- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

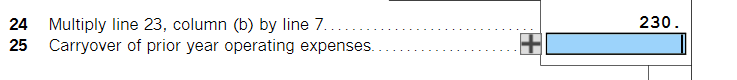

The home office loss carryover would have to be entered directly on form 8829 on line 25 as you can see here:

When you go through the rental income section in TurboTax you will see an option to enter your rental house and furniture and equipment. You woud enter it as you did originally, just enter the date put into service, which will be in prior years, and TurboTax will do the rest.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

February 7, 2023

4:56 PM