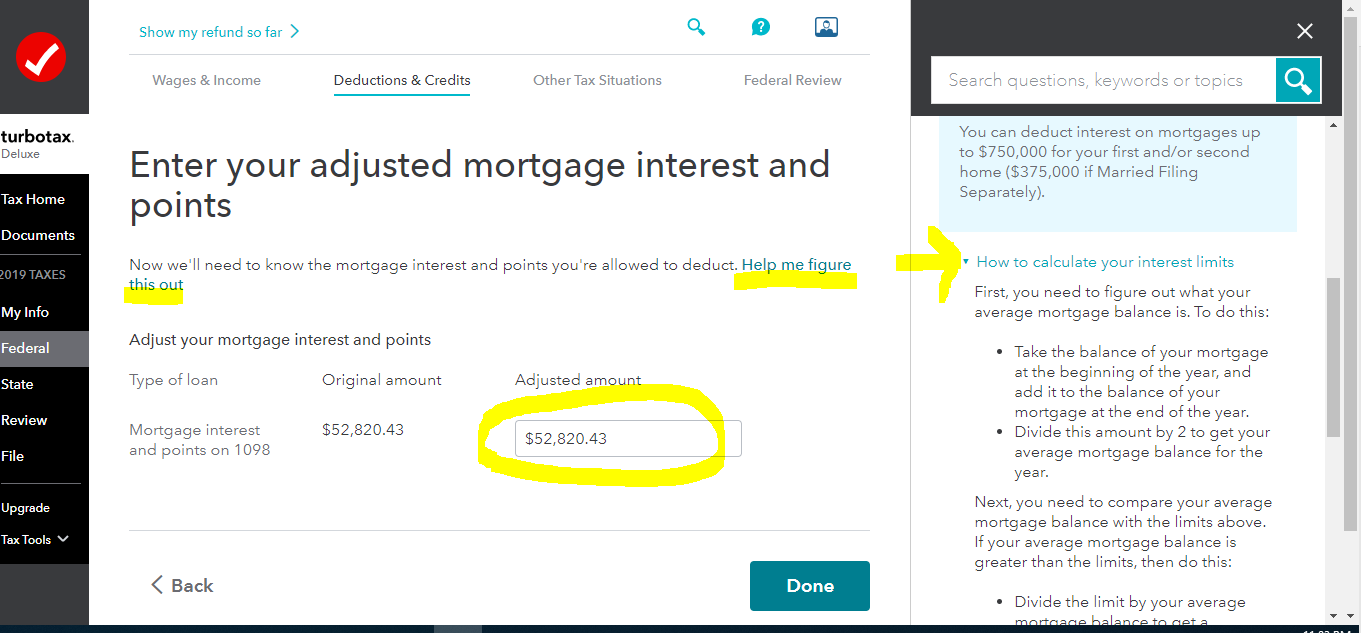

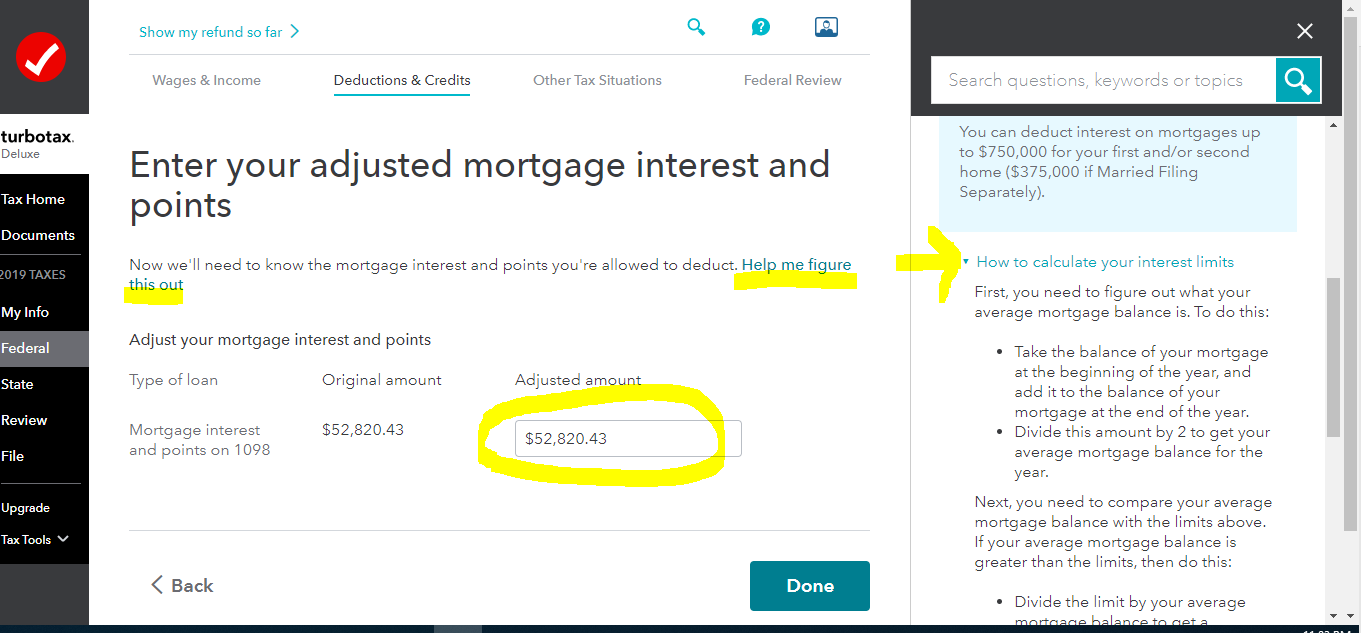

On the following screen, you will see the “Original amount”.

Enter the amount you can claim as a Home Mortgage Interest deduction in the “Adjusted amount” box. The Adjusted amount cannot be larger than the original amount or you will receive an error when trying to file. Instructions on who needs to adjust interest and how to calculate are available by clicking the blue “Help me figure this out” link.

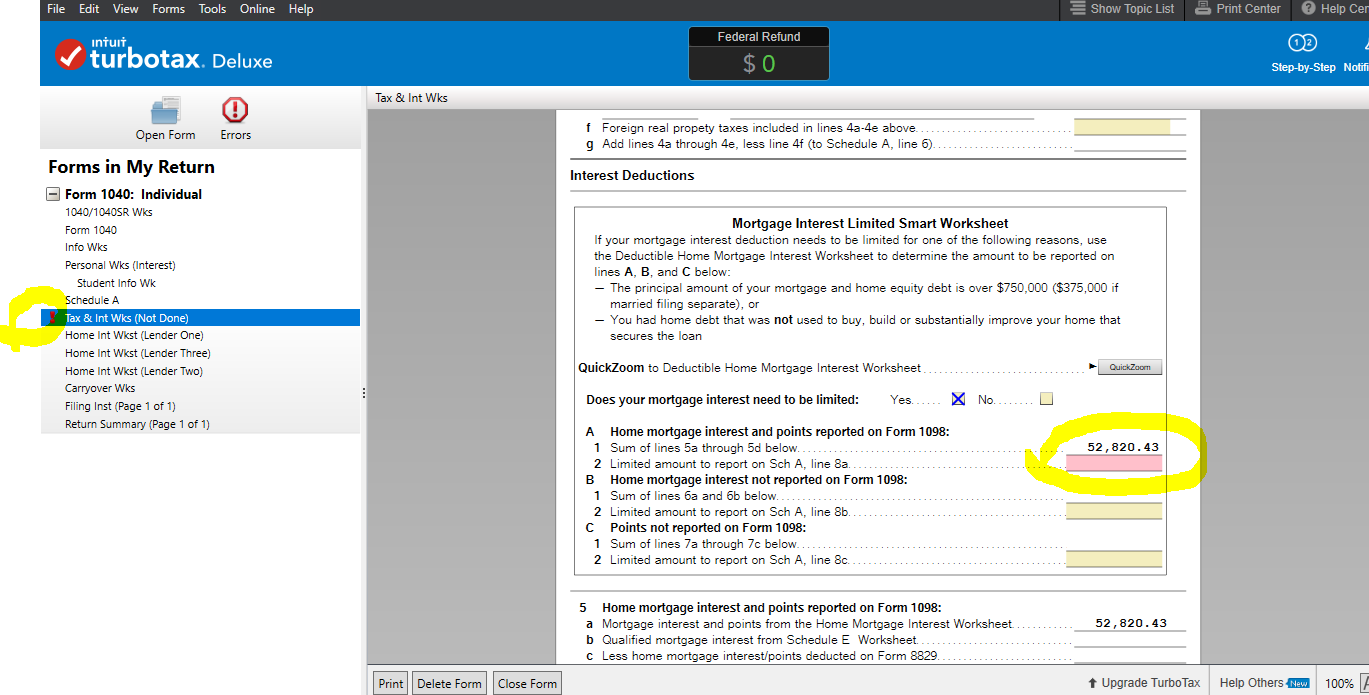

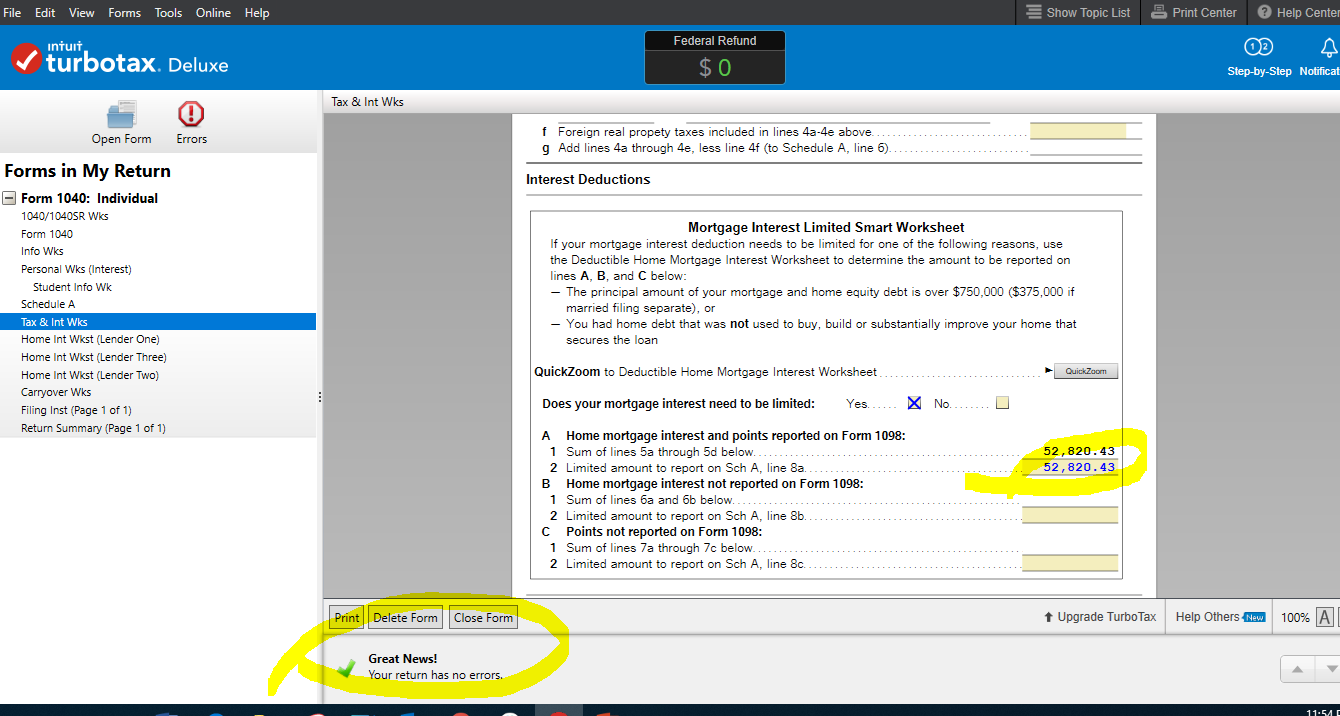

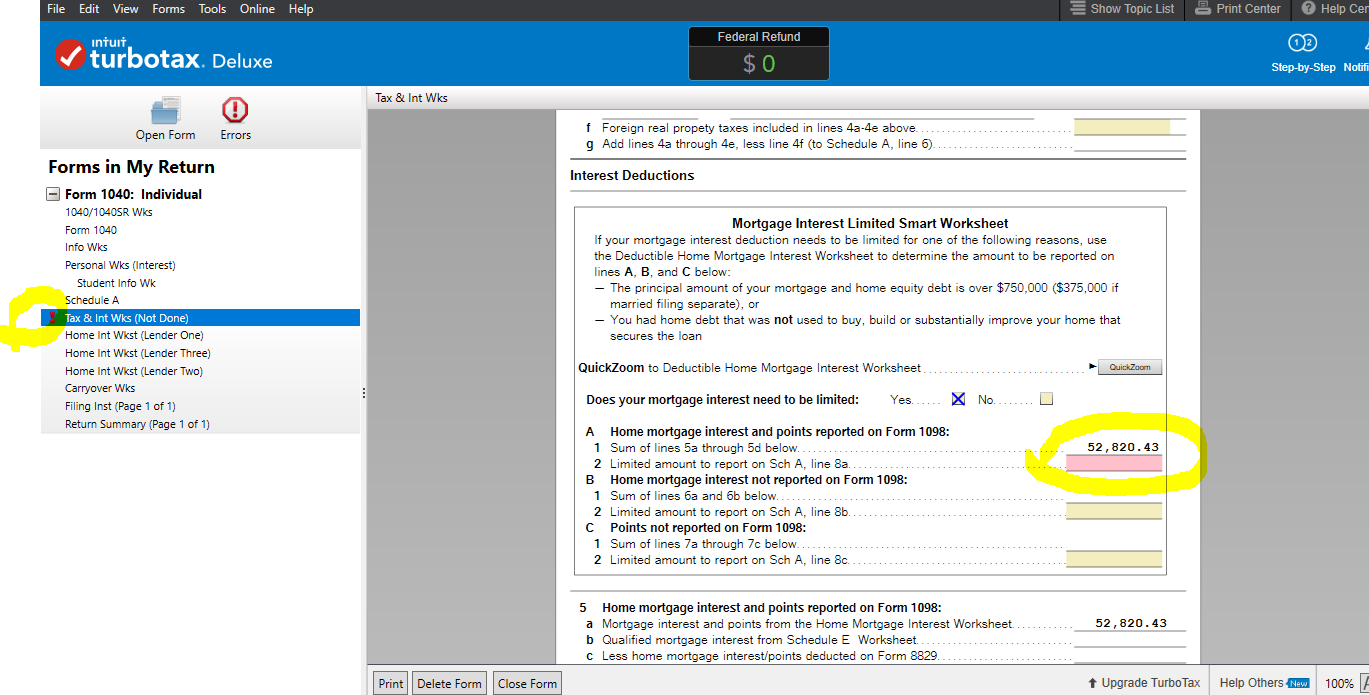

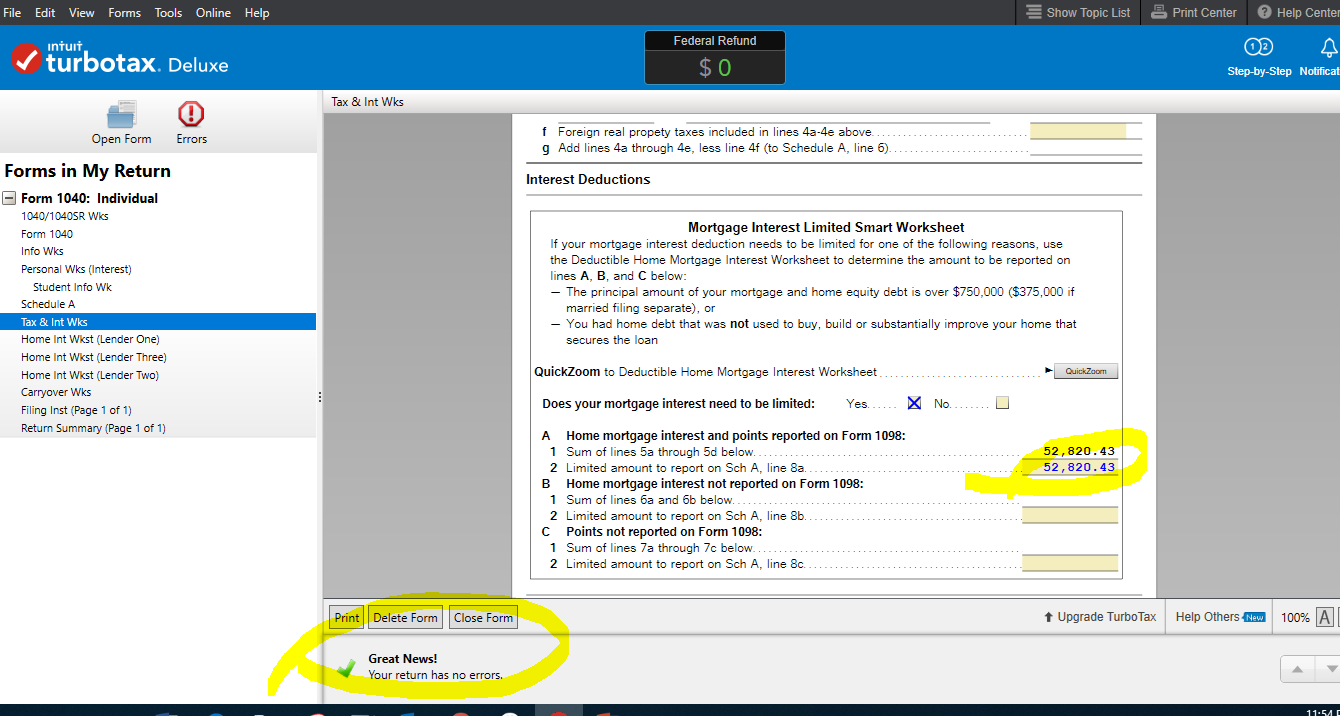

DESKTOP USERS:

Go into Forms (top right)

Enter the amount on Tax & Int Wks

Mortgage Interest Limited Smart Worksheet section

Line A2

OR

Step by Step

Federal

Deductions & Credits

Mortgage Interest, Refinancing and Insurance Click Update

Click Done

Click Yes, one or both of these situations apply to me. And Continue

Enter the Adjusted amount and Continue

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I refinanced and have two 1098 forms

"OR

Step by Step

Federal

Deductions & Credits

Mortgage Interest, Refinancing and Insurance Click Update

Click Done

Click Yes, one or both of these situations apply to me. And Continue

Enter the Adjusted amount and Continue"

@KrisD15 's instructions worked for me. I used the downloaded version for Mac of TT. I just had to change the $0 at the end to the mortgage interest $ amount (literally just to the left of it) and everything went through fine.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I refinanced and have two 1098 forms

This issue still does not appear to have been resolved. Is this going to be fixed, or do I have to use a different way to file my federal and California returns (presumably with a refund from TurboTax)? I’m having the same issue as the commenters from a month ago.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I refinanced and have two 1098 forms

These instructions have been helpful and eliminates the error with the home interest acquisition debt limit.

Whatever is limited on the Federal may be added as an adjustment (if applicable) on the California state return.

Do not alter the 1098. Enter the 1098(s) as reported. Box 2 should not be blank. Box 2 is the balance of the loan on 01-01-2019 OR the balance on the day the loan was taken out in 2019. Answer the interview questions carefully.

If you get an error concerning the balance, please follow these directions:

ONLINE USERS:

Please go back to the Home Mortgage Interest section:

Click Federal on the left side-bar

Click Deductions & Credits along the top

Scroll down to “Mortgage Interest and Refinancing (Form 1098)” Click Edit/Add

Scroll down the “Here’s your 1098 info” screen and click Done.

Next screen asks “Do any of these situations apply to you?” Select “Yes, one or all of these situations apply to me.” and Continue.

On the following screen, you will see the “Original amount”.

Enter the amount you can claim as a Home Mortgage Interest deduction in the “Adjusted amount” box. The Adjusted amount cannot be larger than the original amount or you will receive an error when trying to file. Instructions on who needs to adjust interest and how to calculate are available by clicking the blue “Help me figure this out” link.

DESKTOP USERS:

Go into Forms (top right)

Enter the amount on Tax & Int Wks

Mortgage Interest Limited Smart Worksheet section

Line A2

OR

Step by Step

Federal

Deductions & Credits

Mortgage Interest, Refinancing and Insurance Click Update

Click Done

Click Yes, one or both of these situations apply to me. And Continue

Enter the Adjusted amount and Continue

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Katie1996

Level 1

btyner1327

New Member

fellynbal

Level 3

user17524355777

Level 1

lydiamaeredman

New Member