- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: cash donation double counted for 2020 tax year?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

cash donation double counted for 2020 tax year?

Hi,

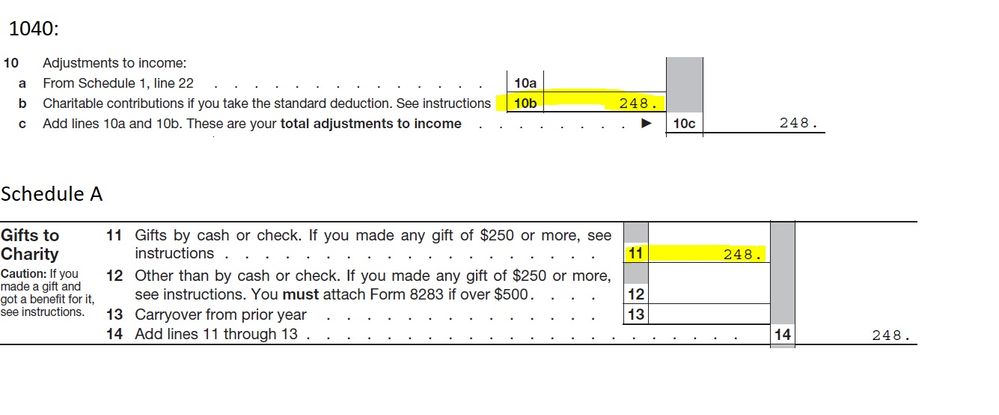

I am using "Itemized Deductions" and the cash donation amount is reflected in Schedule A (line 11, gifts to charity) and in the total deduction (1040 line 12). However the same amount also reported in 1040 line 10b.

The 1040 line 10b states "Charitable contributions if you take the standard deduction" . So I would assume the amount in 10b should be 0 if using "Itemized deductions". Is this understanding correct?

Just wondering whether TT premier get this item double counted or this is intended for 2020 tax year?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

cash donation double counted for 2020 tax year?

That amount does show on Line 10b and is only used if you take the standard deduction. Since you took itemized deductions, Line 10b is simply information on your return. It is not being double counted.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

cash donation double counted for 2020 tax year?

Thanks, can you double check ?

I think it's been double counted for my case. The same donation amount in 10b rollup into 10c and then get deducted in line 11. ( line 11 = line 9 - line 10c) However that amount is also reflected in line 12 (total deductions).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

cash donation double counted for 2020 tax year?

I would recommend reviewing your overall deductions to ensure you have selected either the itemized deductions or the standard deduction.

If you are itemizing, your charitable contribution should not show up on line 10b.

I recommend you review your input as follows to ensure the contributions are picked up correctly.

- Log back into TurboTax and select the Federal Taxes tab.

- Select Deductions & Credits

- Select I'll choose what I work on

- Scroll down to Charitable Donations and review your input for Donations to Charity in 2020

- Select Done with Donations

- Scroll down to the bottom of the Deductions & Credits page and select Done with Deductions

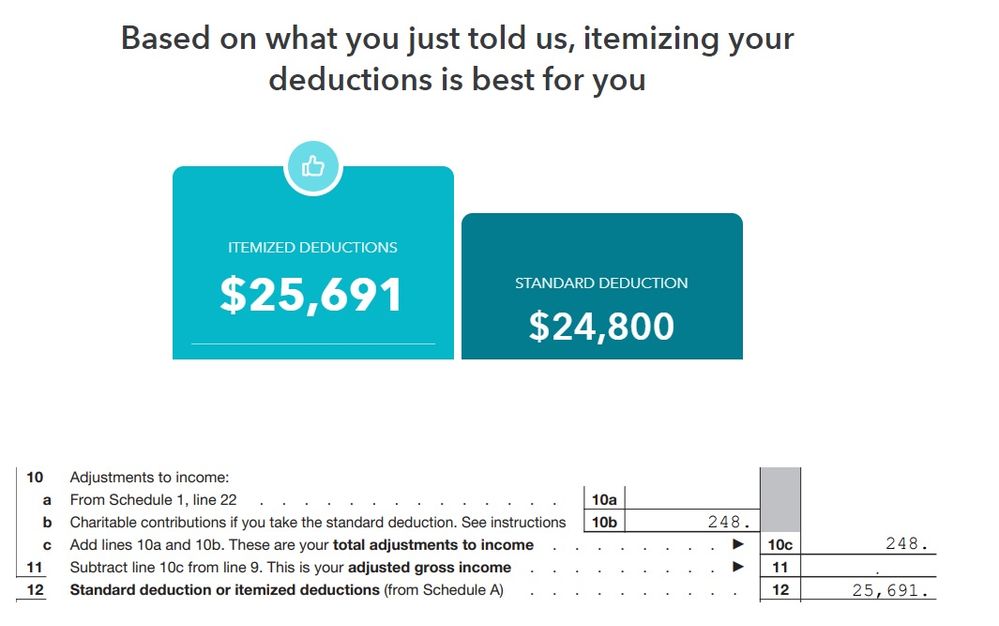

- Continue through the screens until you see the screen titled We've Chosen....Deductions for You as shown in the picture below.

If the results say you are getting the Federal Itemized Deductions, line 10b should be blank as your charitable donations will be on Schedule A.

If the results say you are getting the Standard Deduction, then you would see up to $300 of Cash Contributions on line 10b.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

cash donation double counted for 2020 tax year?

Thanks JotikaT2,

Please see screen snap below -- I am pretty sure the "Itemized deductions" (line 12) is used as the amount higher than standard deduction. However the line 10b is not zero as expected.

Is there some way I can share my file with you or TT team for a detail look?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

cash donation double counted for 2020 tax year?

No, but call intuit tax support at 1-800-446-8848 for further assistance as they can look at your screen to pinpoint any issues you are experiencing and answer your question to determine if this is correctly listed in the program.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

cash donation double counted for 2020 tax year?

Thanks, I will file my return late. Hope such issues get fixed by then.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

cash donation double counted for 2020 tax year?

It would be helpful to have a TurboTax ".tax2020" file that is experiencing this issue.

You can send us a “diagnostic” file that has your “numbers” but not your personal information. If you would like to do this, here are the instructions:

Go to the black panel on the left side of your program and select Tax Tools.

- Then select Tools below Tax Tools.

- A window will pop up which says Tools Center.

- On this screen, select Share my file with Agent.

- You will see a message explaining what the diagnostic copy is. Click okay through this screen and then you will get a Token number.

- Reply to this thread with your Token number. This will allow us to open a copy of your return without seeing any personal information.

We will then be able to see exactly what you are seeing and we can determine what exactly is going on in your return and provide you with a resolution.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

cash donation double counted for 2020 tax year?

Thanks all! During the final review step TurboTax allow me to manually override the 12b amount to 0 so it solve my problem. Though not sure why it is not populated at 0 automatically for itemized deduction.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

IndianRocks

Level 1

fdjct

Level 1

curzirj

New Member

CalebWg

Returning Member

snorlax1

New Member