- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Pregnancy in 2020-2021

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Pregnancy in 2020-2021

How will the credit work if I was pregnant with a child until July 2021. I’m referring to the advance that everyone with children were getting.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Pregnancy in 2020-2021

Hello!

Congratulations on your new baby! If you did not receive the Advance Child Tax Credit payments for your child born in July 2021, you may claim the full amount of your allowable Child Tax Credit for that child when you file your 2021 tax return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Pregnancy in 2020-2021

IRS has a Child Tax Portal where you are able to enter the information for the new child that you will claim on your 2021 tax return. If you do not receive advance Child Tax Credit payments for a qualifying child you will claim in 2021, you may claim the full amount of your allowable Child Tax Credit for that child when you file your 2021 tax return.

Here's a link to the portal:

https://www.irs.gov/credits-deductions/child-tax-credit-update-portal

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Pregnancy in 2020-2021

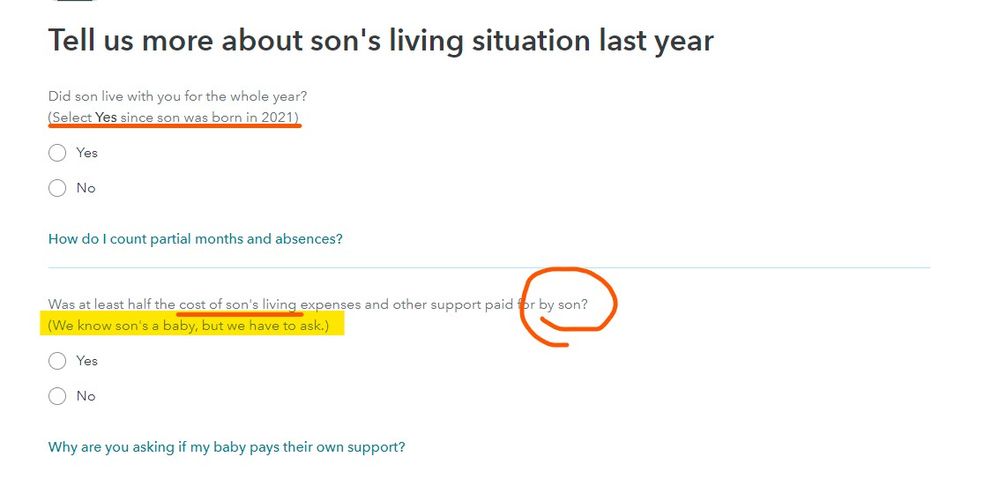

If you have a child who was born in 2021 then you claim your child as a dependent on your 2021 tax return. You never enter anything about pregnancy on a tax return. You will need your child's Social Security number, and you will enter the child as a dependent in My Info. When it asks how long your child lived with you, you need to say the WHOLE YEAR for a newborn, and make sure when it asks if your child paid for over half his own support you say NO to that question.

The software will add the child-related credits for which you are eligible. Make sure you look at the recovery rebate credit to get the 3rd stimulus check. The software will put in the child tax credit and --if you qualify-- earned income credit.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Pregnancy in 2020-2021

Tax code says the child must live with you for more than half of the year; so, why would we be able to claim a child who was born after July?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Pregnancy in 2020-2021

@b-jlangston wrote:

Tax code says the child must live with you for more than half of the year; so, why would we be able to claim a child who was born after July?

A child born during the tax year is deemed to have lived with you for the entire tax year per the tax code.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Pregnancy in 2020-2021

Here's a link to the draft Form 1040 Instructions regarding children that are born or die during the year:

https://www.irs.gov/pub/irs-dft/i1040gi--dft.pdf

See page 21 - "Exception to time lived with you."

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Pregnancy in 2020-2021

In the program READ this screen carefully ... the program gives you the answer :

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Srojas01

New Member

Kuddin2

Level 1

cindy-kubinsky

New Member

krysanders

New Member

Mitchmaberry8

New Member