- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: 2021 Deductions & Credits Summary Error

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2021 Deductions & Credits Summary Error

The TurboTax desktop product shows the "State and local taxes greater than $10,000" line in the Deductions summary, even though the Standard Deduction is listed and no other state and local tax deductions are listed. Furthermore, it actually "deducts" the amount (-$587 in my case) to get the Total Deductions, making it look like the Feds are not only not going to give me credit for these taxes, but they are apparently REDUCING my standard deduction for having to pay them! Fortunately, after examining the tax forms, there is no reduction in the deduction, so the error is only in the summary display itself.

This line should ONLY appear in the display if itemized deductions are actually being used.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2021 Deductions & Credits Summary Error

I understand why you think that looks wrong, but the summary follows the Taxes section of Schedule A.

The negative figure is the amount that would be backed out of your total state and local taxes to arrive at the allowed deduction for line 5e of Schedule A.

Any time your real estate taxes plus your state and local taxes exceeds $10,000 ($5,000, if married filing separately), there will be a negative number in this section to show the maximum allowed amount in the section.

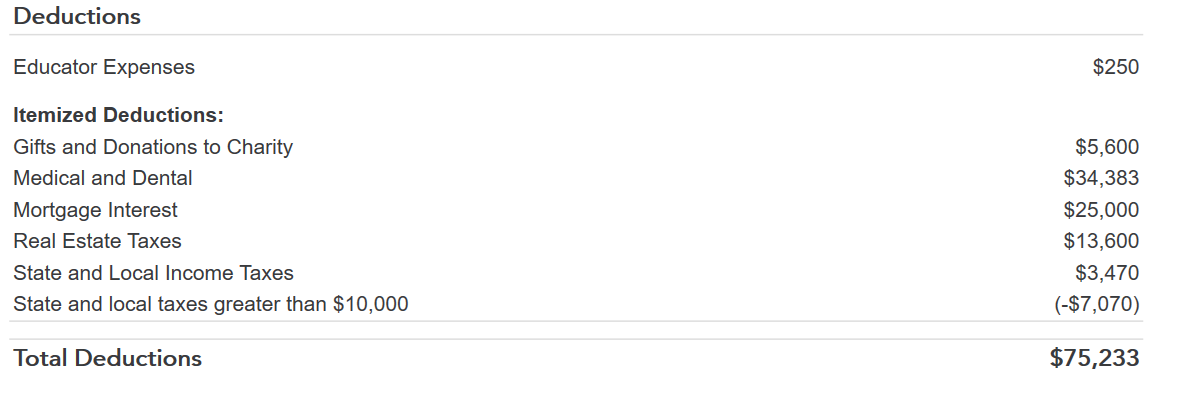

In the example below, the real estate tax plus the state and local taxes equals $17,070, so the negative number is -$7,070. It shows this way on the summary if you have exceeded the allowed deductions, even if you ultimately decide to use the standard deduction instead.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2021 Deductions & Credits Summary Error

I understand the negative number, and how it applies IF deductions are ITEMIZED, as in your example. My point is that it applied it to my total deductions calculation, even though the STANDARD deduction is listed.

Again, this line should not appear in a summary showing the standard deduction. It is confusing and misleading (inaccurate Total Deductions) for those using the TurboTax EasyStep interface and not looking at Schedule A.

I also noticed that the same inaccurate Total Deductions figure reappears in the final tax summary later in the EasyStep interface. This is a bug which should be fixed.

Fortunately, the interface display error does not translate to the forms or the actual tax calculation.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

g-detzel

New Member

Vultano

New Member

Nancy-Farrar

New Member

skj

Level 3

34npr

New Member