- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Qualified Charitable Deduction How do I enter it on my Turbo Tax?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Qualified Charitable Deduction How do I enter it on my Turbo Tax?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Qualified Charitable Deduction How do I enter it on my Turbo Tax?

Go back through your TurboTax interview and see if you entered your qualified charitable distribution (QCD) as follows:

- Sign into your TurboTax Account

- Click on Continue where I left off

- On the left side screen, select Federal then Wages & Income

- On the Wages & Income screen, scroll to IRA, 401(k), Pension Plan Withdrawals (1099-R) and click on Edit/Add

- If you come to the Review your 1099-R info screen, Edit the 1099-R you QCD.

- Continue with the onscreen interview.

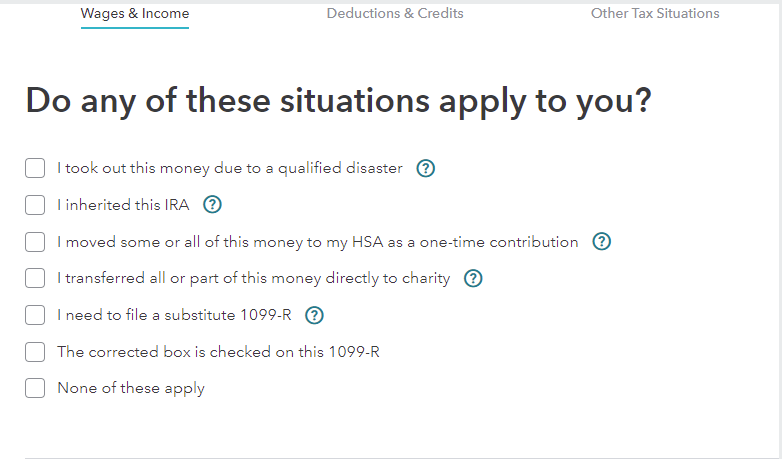

- On the Do any of these situations apply to you? screen, select I transferred all or part of this money directly to charity.

- Continue with the onscreen interview until complete.

A qualified charitable distribution (QCD) is a distribution from an IRA made directly by the trustee of the IRA to a qualified charity. A QCD reduces the amount of your IRA distribution that you are required to recognize as income.

- You must be at least 70 1/2 years old on the day of the distribution. The maximum amount that may be contributed is limited to $100,000. The qualifications and limitations are applied separately to each spouse on a joint return.

Because the QCD reduces your taxable income, you can’t also claim a charitable deduction for these same donations, if you itemize, since this would be double-dipping.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Qualified Charitable Deduction How do I enter it on my Turbo Tax?

On my Turbo Tax there is no mention on my version where to enter my QCD info to enter on the form!

zip…nothing…and very confusing too. I’ll never use TurboTax again. I called in and Dana replied. She didn’t have an answer after 15-20 minutes. She then said she would forward me to a tax deduction expert. At that time, I was informed that I had to pay more for that kind of help.

totally a scam! And blackmail to boot. Never again!!!!

Larry Carr

Westerville Ohio

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Qualified Charitable Deduction How do I enter it on my Turbo Tax?

@lcfishes wrote:

On my Turbo Tax there is no mention on my version where to enter my QCD info to enter on the form!

zip…nothing…and very confusing too. I’ll never use TurboTax again. I called in and Dana replied. She didn’t have an answer after 15-20 minutes. She then said she would forward me to a tax deduction expert. At that time, I was informed that I had to pay more for that kind of help.

totally a scam! And blackmail to boot. Never again!!!!

Larry Carr

Westerville Ohio

Are you age 72 or older? Did you check the box on the Form 1099-R to indicate the funds were from an IRA/SEP/SIMPLE account? What code did you enter in box 7? Was it a 7?

If the above is all true then the TurboTax software would have asked if the distribution was for a QCD.

Check your entries and if all are correct and you are not being asked about the QCD then delete the Form 1099-R and re-enter the form manually.

Hundreds of other users have filed a Form 1099-R and successfully completed entry for a QCD.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Qualified Charitable Deduction How do I enter it on my Turbo Tax?

Turbo tax never subtracts QCD from the total RMD?? And on form just enters an amount of the total distribution minus $5,000??? Thia is not correct. POlease help, the software is messed up???

Pat

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Qualified Charitable Deduction How do I enter it on my Turbo Tax?

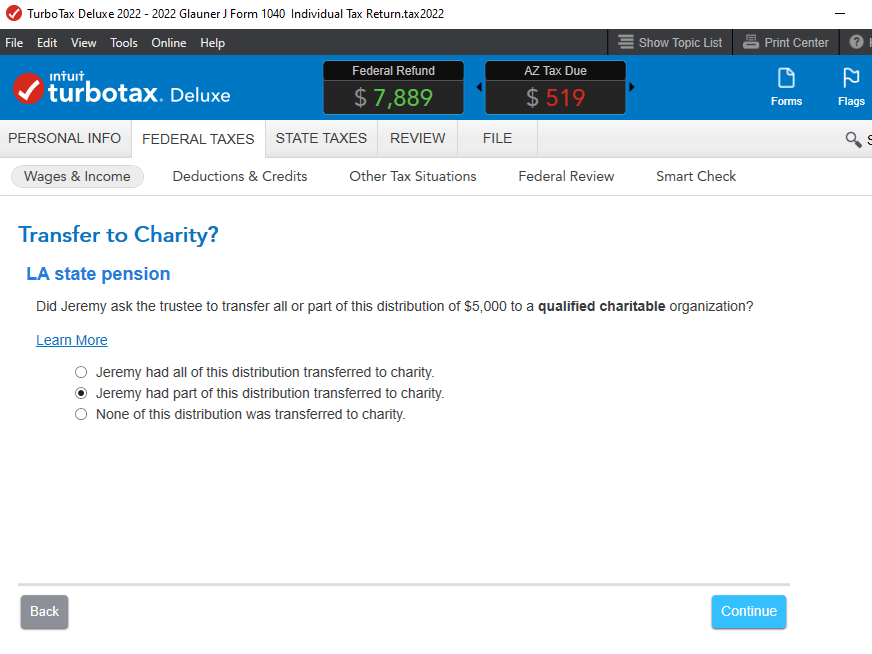

When you enter your 1099-R into, TurboTax asks if 'all of part of this distribution was RMD'. Say 'all of this distribution was RMD', even if it was not. The IRS does not know or care what your RMD is supposed to be; your Plan Administrator is responsible for issuing you the proper RMD amount each year.

Continue, and you will get a screen asking 'did you transfer some or all of this distribution to charity?'. Say YES and enter the amount. Screenshots from both TurboTax Online and TurboTax Desktop are below. You will not get the QCD question if you don't indicate that your distribution was RMD.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Kh52

Level 2

TRIBBIE

Level 1

in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill

nnennak

Level 1

in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill

ssolfest

Level 2

in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill

anonymouse1

Level 5

in Education