- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

@vaca wrote:

@AnnetteB6 that’s confusing because the question TurboTax asks is based around a January 1 date. So last year when we filed the correct answer to the question was “yes, on Jan 1 2019 this was our home.”

So you are saying that when we sold the home in March of 2019 we needed to actually pay the balance in 2020 for the tax year 2019? (Again that’s not the way TurboTax phrases it. They ask about January 1...Frustrating.)

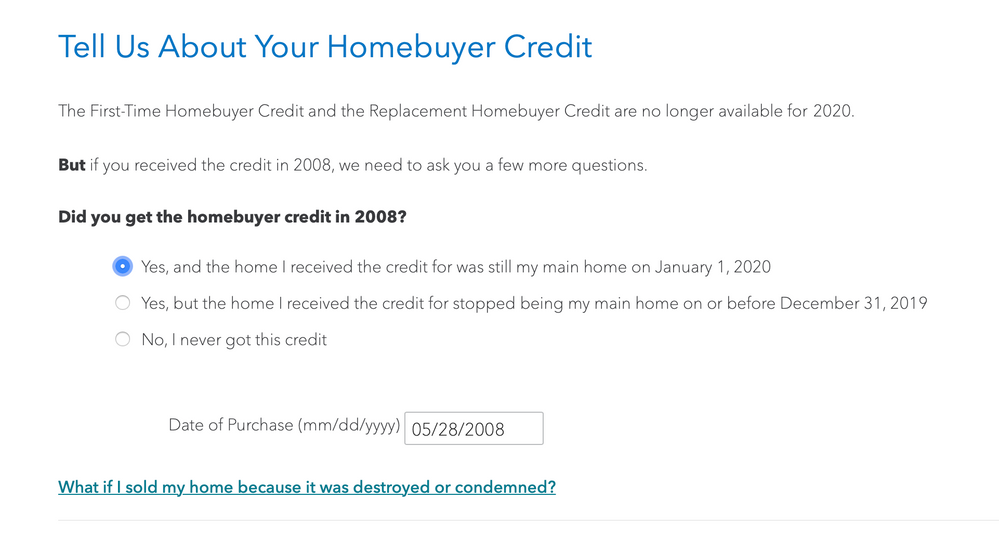

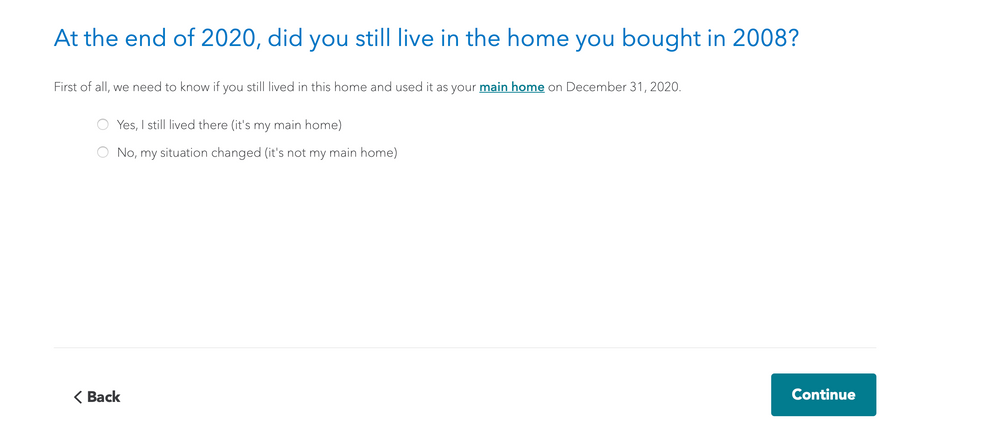

In Turbotax there are two separate question. First, were you still living in the home as of Jan 1, 2020? If you answer Yes, you get a screen full of information and then a second question, "were you still living in the home at the end of 2020? If you answer No, you are led through a series of questions to calculate your payment.

I assume that for 2019 the questions were the same, just with 2019 dates.

For 2019, you would have been required to pay back the entire remaining amount of the credit, unless you did not make a profit on the home, in which case you might have owed a partial or no repayment.

Now for 2020, you don't owe a repayment, but your tax return will get rejected if you don't include one.

The problem is what to do next. The standard answer is that you will need to amend your 2019 return to report the sale and make your repayment. You will have to mail your return for 2020 since e-filing is blocked. However, since the IRS will process the 2020 return first, they may subtract $500 from your refund automatically and apply it to the credit. Then, when they process the amended return in 6 months, they should recognize the overpayment and send you a check for $500.

An alternate answer is that you make the payment for 2020 by saying you still live in the home, that will allow you to e-file. File your 2020 return first and wait for the refund to be paid. Then file the amended 2019 return, and when the program asks "How much credit have you repaid so far" be sure to include both the 2019 payment and the 2020 payment. That will reduce the amount you owe with the amended return.