- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: Credit on foreign tax paid: Turbotax does not allow one to list multiple countries and itemiz...

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Credit on foreign tax paid: Turbotax does not allow one to list multiple countries and itemize the taxes paid in each one.

Regarding non-dividend income, specifically capital gains, here is the key part in the IRS documentation regarding not needing to file 1116: "Capital gains not related to the active conduct of a trade or business are also generally passive income." This indicates to me that cap gains from buying and selling shares of a foreign fund/ETF are passive income, and as long as you paid <$300 in foreign taxes you're good not to file a 1116. If the capital gain is related to your business or work, apparently it's non-passive.

This does make it easy for most of us paying <$300 in foreign taxes. On the TT version 2 weeks ago I ticked the foreign income description as "other" because I had both cap gains and dividends. This locked me into a partially filled out form 1116. And yes I went over all 3 1099-DIVs I had and meticulously added up all the foreign gains-oy. Then when I started to realize I might need the 1116, I tried changing the income description to "dividend"-- but the 1116 would not go away. So I deleted the whole return and started over. The latest version just tells me I can file without the 1116 and it does not ask for a description of the income besides if it's on a 1099-DIV. It makes no mention of non-passive gains. So it works for most of us now. If you need to file a 1116, hopefully that's solved 3/3-I say good luck but don't hold your breath. Now it turns out things are improving, but....the whole experience has been frustrating, time-consuming and very slow. I wonder if HR Block software has found this issue so vexing. To fully understand this whole thing, I had to read/research the tax code and look up terms for hours. For you guys that really need the update due out 3/3 I say good luck but don't hold your breath. The K-1 experience was just as bad.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Credit on foreign tax paid: Turbotax does not allow one to list multiple countries and itemize the taxes paid in each one.

I forget to thank RobertB4444 for his item allowing me clarification. But, I'm no accountant!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Credit on foreign tax paid: Turbotax does not allow one to list multiple countries and itemize the taxes paid in each one.

reply to nikesvrena

"The problem is not what the IRS wants, but that the software does not work when one tries to provide what the IRS wants. The calculation of the allowable credit is the same whether it is reported as multiple countries or a single country. The solution is to do a spread sheet and bunch all of your credits and report them all as one country, which means to enter a separate 1099 Div for each country as to which you had a foreign tax withheld from your dividends and then report it to the 1116 as a single country."

For passive, dividend income, I noticed that if one uses the interview form and puts "various" as the country name and then goes to the forms view, you can list the countries by clicking on the dividend revenue. A "plus sign" shows-up where the list can be completed. The detail list says to click a "box" not to print, so I thought the list would show up with the return. I did not see the list as part of the return. "Various" as a country description showed-up on the Form 1116. I typed see statement on one of the lines, but the statement page unfortunately is not detailed on the forms for submission. I plan to print the detail country statement to keep with my return and if audited, I have the detail. Seems like TT is almost there, just some more coding required. I assume that professional software would show "various" on the Form 1116 and then show a detail stament.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Credit on foreign tax paid: Turbotax does not allow one to list multiple countries and itemize the taxes paid in each one.

That is an excellent tax tip to follow. The term "Various" will satisfy the IRS requirement to report multiple countries but it is good to have a backup source for your own records in the event you are audited. The statement page you referred to is not necessary to be submitted to the IRS, but if you are audited these are excellent records to keep with your tax return, if or when needed.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Credit on foreign tax paid: Turbotax does not allow one to list multiple countries and itemize the taxes paid in each one.

I must admit that I am still confused about the work-arounds for firm 1116. I have foreign taxes reported in the 1099-divs. Am I to understand the the IRS disallows listing a total of foreign taxes paid for each brokerage and listing the countries as various?

Am I then to extract the foreign dividends from the div. Forms and then make a separate div. For each country? If so, I am confused about how to name these div. forms. Would I for example label one CANADIAN INCOME from Goldman Sachs? I would then continue to enter other foreign sourced dividends from that country from other brokerages by double-clicking to link to that column?

If this is done, I don’t see the need for dummy forms, etc.

Am I missing something?

Thanks for you considerable assistance.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Credit on foreign tax paid: Turbotax does not allow one to list multiple countries and itemize the taxes paid in each one.

The IRS does not disallow you list a total of foreign taxes paid for each brokerage and list the countries as various. You do not need prepare these 1099 DIV entries individually.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Credit on foreign tax paid: Turbotax does not allow one to list multiple countries and itemize the taxes paid in each one.

Thanks for the encouraging advice.

Do you know please whether or not TT allows you to e-file if you use various with regard to brokerage accounts? I recall last year that such returns were rejected for e-filing. Or maybe it was simply using Form 1116 which triggered the rejection?

I was told that the new form 1116 is in synch with tax software. So maybe the problem is fixed?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Credit on foreign tax paid: Turbotax does not allow one to list multiple countries and itemize the taxes paid in each one.

Yes, the problem is fixed. You may efile if you reported various in regards to multiple countries used in reporting brokerage statements that paid foreign tax.

@Periwinkle65

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Credit on foreign tax paid: Turbotax does not allow one to list multiple countries and itemize the taxes paid in each one.

Thank you very much for giving a definitive response to an issue which has concerned a large group of tax filers.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Credit on foreign tax paid: Turbotax does not allow one to list multiple countries and itemize the taxes paid in each one.

Gloriah's response is very wrong.

If you have dividends from two countries AT A SINGLE BROKERAGE then the scheme described by Gloriah DOES NOT WORK.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Credit on foreign tax paid: Turbotax does not allow one to list multiple countries and itemize the taxes paid in each one.

I would also like to correct the advice that you cannot efile if you use more than 1 page of Form 1116. I spoke to 2 different TT specialists who seemed knowledgeable on other matters. They told me emphatically that THERE IS NO LIMITATION ON THE NUMBER OF 1116 COPIES TO EFILE on all but the free TT version.

I hope this eliminates the complex work-arrounds,

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Credit on foreign tax paid: Turbotax does not allow one to list multiple countries and itemize the taxes paid in each one.

But I can't get rid of the foreign tax credit entry that is more than twice the actual tax I paid. Don't know where it came from either. Suggestion?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Credit on foreign tax paid: Turbotax does not allow one to list multiple countries and itemize the taxes paid in each one.

It depends on where the foreign tax amount came from. If you have a foreign tax carryover from 2021, the amount may be correct.

Foreign tax paid or accrued is often on Form 1099-DIV, box 7 and sometimes on Schedule K-1. If your foreign tax is entered on these forms, you don't need to enter it again under the Foreign Tax Credit.

You should review your entries for duplication if you have either of these forms.

To review 1099-DIV:

- Open your return and select Federal on the left side menu.

- Select Wages & Income.

- Scroll down, or expand the list and find Investments and Savings (1099-B, 1099-INT, 1099-DIV, 1099-K, Crypto).

- Click Edit next to each 1099-DIV that you need to review. If you find a duplicated entry, click the trash can icon to remove it.

If you have a Schedule K-1 and need to review it:

- Open your return and select Federal on the left side menu.

- Select Wages & Income.

- Scroll down and find S-corps, Partnerships, and Trusts, expand the section.

- Click Start or Revisit to the right of Schedule K-1.

- Click Update next to the type of Schedule K-1 that you need to review. If you find a duplicated entry, click the trash can icon to remove it.

- Continue through the section until you get to the questions about Foreign tax.

If you can't find the problem, you can delete Form 1116 and start over with it. If you have a foreign tax carryover, do not delete the form.

- From inside the return, scroll down to Tax Tools on the bottom of the left side menu.

- Select Tools.

- Click on Delete a form (third on the list at the bottom of the screen).

- Find Form 1116 on the list of forms.

- Click Delete to the right.

- Confirm your Delete.

- Click Continue in the lower right.

- Click Continue with my return.

If this doesn't resolve your issue, please respond back to this thread with more details.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Credit on foreign tax paid: Turbotax does not allow one to list multiple countries and itemize the taxes paid in each one.

I have the same problem even after reading and following instructions under the more info box. This is an over simplification but it mentions you must enter the largest tax credit country/income category first and then proceed through the whole interview without entering other countries - then go back in and enter other countries. Unfortunately, the only way to revisit the field to make another entry is to say yes to revisit which then removes your first entry. I think this is a software glitch that requires a software correction by intuit. If someone has a workaround, please let me know!!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Credit on foreign tax paid: Turbotax does not allow one to list multiple countries and itemize the taxes paid in each one.

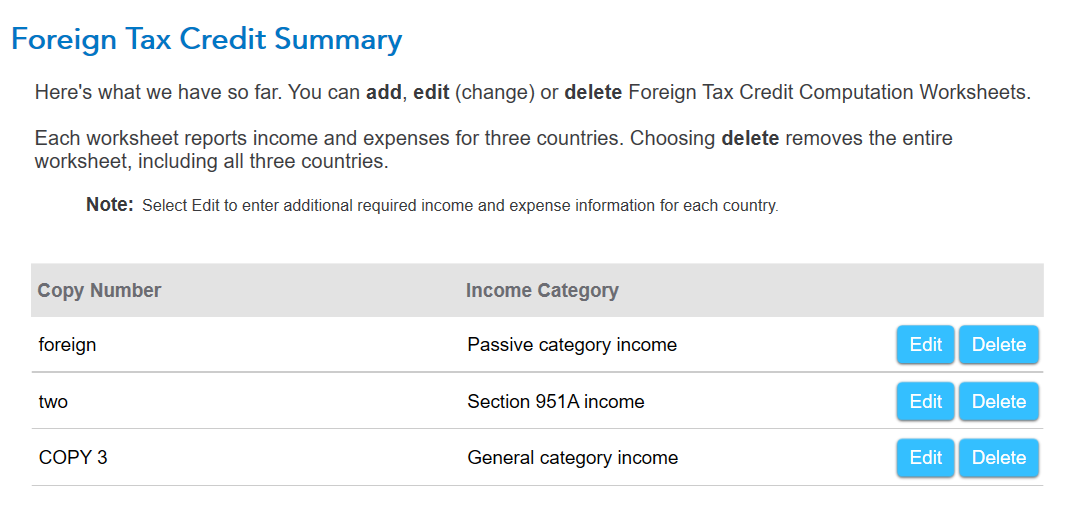

Nothing should be removed when you go back to the 1116. You should be able to select the Foreign Tax Credit and enter up to 3 countries for the same income category. If you have income from different categories, you must complete one form before starting with another type of income.

This means you start with one type of income, enter the first country, complete it, then enter the second and third countries, if applicable. Next, you enter the new income category type, repeat by going completely through the first country.

Review any carryover and adjustment along the way.

@VSP1 If you are using desktop, make sure your software is up to date. If you are using the online version, you may need to clear cache and cookies,

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17524270358

New Member

galaxy-bean-03

New Member

acoolman245

Level 1

leischerkaden

New Member

maya-cooper-brill

New Member