- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: Enter the amount withheld in the "Withholding not already...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do i enter CA real estate withholding?

I live and file in CA. I sold a rental house and 3% was withheld for Franchise Tax Board Real Estate Withholding by the escrow company. I have not received a Form 592-B or Form 593. Where and how do I enter the amount withheld?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do i enter CA real estate withholding?

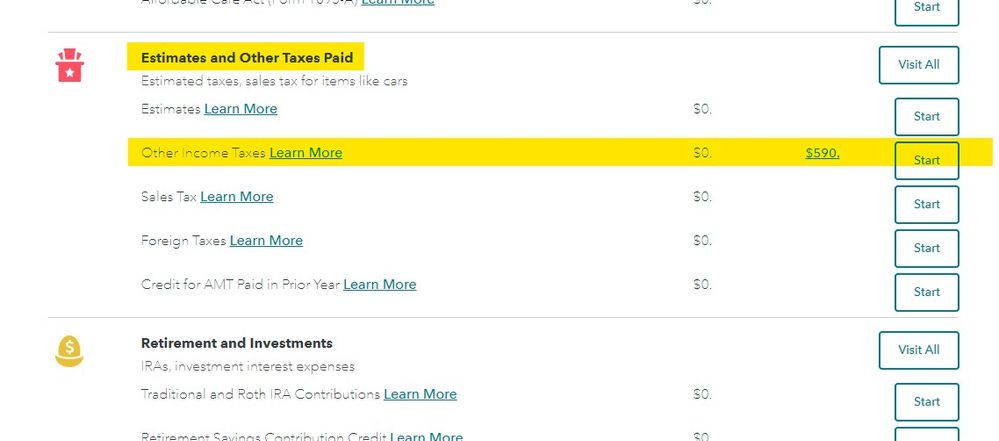

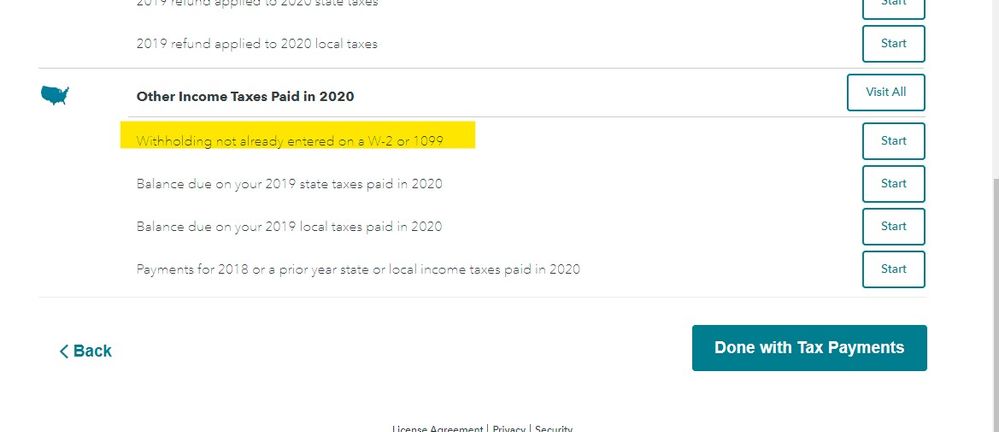

Enter the amount withheld in the "Withholding not already entered on a W-2 or 1099" interview.

This interview is found under Federal Taxes > Deductions and Credits > Other Income Taxes > Other Income Taxes paid in 2016.

See the attached screenshot to see what the entry screen will look like.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do i enter CA real estate withholding?

Enter the amount withheld in the "Withholding not already entered on a W-2 or 1099" interview.

This interview is found under Federal Taxes > Deductions and Credits > Other Income Taxes > Other Income Taxes paid in 2016.

See the attached screenshot to see what the entry screen will look like.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do i enter CA real estate withholding?

I think this is out dated. THis is required by the state and needs to placed somewhere

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do i enter CA real estate withholding?

The info is not outdated ... the state withholding is entered in the federal section and will be carried to the state automatically.

Look in the Deductions & Credits section ...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do i enter CA real estate withholding?

With real estate we can not do efile with California?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do i enter CA real estate withholding?

We solved the problem with some advise from TurboTax, we did use efile and the returns are complete and accepted.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do i enter CA real estate withholding?

I am getting the same message from TurboTax that because when I sold the property the escrow company just withheld 3.33% of the sale. Can I efile if I did not get a form 523 or whatever it is that lists real estate witholdings?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do i enter CA real estate withholding?

Yes, you can e-file and you can enter the amount of tax withheld as long as you know the dollar amount.

Here is how to enter it:

- Select Federal, then Deductions and Credits.

- Scroll down/ expand the list and find Estimates and Other Taxes Paid.

- Select Other Income Taxes.

- Scroll and select Withholding not already entered on W-2 or 1099.

- Answer the question Yes and Continue.

- Enter your federal tax withheld and/ or select a state and enter state tax withheld.

Make sure you know what type of tax was withheld, this is for income taxes only.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

_John__

New Member

Desirae1289

Level 2

iyad-alsharif330

New Member

Pooda1234

New Member

jeezerz

New Member