- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

@amooney wrote:

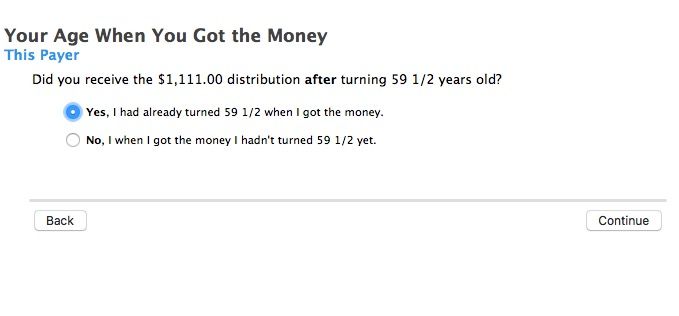

I think I have an exception to the penalty because my birthday is Jan 1960 and I withdrew the money Sept 2019. Past 59 1/2.

If you entered your DOB correctly in the personal information section then if the box 7 code on the 1099-R is a 1, or J then you should get this question in the 1099-R interview. If not, then delete the 1099-R and re-enter.

**Disclaimer: This post is for discussion purposes only and is NOT tax advice. The author takes no responsibility for the accuracy of any information in this post.**

May 2, 2020

12:33 PM