- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: I have $760 foreign tax paid from mutual funds with Fidelity and Vanguard. However, I do not ...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have $760 foreign tax paid from mutual funds with Fidelity and Vanguard. However, I do not see a $760 credit on 1040-SR, line 20, "Amount from Schedule 3, line 8." I think there should be a credit, as I see in past years. Can anybody help? Thank you!!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have $760 foreign tax paid from mutual funds with Fidelity and Vanguard. However, I do not see a $760 credit on 1040-SR, line 20, "Amount from Schedule 3, line 8." I think there should be a credit, as I see in past years. Can anybody help? Thank you!!

Are you seeing the credit on Line 1 of Schedule 3? Please remember this is a nonrefundable credit that will generate if you have taxes due on line 16 of Form 1040.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have $760 foreign tax paid from mutual funds with Fidelity and Vanguard. However, I do not see a $760 credit on 1040-SR, line 20, "Amount from Schedule 3, line 8." I think there should be a credit, as I see in past years. Can anybody help? Thank you!!

Hope, I do see an $85 credit, but I am so confused as to why it is not much larger, since I had $667 of foreign taxes paid. Just because I am $67 over the joint limit of $600, the actual credit is only a fraction of the $667??

Also, Form 1116 from TT is confusing: the 1099-DIVs from Fidelity and Vanguard show $667 combined for "Foreign tax paid," from line 7 of the two 2022 1099-DIVs. BUT, IRS Form 1116, line 1a says I have $667 in "Gross income from within country shown above." The country is "RIC."

So, the 1099-DIVs says the $667 is for foreign taxes paid, but Form 1116 say $667 is the foreign income. That does not make sense to me, given my limited understanding!

I sure hope you can help me understand why this is the case.

Thank you!!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have $760 foreign tax paid from mutual funds with Fidelity and Vanguard. However, I do not see a $760 credit on 1040-SR, line 20, "Amount from Schedule 3, line 8." I think there should be a credit, as I see in past years. Can anybody help? Thank you!!

The credit allowed on foreign taxes is limited by the ratio of your foreign income to your total income. For instance, if your foreign income was $10,000 and your total income was $100,000, you could only deduct 10% of your foreign taxes. The rest would get carried over to future years. That may be why your credit is less than the foreign taxes you paid.

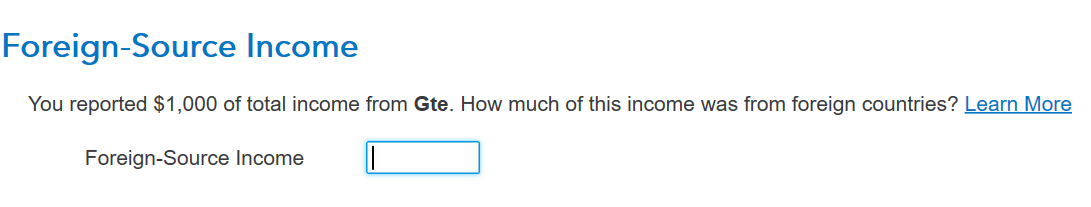

You enter the foreign source income when you work through the foreign tax credit section, you may have entered the foreign tax paid in error. The entry screen looks like this:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have $760 foreign tax paid from mutual funds with Fidelity and Vanguard. However, I do not see a $760 credit on 1040-SR, line 20, "Amount from Schedule 3, line 8." I think there should be a credit, as I see in past years. Can anybody help? Thank you!!

Thomas M, thank you for the response. I am understanding more, but still have confusion.

First, what IRS form is the example entry screen you show? I see IRS Form 1116 in current print version of the TT return, and it does not have this particular entry, "You reported $X of total income from (Company Name). How much of ..... "

I seems that the current TT Form 1116 is wrong in that it shows the $667 we paid for foreign tax on Form 1116 line 1as the gross foreign income. This $667 is treated as foreign income on the rest of Form 1116. It is not; it is the foreign tax paid!

Somehow, TT is taking the foreign tax paid and saying it is income. I do see from the 1099-DIVs that the total foreign income is about $6,858. Can I even over-ride TT in completing this Form?? I sure don't want to try that.

Does this help to understand where I am going wrong? Thank you!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have $760 foreign tax paid from mutual funds with Fidelity and Vanguard. However, I do not see a $760 credit on 1040-SR, line 20, "Amount from Schedule 3, line 8." I think there should be a credit, as I see in past years. Can anybody help? Thank you!!

The screen shot I posted is from the TurboTax program.

You mention that you have foreign taxes paid from mutual funds, which I assume was reported to you on a form 1099-INT or 1099-DIV. That is where you entered the taxes paid, but you also have to enter the foreign income on which the taxes were paid, and you enter that in Foreign Taxes section in TurboTax. That is where you will see the question regarding what your foreign income was. I think you may have entered your foreign tax as the amount of your foreign income.

Follow these steps to review your foreign income entry:

- Choose the Federal option on your left menu bar

- Choose Deductions and Credits

- Choose Estimates and Other Taxes Paid

- Choose Foreign Taxes

Work your way through that section and you should see an entry for foreign income.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

mailsaurin

New Member

ebomze2254

Level 2

ohjoohyun1969

New Member

Major1096

New Member

gagan1208

Level 1

in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill