in [Event] Ask the Experts: Investments: Stocks, Crypto, & More

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: carryover losses and depreciation

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

carryover losses and depreciation

Usually you import LAST YEAR'S TT file. Last TT file completed was 2020. 2021 was skipped TT. There is a however, a hardcopy document for 2021. So when starting 2022 files, have to start brand new since cannot import 2021 TT file (since there is no 2021 TT file, only 2020 TT file). Have to start from scratch.

How do I capture carry forward losses and depreciation if there is no 2021 TT file?

Is there an easy way to manually transfer them from 2021 hardcopy to 2022 TT file (assuming you are not accounting background)?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

carryover losses and depreciation

As far as depreciation is concerned, you can add the assets and when you answer the questions regarding cost, date put into service, bonus or section 179 depreciation taken, etc. TurboTax will calculate the correct depreciation deduction for the current year and going forward. I'm not sure what kind of loss carryovers you have, but as you work through the program you will see options to enter your loss carryovers by type. For instance, when go through the qualified business income deduction (QBI) section, you will be asked to enter any QBI loss carryover you have from the previous year.

To transfer other information from the previous year, you just need to go through the sections in TurboTax that pertain to the information you need to enter and answer the questions.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

carryover losses and depreciation

Most of the carried over losses have to do with home office expenses and percentage of upgrades to house attributed to home office. Not sure where/what form and what line, that would be found to manually put that.

In regards to rental property depreciation, if you skipped one turbo tax year in 2021, you still have to manually enter it from the hard copy document? Is that found in the 2022 schedule E section?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

carryover losses and depreciation

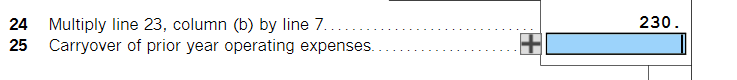

The home office loss carryover would have to be entered directly on form 8829 on line 25 as you can see here:

When you go through the rental income section in TurboTax you will see an option to enter your rental house and furniture and equipment. You woud enter it as you did originally, just enter the date put into service, which will be in prior years, and TurboTax will do the rest.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

carryover losses and depreciation

Assuming the same rental properties, does the schedule E list the date put into service? (Found on any tax year return)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

carryover losses and depreciation

No, schedule E would list the total depreciation for the year, but not the assets from which the depreciation is derived. You would have to look on the asset entry worksheets to see details on asset cost and date put into service.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

carryover losses and depreciation

What form number is the asset document?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

carryover losses and depreciation

There is no form number for Rental Property assets and Depreciation.

The information is on the Federal Summary Depreciation Schedule. This lists the building, and fixtures with the date acquired, cost basis, prior depreciation, method, life, and current depreciation.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

carryover losses and depreciation

@ThomasM125 @PattiF I do not see form 8829. I see a couple of pages called “Deduction for Business Use of Your Home”.

part 1 is part of your home used for business as square feet of office divided by square feet of total house and then gives a percentage.

part 2 is figure your allowable deduction

part 3 is depreciation of your home

Last page, Business Use of Home Worksheet, is deduction of business use of your home Line 19 Other Expenses - Schedule E

It appears that line 34 = allowable expenses for business use of your home.

Do I enter this number as the carry forward losses?

Do these numbers need to be carried forward?

There is also a General Information cover page. This lists Carryovers to 2022. The value of X is all the same for the four areas. This number X is different from line 34 above. I’m probably mixing different carryover losses from different sections.

Federal Carryovers

Unallowed Passive Losses = X

AMT Unallowed Passive Losses = X

State Carryovers

Unallowed Passive Losses = X

AMT Unallowed Passive Losses = X

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

carryover losses and depreciation

@PattiF There was no Federal Summary Depreciation Schedule. I did find a Schedule E Worksheet Depreciation Report for each rental. I believe that is what you are referring to that lists the in service date.

Just curious where you get the figures for the Cost (Net of Land) and the Land?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

carryover losses and depreciation

There should be a 'Depreciation Report' or 'Depreciation Worksheet' included in your tax file. This is the report that shows the asset name, date placed in service, cost and accumulated prior depreciation, as well as current depreciation.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

carryover losses and depreciation

Assuming there is a new schedule E property. Where do you get the cost (net of land) and the cost of land?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

carryover losses and depreciation

If you purchased the property, your cost is the amount that you paid for it, plus some of the closing costs you paid to acquire it. The cost is the amount you pay for it in cash, mortgage, and other property or services.

The purchase of a home and land, includes the land, so you need to determine the value of the land because it cannot be depreciated. The best place to get an estimate of the land value, is to look at your property tax bill.

If your property tax bill doesn't list the land separately, you can rely on comparable sales, or an estimate by a real estate professional.

If you acquired the property in a way other than buying it, you need to figure your basis in a different way. Click here to learn more.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

carryover losses and depreciation

Is it possible that the schedule E depreciation is different from the form 4562 "Depreciation and Amortization"? It seems that if my rental expense + depreciation expense > total rental income, turbo tax will limit my depreciation expense reported in Schedule E so the net rental income is 0.

And do I need to manually calculate the deprecation loss when I report the tax the next year for the "unused deprecation expense"?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

carryover losses and depreciation

Yes, the amount of depreciation reported on Schedule E is the portion allowed by your rental income. The excess is carried forward to next year. TurboTax does this for you on Form 4562 and on the Schedule E Worksheet (a TurboTax form).

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17524160027

Level 1

user17524121432

Level 1

in [Event] Ask the Experts: Investments: Stocks, Crypto, & More

titan7318

Level 1

mjtax20

Returning Member

Jim_dzg5zg

New Member