- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

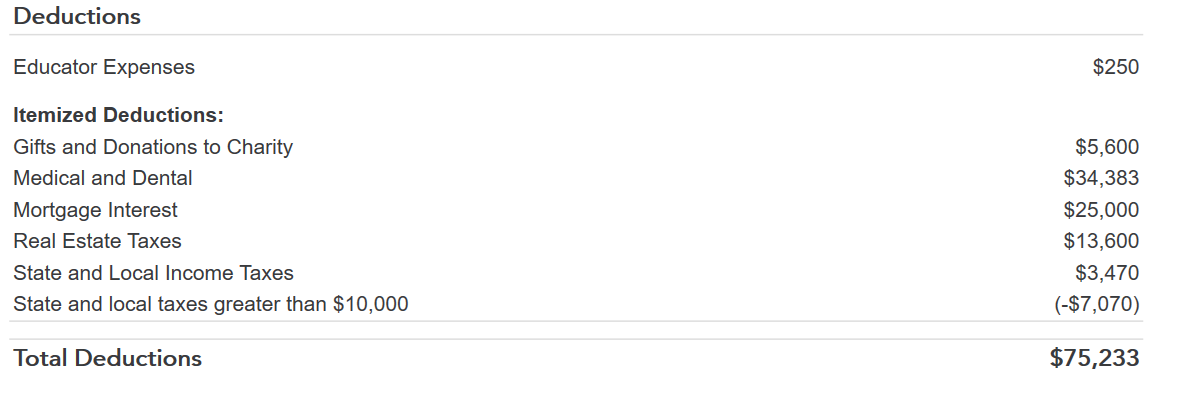

I understand why you think that looks wrong, but the summary follows the Taxes section of Schedule A.

The negative figure is the amount that would be backed out of your total state and local taxes to arrive at the allowed deduction for line 5e of Schedule A.

Any time your real estate taxes plus your state and local taxes exceeds $10,000 ($5,000, if married filing separately), there will be a negative number in this section to show the maximum allowed amount in the section.

In the example below, the real estate tax plus the state and local taxes equals $17,070, so the negative number is -$7,070. It shows this way on the summary if you have exceeded the allowed deductions, even if you ultimately decide to use the standard deduction instead.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

February 9, 2022

1:02 PM