- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: 2021 Form 1116 Schedule B (carryovers) can't efile

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2021 Form 1116 Schedule B (carryovers) can't efile

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2021 Form 1116 Schedule B (carryovers) can't efile

Hmm...I'll give it 48 hours to see if the rumor that this has been escalated is true. When I requested a partial TurboTax refund (for the exact amount of my tax refund I'd lose without the Schedule B), I mentioned this needed to be escalated because it's likely to impact a large proportion of their customers. If others call requesting a refund and saying the same thing, perhaps Intuit actually will respond.

I appreciate that the IRS released these new forms extremely late, but when H&R Block and other Intuit competitors have successfully incorporated the Schedule B, it's reasonable to expect Intuit would as well.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2021 Form 1116 Schedule B (carryovers) can't efile

I just sent tweets. Thanks for the suggestion.

Still hoping that Alexander’s message about TurboTax fixing the issue will come true. I’m not going to hold my breath however.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2021 Form 1116 Schedule B (carryovers) can't efile

I just confirmed with TT Resolution Desk, you will not be able to e-File State without e-File Federal.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2021 Form 1116 Schedule B (carryovers) can't efile

While that's true, you COULD e-file your federal and state without the 1116 Schedule B, then on March 31 file an amended federal return via mail. If I did that, I don't think I would need to file an amended state return because the 1116 Schedule B doesn't affect my state taxes. So, that would save one mailed package, and also get the majority of my refund to me much faster (since only the portion affected by the Schedule B would be put on the IRS' 10 month backlog).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2021 Form 1116 Schedule B (carryovers) can't efile

I had the same problem (after downloading today’s update with Form 1116). So I switched from taking the foreign tax credit (with Form 1116) to taking the foreign tax as an itemized deduction. Figured I could amend later if it made a big difference. But to my surprise, it made no difference and TT now says I’m good to efile.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2021 Form 1116 Schedule B (carryovers) can't efile

Thanks for the suggestion corys but I don’t think that will help those of us that have a foreign tax credit carry forward. Please let me know if I’m missing something because I’m still hoping for some type of TT solution.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2021 Form 1116 Schedule B (carryovers) can't efile

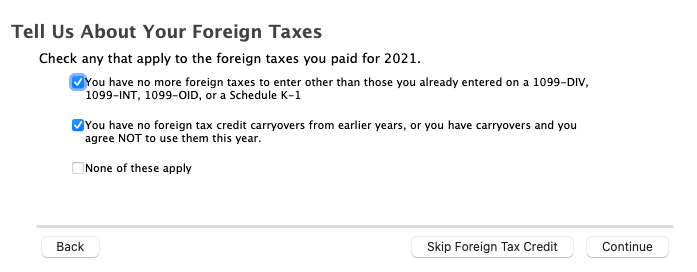

Yes, you can elect to not use last year(s) carryover tax credits. I was stuck like everyone with the 1116 change and not able to e-file. The second check box states: "or you have carryovers and you agree NOT to use them this year."

By checking the second box, I no longer need the 1116 form and can e-file. Not sure if I will be able to use my 2020 carryover next tax season, but not worth it to me to wait any longer on TT to figure it out. Seems like being able to carryover up to 10 years should give TT enough time to fix this mess!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2021 Form 1116 Schedule B (carryovers) can't efile

Thank you, jcbaykal. I am going the deduction route. It is a smaller benefit as a deduction instead of the credit, but I have no interest in waiting until March 31 and then mailing my return in.

This 1116 Schedule B issue is complete nonsense, and is the last straw for me. I'm done with TT after this.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2021 Form 1116 Schedule B (carryovers) can't efile

Hi @SCswede SCswede:

You asked if IRSwill accept 1116 SchB electronically.

Over at the (much bigger) TT Community parallel discussion on this exact topic, going on right now, poster @Anonymous , after telling everyone to chill out and stop whining (this is very close to an exact quote, I believe), stated that no tax software can technically e-file 1116 SchB, but that IRS can accept a pdf attachment for 1116 SchB with the electronic filing, and that

TurboTax has not (yet) added this capability to its product.

annajoe803, if I didn’t quote you accurately, please feel free to chime in here.

On page 1 of this (here) discussion, @Payer06 and @Taxachusetts got into a back and forth with Don from Georgia about whether or not TT had been deceptive in claiming support for e-filing of 1116. Don, who is an expert in fine parsing, stated TT was not deceptive. But after Taxachusetts pointed out :

“TurboTax has historically supported E-filing when customers had foreign tax credit carryovers. Now, TurboTax will not support that. There is a $10 online tax program that will e-file tax returns when a person has foreign tax credit carryovers. Surely Intuit could restore this functionality if it wanted to”, the disagreement seemed to be settled.

Taxachusetts did reject the possibility that TurboTax doesn’t have the know-how (possessed by some other tax software companies) to restore functionality (rather than TT just deciding not to, to save money and maximize its profit). In the Bogleheads.com discussion on this topic :

https://www.bogleheads.org/forum/viewtopic.php?t=366971

the very knowledgeable poster - talzara - observed:

”Intuit is good at dark patterns, marketing, and lobbying. Intuit is bad at software engineering, and Form 1116 is one example”

He made that comment on January 9.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2021 Form 1116 Schedule B (carryovers) can't efile

I am getting the same error mentioned earlier with the new version that came out on 3/3/22.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2021 Form 1116 Schedule B (carryovers) can't efile

Just got off the phone with Intuit support on this. The rep was actually very helpful and cordial. Here's what I learned:

1) You currently have several options; check how each one affects your refund/bill.

a) Take a deduction instead of a credit.

b) State that you have no carryforward/carryback credits (or choose not to use them this year).

c) Do (a) or (b) now and file electronically, then file an amended return via mail on March 31 to handle the difference. You may not need to file an amended state return if you go this route.

d) Just wait till March 31 and file via mail.

2) The rep could not answer if taking a deduction this year, then a credit next year, would be a problem, since your prior year return would not mention the carryforward/carryback schedule.

3) If you go with one of the E-file options listed above, first be sure to record, outside of TurboTax, your carryover schedule as reported by TurboTax. As soon as you elect one of these routes in Interview, that schedule will be erased, and it can be complicated to recalculate. Ideally, go to your 1116 form in TurboTax and record both your 2021 and 2022 numbers, prior to selecting in Interview. (You can probably ignore the AMT schedule if you don't do alternative minimum, but it's best to record both.)

4) Intuit upper management has taken notice of the volume of complaints on 1116 and 1116 Schedule B. In fact, there have been so many 1116-related refund requests, those refunds are backlogged. The rep said there were no promises but "there's a good chance they'll change their minds and start supporting the form after all". I'm waiting a few days to find out.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2021 Form 1116 Schedule B (carryovers) can't efile

Will e-filing with Form 1116 be added before April 15th?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2021 Form 1116 Schedule B (carryovers) can't efile

I am also in this situation, with a tax credit carry forward to 2022, and so like everyone else here, I was waiting for a couple of months for 1116 to be completed, only to be stuck and unable to efile.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2021 Form 1116 Schedule B (carryovers) can't efile

Switching to deduction shorts me about $190. I guess I'll wait a day or two to see wth is going to happen, or maybe I'll just remove the DIV that's causing this and amend later.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

dinesh_grad

New Member

HNKDZ

Returning Member

titan7318

Level 1

drewdippold

Level 1

DoctorJJ

Level 2