- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: For vehicles used in your business you can either take mi...

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter mileage or vehicle expenses that would get me the full mileage expense deduction?

@CJC8N469 What do you mean by "business vehicle expenses?"

If you are a W-2 employee you cannot deduct any job-related expenses on your federal return. Your state laws might be different.

If you are self-employed then your mileage, etc. are entered on the Schedule C with your other business expenses.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter mileage or vehicle expenses that would get me the full mileage expense deduction?

I REGISTERED 16000 MILES USING UBER ALONE, EXCLUDING MILES USING LYFT....YET IT SAYS I CANNOT LOG MORE THAN 2000, HOW TO FIX THIS ISSUE?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter mileage or vehicle expenses that would get me the full mileage expense deduction?

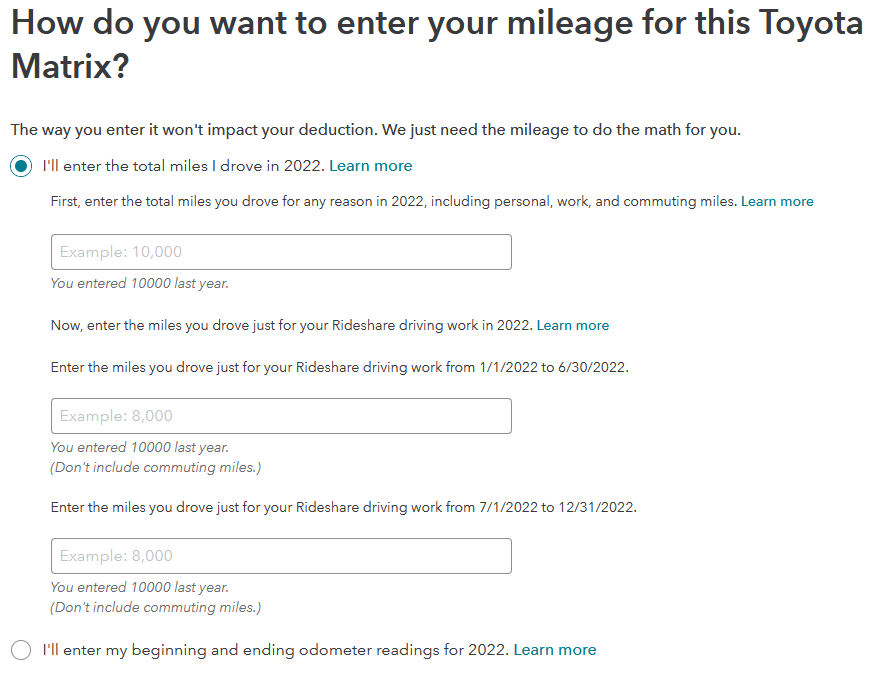

On the screen titled How do you want to enter your mileage you will want to make sure that the miles driven for your business do not exceed the total miles driven less any personal mileage. It will limit your mileage deducted to this calculation.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- « Previous

-

- 1

- 2

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

joebisog

New Member

user17557136899

New Member

ej13722

New Member

a-bbook

Returning Member

TaxesForGetSmart

Level 1