- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: 1099-R

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-R

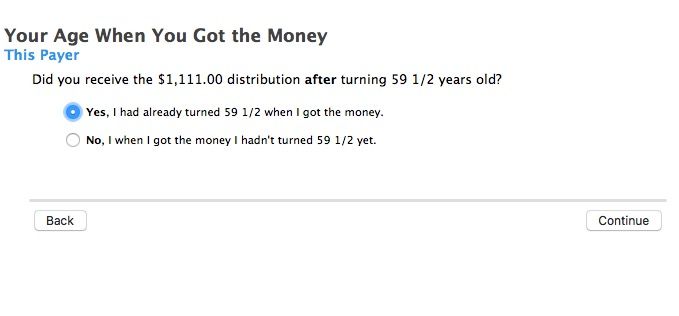

Section Money Received Before Age 59 1/2?

I answered no but when I go back to review, it defaulted back to Yes. Did this several times and it keeps defaulting back to Yes. Why is Turbo Tax not accepting my selection? I think I'm being charged a penalty for early withdrawal and I should not be.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-R

Answers are not remembered, it is only used to get you to the next screen. If you repeat the interview, you must answer the question again.

Why do you think you have an exception to the penalty?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-R

I think I have an exception to the penalty because my birthday is Jan 1960 and I withdrew the money Sept 2019. Past 59 1/2.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-R

@amooney wrote:

I think I have an exception to the penalty because my birthday is Jan 1960 and I withdrew the money Sept 2019. Past 59 1/2.

If you entered your DOB correctly in the personal information section then if the box 7 code on the 1099-R is a 1, or J then you should get this question in the 1099-R interview. If not, then delete the 1099-R and re-enter.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-R

The code in box 7 is 7 - Normal Distribution. The screenshot you provided is different than what my TurboTax shows. But I don't know if that matters. Will I need to contact the company that provided the 1099-R and ask that it be revised/corrected if the code they entered is incorrect? Just looking for advice.

Thank you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-R

@amooney wrote:

The code in box 7 is 7 - Normal Distribution. The screenshot you provided is different than what my TurboTax shows. But I don't know if that matters. Will I need to contact the company that provided the 1099-R and ask that it be revised/corrected if the code they entered is incorrect? Just looking for advice.

Thank you.

A code 7 is not subject to the penalty at all, so the payer knew that you were over age 59 1/2.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-R

So it looks like I need to contact TurboTax support since the software will not save my selection. Thank you for your time.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-R

He already noted that ...IF...if you go thru the interview a second time, the software resets the questions.

So as long as you answered them right the first time, you just don't go thru a second time.

IF you do go thru a second time, to change something else, then all the questions are asked again and a number of them do reset to something else ....but only because you started thru them again....so don't go back to Edit that 1099-R unless you have to for some other problem.

If you don't trust it, and want to see if there is a penalty, check your tax forms...check to see if there is a penalty on line 6 of the Schedule 2. IF no penalty on that line, or if a Schedule 2 is entirely absent, then there is no penalty.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-R

@amooney wrote:

So it looks like I need to contact TurboTax support since the software will not save my selection. Thank you for your time.

What selection? TurboTax never saves answers to questions that only select the next screen. If you repeat the interview it is like starting over and you must select the correct answer again.

What exactally do you think is wrong? Are you seeing a penalty somewhere?

A code 7 in box 7 never adds a penalty.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-R

I get it now. Thank you

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-R

The reason I think there is an issue is it says I owe over $4500. I've never owed taxes in my life - always received a refund - and the only difference this year was closing an old IRA. So my first thought was a penalty. I may need to go to a tax accountant now to see why this is because I don't know where else to look.

And now I do understand if I go back to a section in TurboTax I need to answer the questions again like it's the first time. Sorry I misunderstood that part.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

wagilmore

New Member

Kevin1970

New Member

tool-man

Level 2

user17710127983

New Member

user17709977784

New Member