- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: I added a second dependent to my W4 and my federal withholding has decreased. Will this affec...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I added a second dependent to my W4 and my federal withholding has decreased. Will this affect my eligibility for the Child Tax Credit on next years' return?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I added a second dependent to my W4 and my federal withholding has decreased. Will this affect my eligibility for the Child Tax Credit on next years' return?

No---that does not affect your eligibility for the child tax credit. It only affects the amount of tax your employer will withhold from your paychecks.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I added a second dependent to my W4 and my federal withholding has decreased. Will this affect my eligibility for the Child Tax Credit on next years' return?

No. The amount you have withheld from your wages does not affect your eligibility for the Child Tax Credit. Although it will not affect the Child Tax Credit, you may still end up with a lower refund or possibly owing taxes, depending on how much they are withholding compared to how much you earn. If this is your second dependent, it would not change your filing status. Also, the fact that a Child Tax Credit is at most $2,000 means, they are not withholding that much more.

There are not dependent exemptions anymore, so even if you only get paid every other week, a $7,800 drop seems excessive for a change in your withholdings because you added a second dependent. If you didn't already have a dependent and you are single, then this change likely reflects the change from single to Head of Household.

You may want to contact your employer to find out why they changed so much.

Also, look at lines 16, 24 and 34. Then subtract $7,800 (if paid biweekly) to see where that leaves you for next year. Add in $2,000 for the Child Tax Credit (IF you definitely qualify) and if your wages stay relatively the same and you have no other income sources, this will give you a rough idea of your tax refund or amount due next year when considering your extra $300 per pay.

Also, if you are married, your spouses wages should be considered when you adjust your W-4.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I added a second dependent to my W4 and my federal withholding has decreased. Will this affect my eligibility for the Child Tax Credit on next years' return?

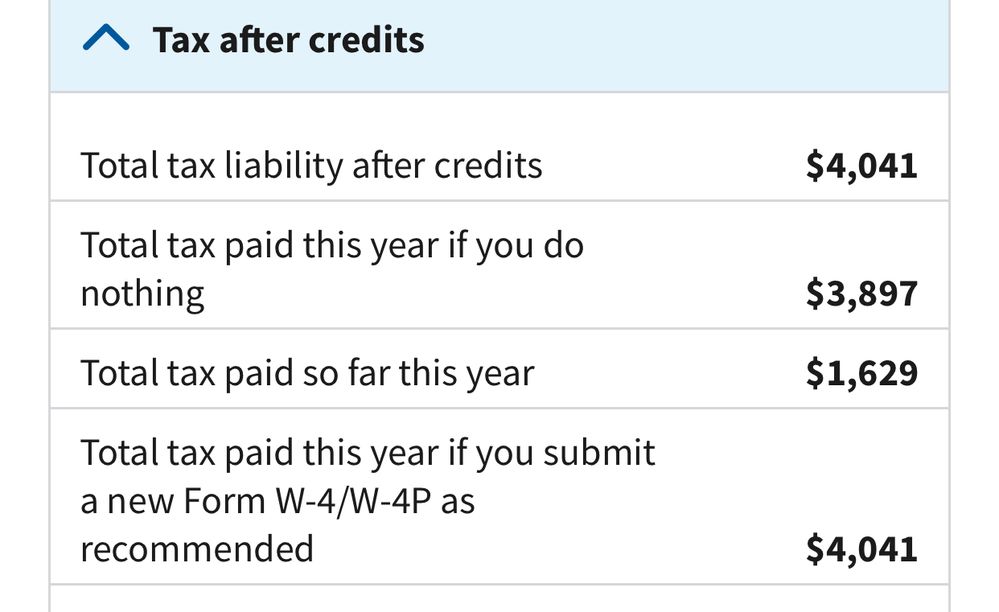

Thank you! I used the IRS withholding estimator, which seems to be telling me that if I kept the current lower withholding (which would give me an additional $6,720/ year in my take home pay) that I would not get a refund, and instead would owe $145 when I file for 2024. Does that sound about right?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I added a second dependent to my W4 and my federal withholding has decreased. Will this affect my eligibility for the Child Tax Credit on next years' return?

I'm sure I don't have the whole story, but I'd like you to clarify a couple of things.

- Did the additional child trigger some additional Credits?

- Where did you get the $6,720 that you weren't going to pay in taxes?

- Did you have over $10,000 withheld this year?

- How much was your tax bill for 2023?

- This shows you've paid almost half of the taxes you'll pay this year in about 12 weeks. Is that true?

Please contact us again with any additional questions or to provide some additional details.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I added a second dependent to my W4 and my federal withholding has decreased. Will this affect my eligibility for the Child Tax Credit on next years' return?

No additional credits that I’m aware of or that I’m accounting for other than the second child on the CTC. The only thing that’s changed compared to last year is my updated W4 and a slight salary increase. I got $6,720 by taking the difference between my previous federal withholding per pay and my current, which is $280 less withheld now. Twice a month over a year is $6,720. That’s about $2,000 more than my 2023 refund, so it seems like by marking my two dependents on my W4 I’m being set up to not receive a refund, but get a significant amount more in my pay each month instead.

I had $9,626 withheld last year, so just under $10k.

As to your last question, I don’t know. My most recent stub says I’ve had $1,629 withheld so far this year.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I added a second dependent to my W4 and my federal withholding has decreased. Will this affect my eligibility for the Child Tax Credit on next years' return?

That is correct. Based on the estimator you posted, it looks like with the current withholdings, you would have to pay in around $150 when you file your taxes instead of getting a refund. If you make the suggested updates, you would not get any type of refund, you would simply break even on your return (assuming all numbers don't change from the estimates)

So, it comes down to personal preference. Do you want a refund at the end of the year or do you want the money with each extra check. You also have the option of just having an amount in the middle extra withheld. This would still give you a refund, but would also give you more on your check than you had before you made the change.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I added a second dependent to my W4 and my federal withholding has decreased. Will this affect my eligibility for the Child Tax Credit on next years' return?

I’m kind of in the same situation as this person the moment I added my 2nd child I ended up getting no federal taxes withheld from my checks and my w4 was always set to head of household with my 1 child so I kept it the same with my 2nd and when I filed taxes I refund was almost $6000 less than what it was the prior year and I ended up owing state almost $500 (I live in Georgia) For me, I had to change my filing status to single on my w4 and claim 0 in order to get taxes to start coming out but now they take so much money out for taxes. Example one of my pay checks was $3400 before tax and there was about $844 taken out in taxes. So would I need to change it to where I claim 1 in order to have less taxes taken out but enough to where I still get a nice refund and don’t owe or should I leave as single it without claiming any dependents and just keep letting them take huge chunks out of my checks. Is being head of household the issue should I keep it as single or if I claim head of household and just put 1 dependent will that work?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I added a second dependent to my W4 and my federal withholding has decreased. Will this affect my eligibility for the Child Tax Credit on next years' return?

If you change the W4 from 'Single' to ' Head of Household' with 1 dependent they will still take taxes out of your check but they will take out less taxes than they are currently taking.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

jimxdriver

New Member

JGCPA

Returning Member

yuichi-ou-edu

New Member

sgeubank

Level 1

christmar15

Level 1