- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: Checked "...home we received the credit for stopped being our main home...before December 31,...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Checked "...home we received the credit for stopped being our main home...before December 31, 2019." T.Tax changes it to"...never got credit." How do we replay balance?

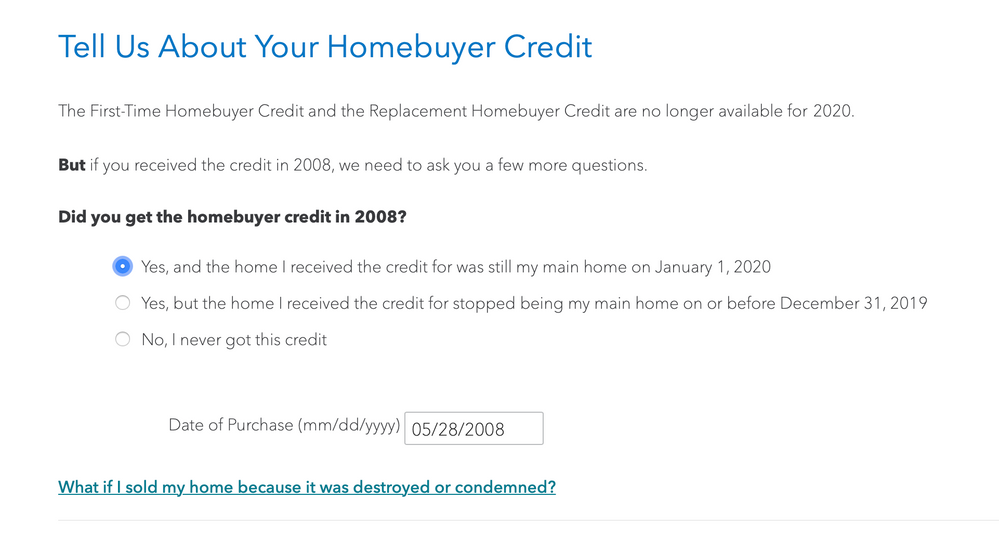

We always use TurboTax, so last year we checked "Yes, and the home we received credit for was still our main home on January 1, 2019." Now the date has moved out a year and we want to check "Yes, but the home we received the credit for stopped being our main home on or before December 31, 2019." When we do that, it deleted the form 5405 and we don't see the balance of the loan coming off in out total taxes. I keep "revisiting" the topic and clicking the accurate radio button but TurboTax just ignores it and sets it back to "no credit." The correct answer to TurboTax's prompt is indeed that the home stopped being our home before December 21, 2019.

It is our understanding we must pay the balance remainder as in 2020 we did not live in the home that we received the credit for. We confirmed at the IRS that we have credit repayment balances...TurboTax seems oblivious.

Any help is appreciated! Is this a bug or something I'm doing wrong?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Checked "...home we received the credit for stopped being our main home...before December 31, 2019." T.Tax changes it to"...never got credit." How do we replay balance?

issue 846

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Checked "...home we received the credit for stopped being our main home...before December 31, 2019." T.Tax changes it to"...never got credit." How do we replay balance?

Not sure what you mean. I search that and get nothing. Sorry I feel dumb!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Checked "...home we received the credit for stopped being our main home...before December 31, 2019." T.Tax changes it to"...never got credit." How do we replay balance?

The key thing to keep in mind with repaying the 2008 first time homebuyer credit is that you would need to repay the remaining portion of the credit during the tax year that the home is no longer your main home.

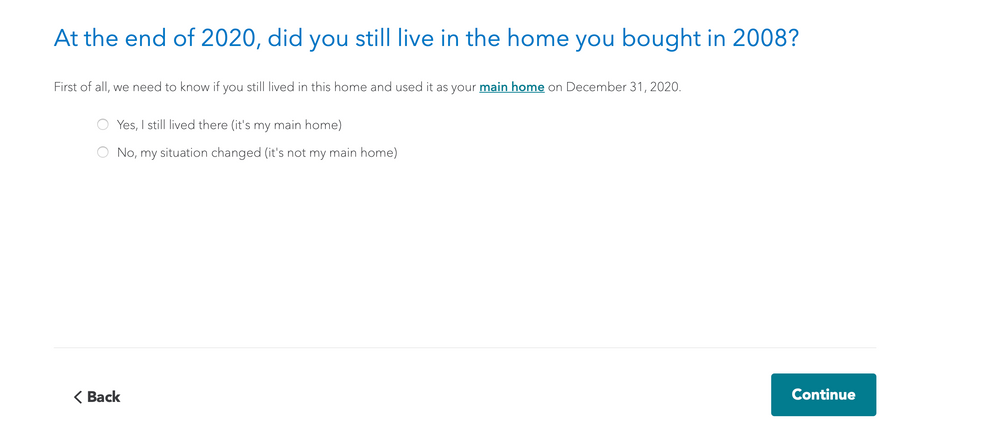

If that occurred during 2020 for you, you should select the first option on the screen stating that it was still your main home on January 1, 2020. Then, through the follow-up question you can indicate the date that the home was no longer your main home. This will place the remaining payment on your tax return.

If this occurred for you during 2019, then you need to amend your 2019 return to repay the remaining balance of the credit. You cannot include the repayment on your 2020 return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Checked "...home we received the credit for stopped being our main home...before December 31, 2019." T.Tax changes it to"...never got credit." How do we replay balance?

@AnnetteB6 that’s confusing because the question TurboTax asks is based around a January 1 date. So last year when we filed the correct answer to the question was “yes, on Jan 1 2019 this was our home.”

So you are saying that when we sold the home in March of 2019 we needed to actually pay the balance in 2020 for the tax year 2019? (Again that’s not the way TurboTax phrases it. They ask about January 1...Frustrating.)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Checked "...home we received the credit for stopped being our main home...before December 31, 2019." T.Tax changes it to"...never got credit." How do we replay balance?

Yes, if the home ceased to be your main home during 2019, it should have been reported on your 2019 tax return so that the remaining balance could be repaid then.

When you answer the initial question about whether it was still your main home on January 1, 2019 that was correct. After that page, there was another follow-up question that asked if you still lived in the home at the end of 2019. This is where you would indicate that you sold the house in March 2019, which would trigger the repayment of the remaining credit.

For your reference, here is a TurboTax article with instructions to amend your 2019 return: How do I amend a 2019 return in TurboTax?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Checked "...home we received the credit for stopped being our main home...before December 31, 2019." T.Tax changes it to"...never got credit." How do we replay balance?

@vaca wrote:

@AnnetteB6 that’s confusing because the question TurboTax asks is based around a January 1 date. So last year when we filed the correct answer to the question was “yes, on Jan 1 2019 this was our home.”

So you are saying that when we sold the home in March of 2019 we needed to actually pay the balance in 2020 for the tax year 2019? (Again that’s not the way TurboTax phrases it. They ask about January 1...Frustrating.)

In Turbotax there are two separate question. First, were you still living in the home as of Jan 1, 2020? If you answer Yes, you get a screen full of information and then a second question, "were you still living in the home at the end of 2020? If you answer No, you are led through a series of questions to calculate your payment.

I assume that for 2019 the questions were the same, just with 2019 dates.

For 2019, you would have been required to pay back the entire remaining amount of the credit, unless you did not make a profit on the home, in which case you might have owed a partial or no repayment.

Now for 2020, you don't owe a repayment, but your tax return will get rejected if you don't include one.

The problem is what to do next. The standard answer is that you will need to amend your 2019 return to report the sale and make your repayment. You will have to mail your return for 2020 since e-filing is blocked. However, since the IRS will process the 2020 return first, they may subtract $500 from your refund automatically and apply it to the credit. Then, when they process the amended return in 6 months, they should recognize the overpayment and send you a check for $500.

An alternate answer is that you make the payment for 2020 by saying you still live in the home, that will allow you to e-file. File your 2020 return first and wait for the refund to be paid. Then file the amended 2019 return, and when the program asks "How much credit have you repaid so far" be sure to include both the 2019 payment and the 2020 payment. That will reduce the amount you owe with the amended return.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Rprincessy

New Member

janetcbryant

New Member

jh777

Level 3

mread6153

New Member

powelltyler95

New Member