in Education

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: foreign tax paid credit

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

foreign tax paid credit

Yes, you can report claim the foreign tax paid because of the US and Canadian tax treaty. Go to:

- Federal>deductions and credits>deductions and credits>estimate and other taxes paid>Foreign Tax Credit>start or revisit

- When it asks We just need to check if you have any uncommon situations indicate I paid foreign taxes on income I earned while working in another country. Even though technically you didn't, you will to indicate this so the program can move forward.

- Navigate and record the entries that the program asks for and when you reach the page that mentions Foreign Tax Credit Worksheet, this is where you take notice.

- The first that you will be asked is what category of income is it, you will say passive income.

- Next screen will say Country Summary, select add a country and then select Canada.

- When it says Other Gross Income - Canada, don't put anything here since you already reported this on your K1.

- then you will navigate through the screens until you come to a screen that says Foreign Taxes Paid - Canada, here is where you record the amount paid under Foreign Taxes on Other Income. Then below that you will enter the amount of taxes paid.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

foreign tax paid credit

I have foreign tax paid on my 1099-div. I see a number of people with the same issue, and it seems like the advice is to manually enter the 1099-div instead of importing it. That sounds like a Turbo Tax problem to me, so why isn't it getting fixed? For me it turns out the foreign tax paid is from 4 countries, and it is a small amount (about 400). So I say I want to take the credit and get asked the countries. It is a rather strange form I think ,but I enter the countries. And it shows all four. But then it goes through a bunch of forms where it only picks the first country and asks for a lot of things I don't know and which are not on the 1099-div. Again, sounds broken in Turbo Tax to me. So I am getting no where. Anyone have a better answer than entering the 1099-div manually?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

foreign tax paid credit

I agree with you I have used TT for many years and always have foreign tax credits. This is the first year that I can't file electronically and I think it is because of the link between the 1116 worksheet and the actual form. I talked to 2 techs and also a tax specialist and, though they wouldn't say it, I think they believe it is a TT issue. I hate mailing in the return but that is the only option this year.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

foreign tax paid credit

The amount of Foreign Taxes shown on Form 1040 Is different than the amount on source forms. Is there an additional computation that adds to the given amounts?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

foreign tax paid credit

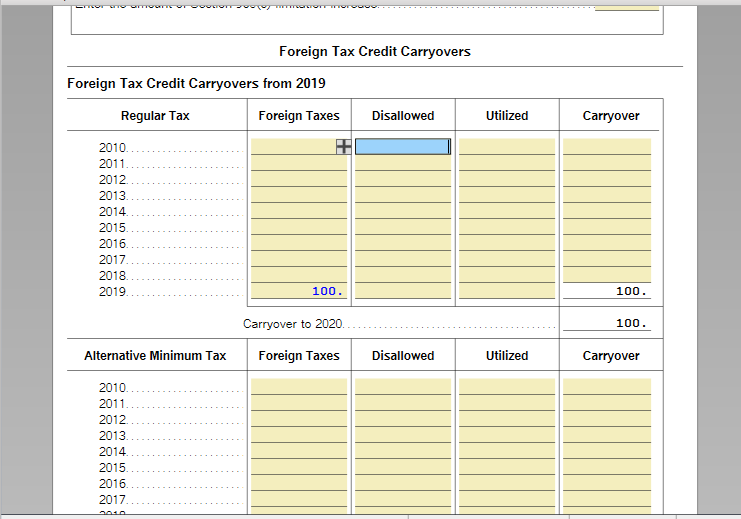

@jbackusn Did you have a Foreign Tax Credit carryover from 2019? Check the Foreign Tax Credit Form 1116 Worksheet (screenshot).

You are correct that your Foreign Tax Credit should not be more than the Foreign Tax you reported you paid on your source documents.

Click this link for more info on Foreign Tax Credit Carryovers.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

foreign tax paid credit

I wasn't given this choice. The whole process is a nightmare. I've spend hours trying to get my foreign tax credit into Schedule 3. It keeps making me fill out form 1116. I don't need to.

This same nightmare happened to me last year. Why can't I just type an amount into Schedule 3?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

foreign tax paid credit

How much foreign taxes did you pay? If you have paid foreign taxes more than $600, you must file a Form 1116 to claim a foreign tax credit. To learn more, click here: Form 1116

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- « Previous

-

- 1

- 2

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

anonymouse1

Level 5

girishapte

Level 3

Sbmccor1963

New Member

douglasjia

Level 3

soccerdad720

Level 2