- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: Claiming credit for Returned Bonus at the same year

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Claiming credit for Returned Bonus at the same year

Hi,

I did receive bonus in 2022 that already taxed at payment time. However, as I changed my employer I had to return prorated amount. The amount I did return was prorated after tax based on company calculations and they mentioned that they will not issue any corrected W2 or other form and I am responsible for its tax return. Now, Wondering How I can report it in online turbotax.

Appreciate any help.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Claiming credit for Returned Bonus at the same year

This is a claim of right repayment. You can only report it in the year you actually repaid the claim.

If your repayment is less than $3,000, you'll claim it as a Miscellaneous itemized deduction in Schedule A.

If the repayment is more than $3,000, please read this TurboTax Help topic on how to make the claim.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Claiming credit for Returned Bonus at the same year

Thank you, The after tax paid amount has to be entered, right?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Claiming credit for Returned Bonus at the same year

Yes, you will report the after tax amount paid.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Claiming credit for Returned Bonus at the same year

Thanks, I followed and I added retuned after tax sign on bonus as repayment over 3000. However, after processing automatically Turbotax added this one as negative value as "Unemployment/paid family leave" in Wages&Income although I did not have such repayment and it was just sign on bonus. Is it Ok and I should leave it as it is?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Claiming credit for Returned Bonus at the same year

No, 'unemployment/paid family leave' does not sound correct.

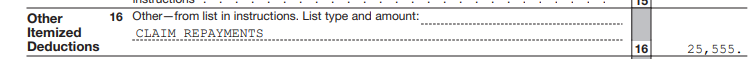

The claim of right repayment over $3,000 will be found on Schedule A Itemized Deductions line 16.

The claim of right repayment treatment qualifies if the original payment was made in one year and the repayment was made in a subsequent year.

Is this what happened?

If the original income was received in 2021 and repaid in 2022, the claim of right treatment takes place on the 2022 Federal 1040 tax return.

If the original income was received in 2022 and repaid in 2023, the claim of right treatment takes place on the 2023 Federal 1040 tax return.

If the original income was received in 2022 and repaid in 2022, the claim of right treatment may not be used.

Follow these steps to report the repayment in TurboTax Online:

- Go to Federal / Deductions & Credits / Your tax breaks / Other Deductions and Credits / Other Deductible Expenses.

- Click Start / Revisit to the right.

- Proceed through the screens until you get to the Did you have any of these less common expenses? screen.

- If your repayment amount was $3,000 or less, answer Yes. Otherwise, answer No.

- On the next screen, Did you have any of these other expenses?, answer Yes if your repayment amount was over $3,000.

- Report your repayment amount in the Claim of right repayment over $3,000 box, then select Continue at the bottom of the screen.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Claiming credit for Returned Bonus at the same year

My scenario is "If the original income was received in 2021 and repaid in 2022, the claim of right treatment takes place on the 2022Federal 1040 tax return." I followed what you mentioned, but Turbo tax add negative of that value in Unemployment wage that seems not right. Any comment?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Claiming credit for Returned Bonus at the same year

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Claiming credit for Returned Bonus at the same year

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

torstenbiernat

New Member

tddunn84

New Member

yysegedin

Level 1

dbnewmiller

New Member

in Education

Smith070812

New Member