- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- NO

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I'm on disability and have one child can I get any money back for the child tax credit

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I'm on disability and have one child can I get any money back for the child tax credit

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I'm on disability and have one child can I get any money back for the child tax credit

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I'm on disability and have one child can I get any money back for the child tax credit

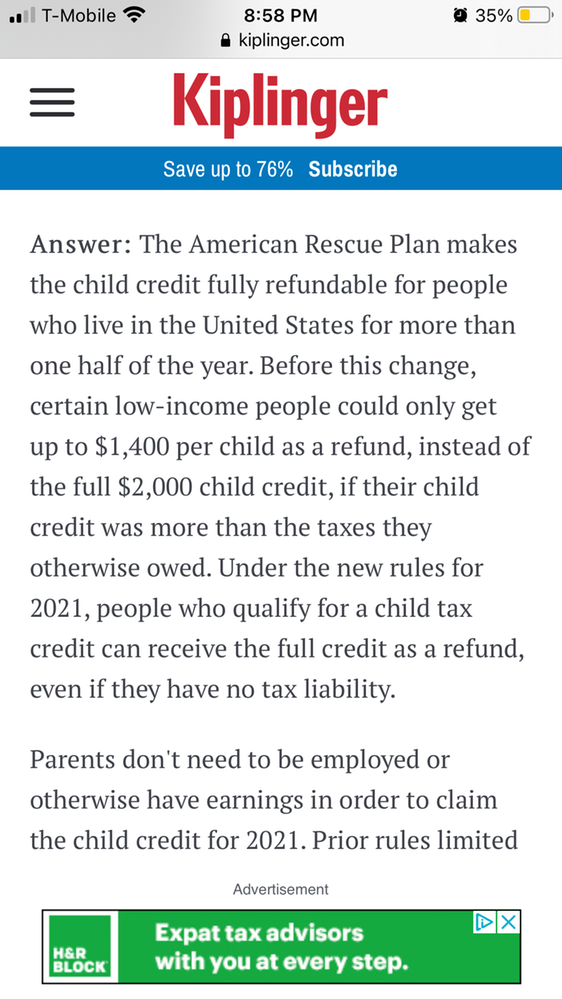

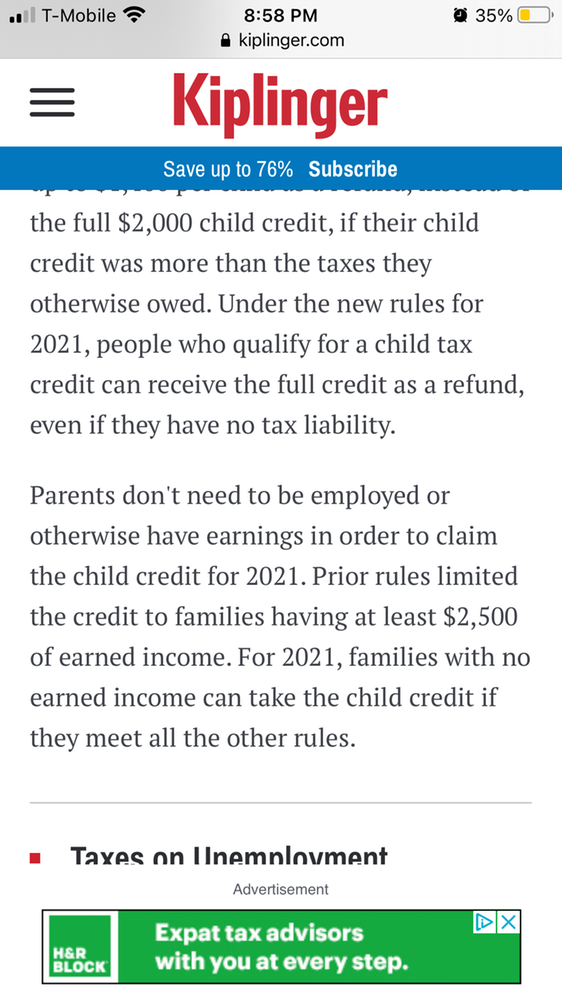

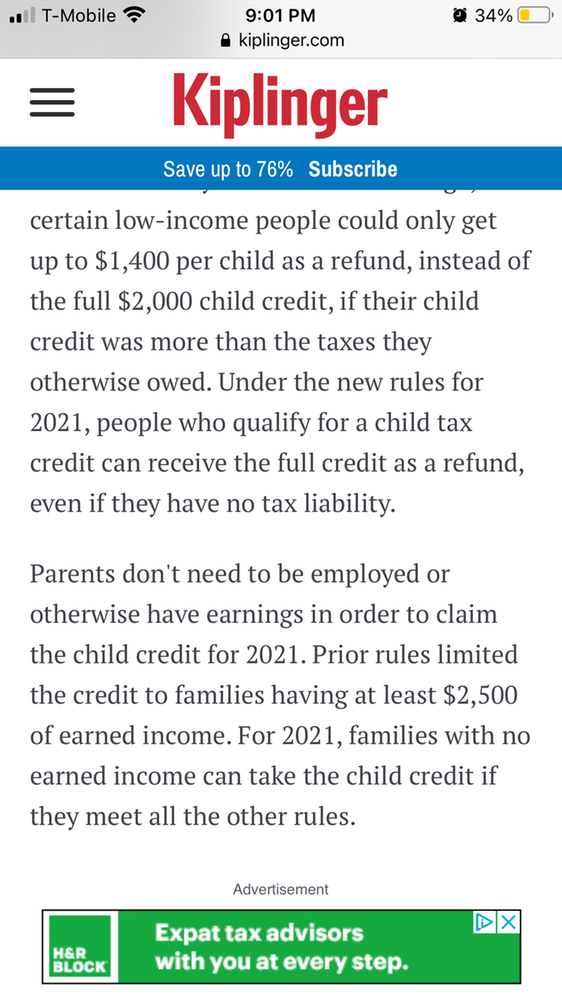

The money you hear about people getting for just filing a tax return claiming kids requires them to have some earned income (wages or self employment). Without earned income, they are not eligible for the "refundable" Earned Income Credit or Additional Child Tax Credit. Both credits are calculated on the amount of earned income you have. No earned income means no "refund". A small amount of earned income means a small refund. The child tax credit does not "kick in" unless you have at least $2500 of earned income.

A child can be the “qualifying child” dependent of any close relative in the household. If you live with someone else, e.g. your parents, it may be better if they claim your child.

Instead, you could allow the non-custodial parent to claim the children. Non-custodial parents are allowed to claim the child tax credit, but not the Earned income credit.

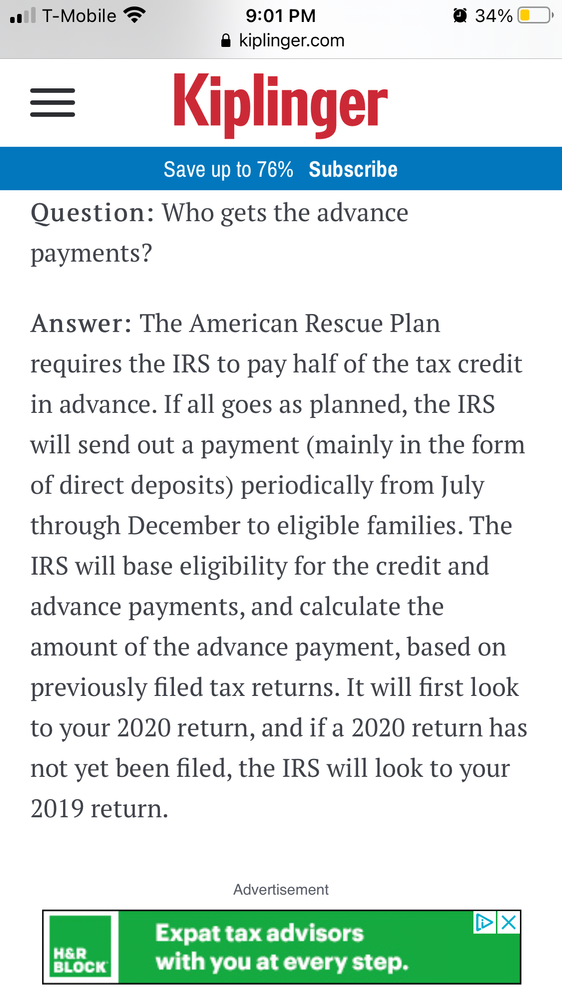

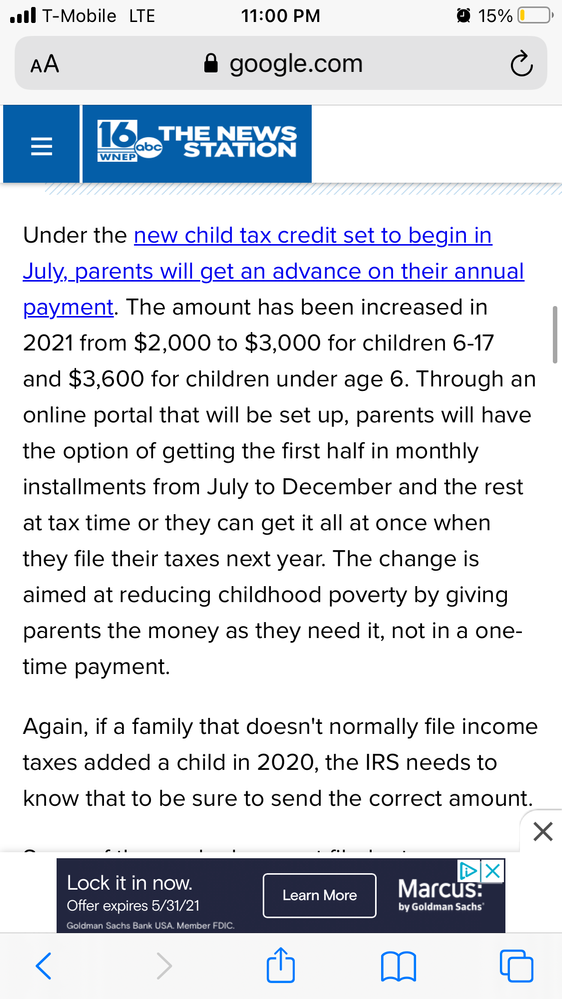

THIS ANSWER DOES NOT APPLY TO 2021 RETURNS. FOR 2021, THE CHILD TAX CREDIT IS FULLY REFUNDABLE, EVEN IF YOU DO NOT HAVE EARNED INCOME.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I'm on disability and have one child can I get any money back for the child tax credit

If all your income was nontaxable Social Security, you won’t have a tax liability to apply the credit to.

To qualify for the additional child tax credit, you must have earned income. If Social Security was your only income, you aren’t eligible to claim this credit.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I'm on disability and have one child can I get any money back for the child tax credit

I get SSI with a disability I like to find out do I get a tax credit for my daughter about to get it

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I'm on disability and have one child can I get any money back for the child tax credit

The money you hear about people getting for just filing a tax return claiming kids requires them to have some earned income (wages or self employment). Without earned income, they are not eligible for the "refundable" Earned Income Credit or Additional Child Tax Credit. Both credits are calculated on the amount of earned income you have. No earned income means no "refund". A small amount of earned income means a small refund. The child tax credit does not "kick in" unless you have at least $2500 of earned income. SSI is neither taxable or reportable and is not earned income.

A child can be the “qualifying child” dependent of any close relative in the household. If you live another related person (parent, sibling, aunt, adult child, but not cousin) someone else, e.g. your parents, it may be better if they claim your child. The relative must be older than the child.

Instead, you could allow the non-custodial parent to claim the children. Non-custodial parents are allowed to claim the child tax credit, but not the Earned income credit.

If you are a student, over age 23, and are not claimed as a dependent by someone else (e.g. your parent) you may be eligible for the up to $1000 refundable American Opportunity (tuition) Credit. That credit is not dependent on having either kids or earned income. You must be at least a half time undergraduate student .

THIS ANSWER DOES NOT APPLY TO 2021 RETURNS. FOR 2021, THE CHILD TAX CREDIT IS FULLY REFUNDABLE, EVEN IF YOU DO NOT HAVE EARNED INCOME.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I'm on disability and have one child can I get any money back for the child tax credit

I'm on disability I don't file taxes I have one child am I going to be receiving any tax credits

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I'm on disability and have one child can I get any money back for the child tax credit

If you did not receive the stimulus payments, you may file a tax return to claim the Recovery Rebate Credit. Otherwise, if you do not have taxable income, there are no tax credits available.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I'm on disability and have one child can I get any money back for the child tax credit

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I'm on disability and have one child can I get any money back for the child tax credit

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I'm on disability and have one child can I get any money back for the child tax credit

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I'm on disability and have one child can I get any money back for the child tax credit

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I'm on disability and have one child can I get any money back for the child tax credit

If I’m on disability and I have one great granddaughter can I file?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I'm on disability and have one child can I get any money back for the child tax credit

If you are the only person who can claim the child then for 2021 AND ONLY 2021 you don't need ANY taxable income to get the refundable CTC so use one of the FREE programs to complete and file the return for 2021. DON'T be in a rush to file ... returns with the CTC on them will not even start to process until mid to late February and don't expect a fast refund this year ... delays are inevitable.

Be aware that the online TurboTax Free Edition is very limited to only simple returns--so be careful----if your return requires any of the schedules or extra forms then an upgrade to a paid version will be required.

There are still eight various software providers who will participate in the Free File program but they will not be available until sometime in January----so if you want to use one of them---WAIT.

Use this IRS site for other ways to file for free when the program opens in January

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

srfrgyrl

New Member

kglason

New Member

xxrubyxxmacxx

New Member

7ddf8a0db64e

New Member

mlaustin09

New Member