- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: If you have refinanced your home, it is normal that you h...

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I refinanced and have two 1098 forms

Did you delete the 1098 and start over fresh?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I refinanced and have two 1098 forms

Did you delete the 1098's and start over fresh?

That screen does not come up when editing, only when entering the 1098 initially.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I refinanced and have two 1098 forms

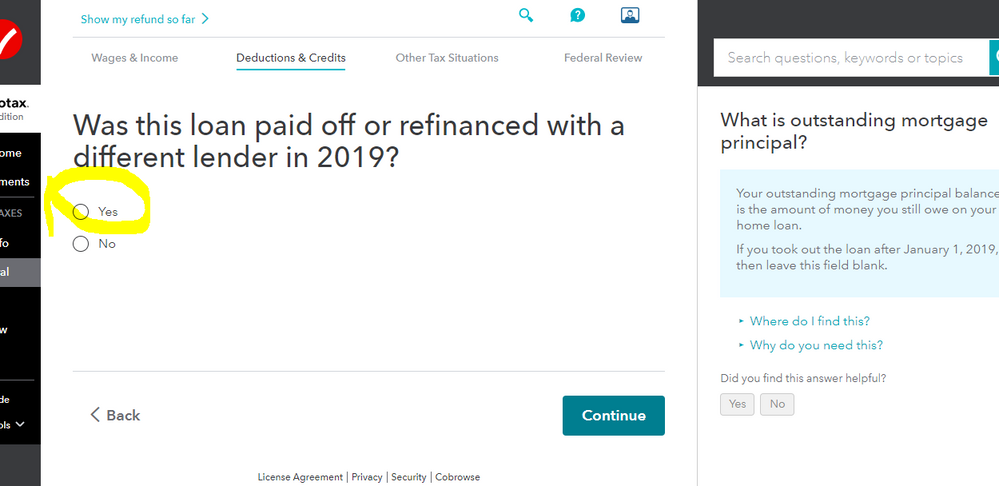

I am having the same issue. I refinanced my original loan in 2019 and then the refinanced loan was sold to another lender so I have actually have three 1098 forms. I deleted all of them and started over with the 1098 for my original loan but unfortunately I'm not being prompted with the screen asking me if my loan was paid off or refinanced.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I refinanced and have two 1098 forms

I followed the instructions. The error persists. Please note that the error isn't in the Federal forms, since the deduction limit is calculated by the user outside TT and entered manually. Rather, the error is in the Ded Home Mort worksheet that feeds Schedule CA in the California return. Rather than have the user calculate the mortgage interest deduction limit, the worksheet draws data directly from the Federal 1098 worksheets and attempts to calculate the deduction limit. However, variously the relevant data don't transfer completely (for example, the "months" and "ending balance" entries necessary to calculate the prorated average, and so the worksheet is still adding the two total mortgage balances together in Part 2 line 2, using that as the denominator to calculate the limit, and so reducing the deduction (in my case) to about half what it should be.

The worksheet should transfer the starting and payoff balances for the original loan, and the starting and end-of-year balances for the refi, plus the date of the refi. It should then calculate the prorated average balance by multiplying each loan's average balance (start minus end divided by 2) by the fraction of the year that loan was active, and then adding those to parts together.

The simplest fix for the moment is to override the amount in Part 2 line 2 with a correctly calculated prorated average; then the rest of the California calculation proceeds properly. I very much hope that TT will fix the worksheet, or alternatively do the same as the Federal form and simply have the user calculate the limit.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I refinanced and have two 1098 forms

And, for the record, I did re-enter the 1098 data from scratch, and responded to queries and checkboxes as you instructed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I refinanced and have two 1098 forms

I am having the identical problem.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I refinanced and have two 1098 forms

Same problem here too. I actually have 3 1098's, 1 from the original loan, 1 from the mortgage broker for 1 months payment and 1 from the bank that finally took over the servicing. I have deleted the information for the 1098's, re-entered it multiple times with no correct result. It keeps saying the standard deduction is best and when I click on the box that says my loans are not over the 750,000 mark, after I click on continue, the refund goes down by a lot and registers it as being over the 750,000 mark by over double. I also have tried to start my refund from scratch and it still does the same nonsense. Intuit needs to get on top of this ASAP or else we are all going to be down the creek without a paddle if the IRS comes a knocking.

Any of you who have gotten the federal form to register that your acquisition debt was less than the 750,000 mark with at least one refi, can you please give us some guidance? Someone mentioned that we fill the forms out outside of TT and then enter it manually. I am not sure what that all means if we are inputting the data directly into TT which then does its magic to get us the wrong info.

Intuit- We need a viable solution for those of us who are running into this refinance nightmare with your product. The solutions that have been posted by the Experts are not doing the trick and every time they get repeated, it makes us not want to use your product more and more after having spent time and money to do our supposed simple taxes.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I refinanced and have two 1098 forms

I kept having this problem in the downloaded version inputting 2 1098s due to a refi. I finally gave up and went through TurboTax online and my refinance is finally being accounted for properly. Very frustrating as I had to re-enter everything.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I refinanced and have two 1098 forms

I tried the online version but still seem to have the same problem. Out of curiosity, on the refinanced loan, did you enter “0” for box 2 since the balance as of 1/1/19 would’ve been 0?

the online version seems to recommend doing it, the downloaded version doesn’t let me enter 0, and the tax rules say I am supposed to enter the amount at the time of origination if after Jan 1 (which is what is written in box 2)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I refinanced and have two 1098 forms

Turbo Tax online didn’t work for me either, it seems. Let me ask you - when you do the online version are you plugging in $0 for box 2 on the refinanced mortgage since no balance on Jan 1? The TT directions appear to require that, however then it would not accurately reflect what’s in the box. Desktop TT will not let me enter 0 for that box, either.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I refinanced and have two 1098 forms

Same problem here. At no time am I asked if the home was refinanced on the first 1098 and I deleted both of the two that I originally entered. It's basically telling me that I can't deduct any of the interest on the second 1098 which I marked as refinanced. This new tax law is a nightmare. It should be simpler this this... I have been using TT for 20+ years and this is the first time it's not clear to me what I should be entering. There should be a question regarding refinance and what portion was not used toward the home itself and allow the user to enter it. I owed 183k, refinanced at 230k with 45k cash out after fees. This is confusing and apparently everyone trying to do refinance is having a problem with this software. Please advise.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I refinanced and have two 1098 forms

I tried the 0 in box 2 but it gave an error. I used the live version so I could get extra help. Once I entered the amount from the 1098 on box 2 for the refinance it worked.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I refinanced and have two 1098 forms

This is a long post, sorry, but it explains what I've had to do to get a refinanced $1m+ mortgage's interest deduction get calculated correctly in TT (downloaded, not online). So far as I can tell, the problem can't be solved in step-by-step; rather, one must go directly to the Federal and California "Ded Hom Mort" worksheets and do some manual data entry and overrides.

My initial mortgage was in April 2017, and so has the $1m federal limit rather than the later $750k one. The refi was Aug 2019, but since it's a no-cash-out refi it too is subject to the $1m limit, since the earlier origination date carries through to the refi as the debt acquisition date.

First, the Fed form. The key here is to enter the "months loan outstanding" counts in the third line of Part 1, in addition to the interest paid on each loan in the first line. Then, in my case (a pre-15Dec17 original mtg), enter the beginning balance and principal applied for the orig and refi loans in the "......before Dec 15..." block; the worksheet will then calculate the end balance for each loan and the average balance adjusted for the number of months. That then flows down to line 2, on page 2, and further automatic calculations ield the deductible amount in Line 15, which then transfers to Schedule A. It would be nice if the step-by-step asked the right questions to fill out the worksheet, but at least the worksheet can be filled out without changing data from the 1098s.

Then the problem child, the California form. California sticks with the pre-2017 rules for my mortgages, so you'd expect its deduction limit to be the same as Fed--but no, since California allows an additional $100k on the limit (that is, you can deduct interest on up to $1.1m rather than the fed $1m). The California Ded Hom Mort worksheet looks like the federal one, but unfortunately it's quite different: it draws some data from the 1098s directly, doesn't understand that acquisition dates carry over to refis, and then fails to pro-rate the averages for the two loans (instead, it adds them together, so it appears there are two active mortgages rather than an original one and a refi).

The fix I found, until TT repairs the worksheet, is to override several entries and enter balances in a particular way. First, enter the months each loan was active in the third line. Second, override and delete the "Mortgage Origination Date" line for all loans in Part 1. Override and delete everything in the "on or after Dec 15" block (assuming, that is, that your orig loan was before that). In the "...before Dec 15" block, enter the begin year balance for the orig loan (which may be there already) and the same number as "principal applied", which will make the ending balance for the orig loan 0. For the refi, enter the initial balance at refi and the principal applied through end of year, and the worksheet will calculate the end balance. The worksheet will then calculate the average balance for 2019 as though there was one loan in effect for the entire year, using the orig loan's starting balance and the refi loan's ending balance. That's not exactly what the Fed worksheet does, and it'll be the same only if the refi was at the end of June. but (end-begin)/2 is California's averaging method.

The California worksheet calculates the allowable interest deduction on Line 12, and that then makes its way into the adjustment on Schedule CA.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I refinanced and have two 1098 forms

I gave this a shot, and my total average debt went down but not by as much as it should have (went from 2.5m to 1.5m, but should be around 590k). I’m having trouble because not only did I re-fi, but before the refi my mortgage was sold, and immediately AFTER the refi it was also sold.

Really hoping TT patches this up, I don’t feel comfortable overriding all this stuff myself.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I refinanced and have two 1098 forms

So far the only thing I have found that worked is to fill out all of the info for the original loan and then leave the box 2 information on the refi 1098 and buyout 1098 (I have 3 1098's) blank but fill in the rest of the info for the 2 refi ones. This allows me to select the check box that I don't have more than 750k in mortgage debt (only have 544k, initial takeout in 2018). However, after all of the deletions etc., the CA form still shows that I have 1.6 million in debt. That I changed with the total grandfathered and new acquisition debt fill in box, changing the 1.6 million to 544k. I am also not comfortable sending this in to the IRS with leaving the box 2 info blank for two of my 1098's, but if TT does not get this squared away soon, we all will have to figure out what works since it sounds like there are a few different problems listed all stemming from having multiple 1098 forms. Gotta love tax season.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

fellynbal

Level 3

user17524355777

Level 1

lydiamaeredman

New Member

patamelia

Level 2

6616jm

New Member