- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

The credit allowed on foreign taxes is limited by the ratio of your foreign income to your total income. For instance, if your foreign income was $10,000 and your total income was $100,000, you could only deduct 10% of your foreign taxes. The rest would get carried over to future years. That may be why your credit is less than the foreign taxes you paid.

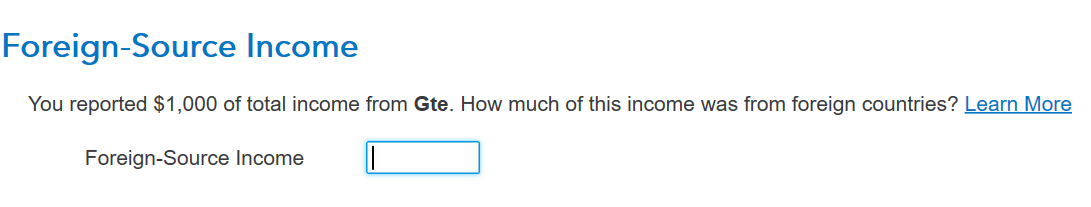

You enter the foreign source income when you work through the foreign tax credit section, you may have entered the foreign tax paid in error. The entry screen looks like this:

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

February 16, 2023

7:49 PM