- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

No, 'unemployment/paid family leave' does not sound correct.

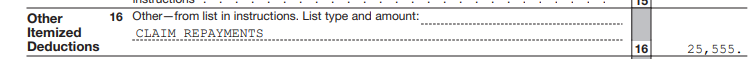

The claim of right repayment over $3,000 will be found on Schedule A Itemized Deductions line 16.

The claim of right repayment treatment qualifies if the original payment was made in one year and the repayment was made in a subsequent year.

Is this what happened?

If the original income was received in 2021 and repaid in 2022, the claim of right treatment takes place on the 2022 Federal 1040 tax return.

If the original income was received in 2022 and repaid in 2023, the claim of right treatment takes place on the 2023 Federal 1040 tax return.

If the original income was received in 2022 and repaid in 2022, the claim of right treatment may not be used.

Follow these steps to report the repayment in TurboTax Online:

- Go to Federal / Deductions & Credits / Your tax breaks / Other Deductions and Credits / Other Deductible Expenses.

- Click Start / Revisit to the right.

- Proceed through the screens until you get to the Did you have any of these less common expenses? screen.

- If your repayment amount was $3,000 or less, answer Yes. Otherwise, answer No.

- On the next screen, Did you have any of these other expenses?, answer Yes if your repayment amount was over $3,000.

- Report your repayment amount in the Claim of right repayment over $3,000 box, then select Continue at the bottom of the screen.

**Mark the post that answers your question by clicking on "Mark as Best Answer"